Smart Bad Debt Expense Cash Flow Statement Indirect Method

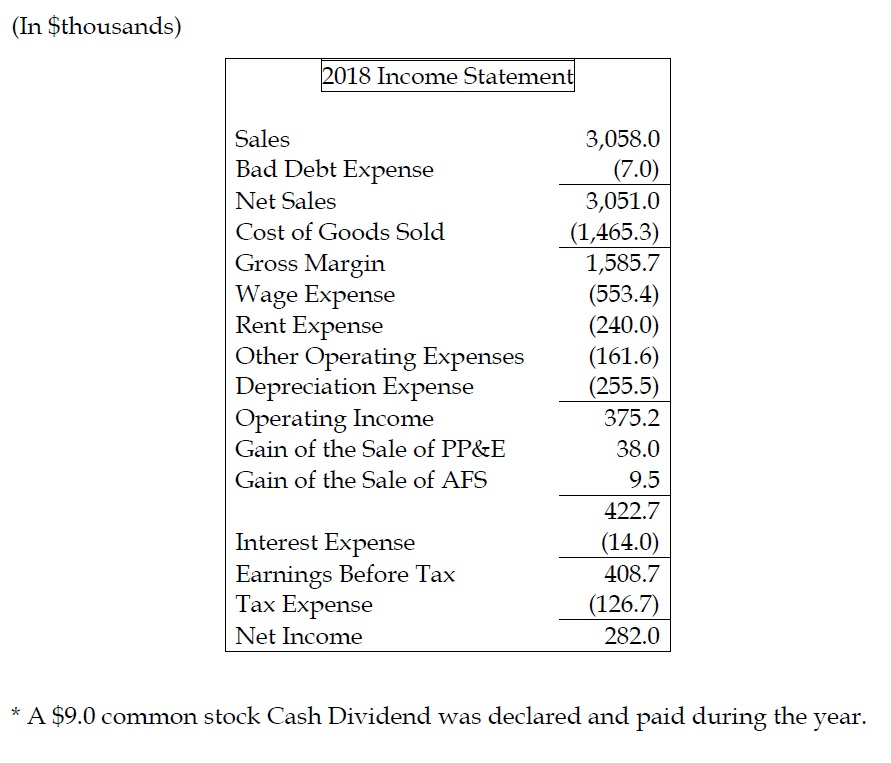

Say your income for the quarter is 125000.

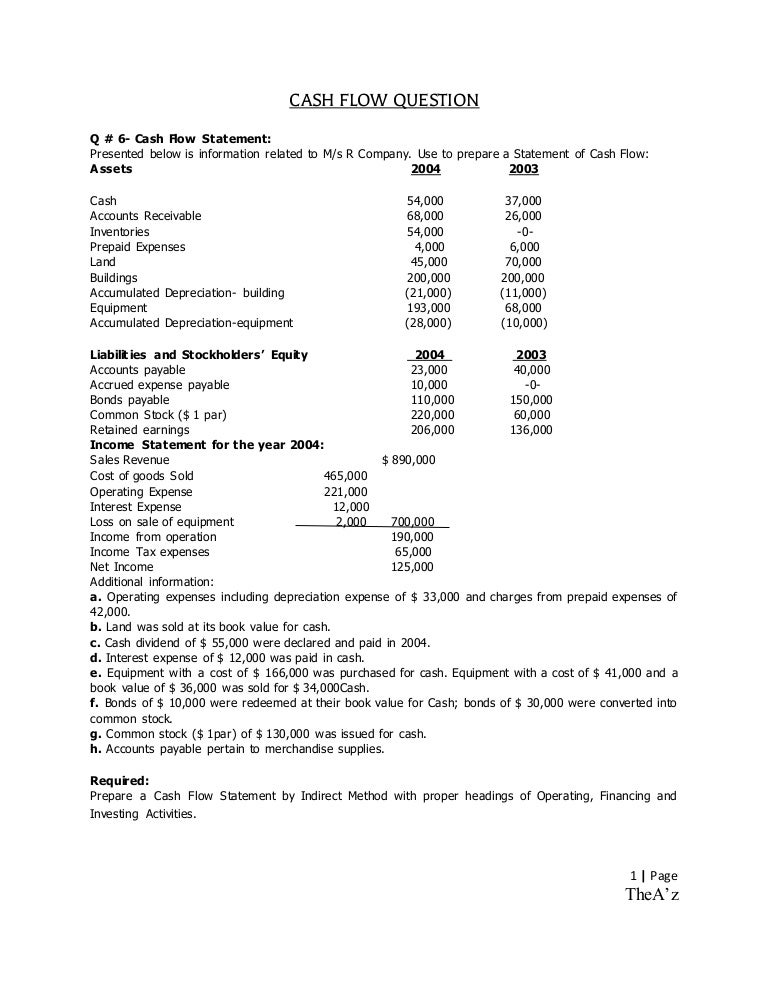

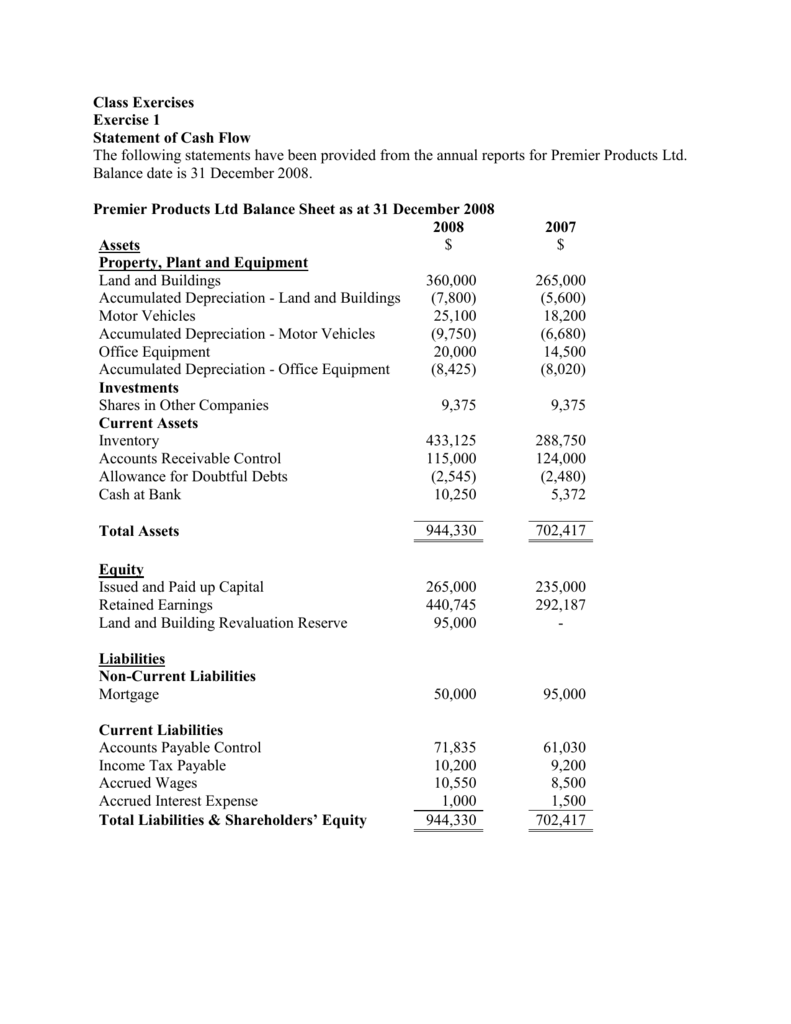

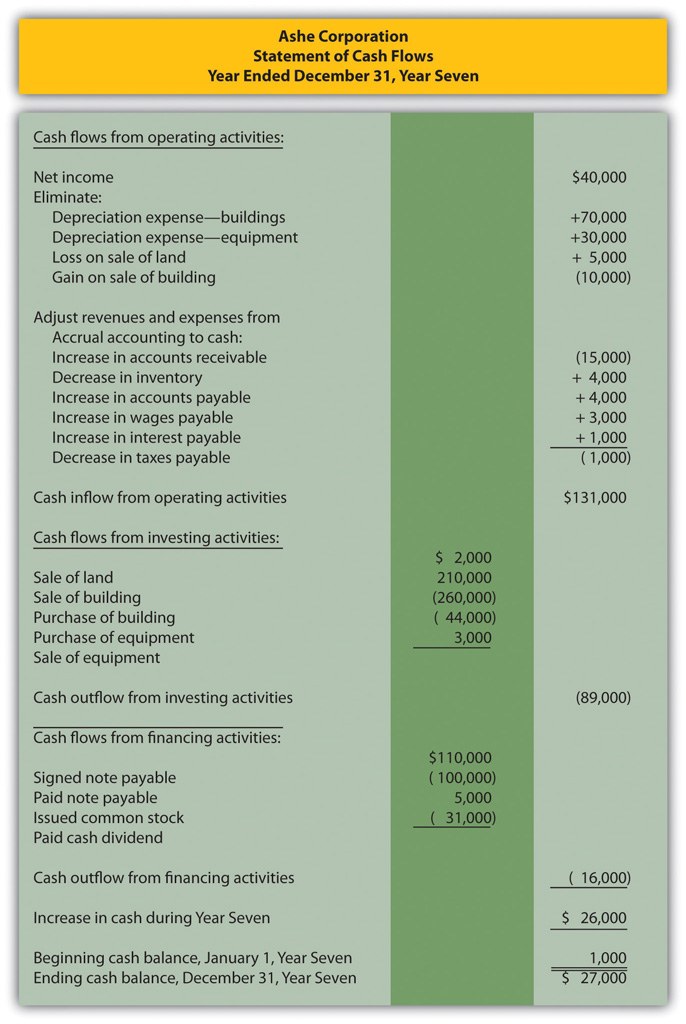

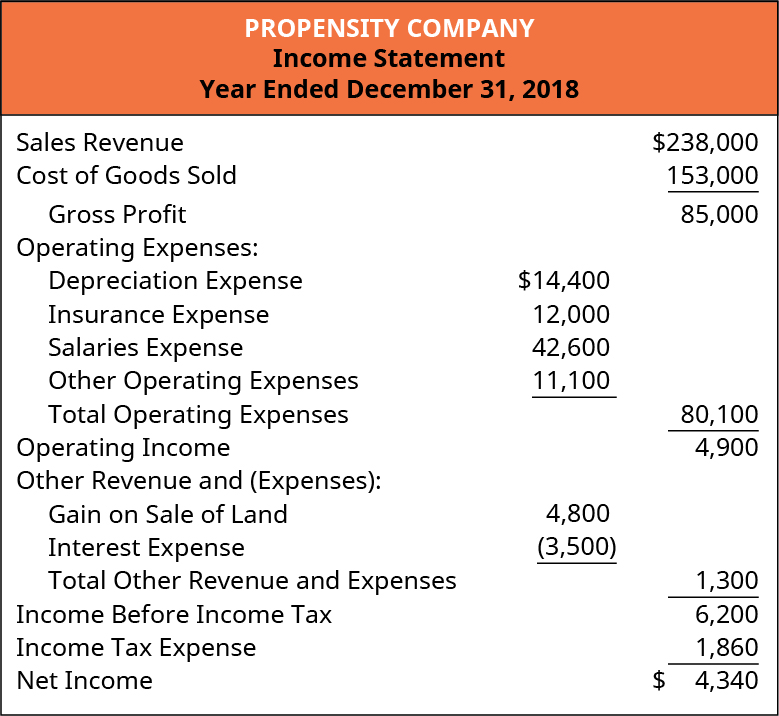

Bad debt expense cash flow statement indirect method. Not all captions are applicable to all reporting entities. A statement of cash flows can be prepared by either using a direct method or an indirect method. In other words changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to arrive at the operating cash flow.

Net income includes bad debt a non-cash transaction. Preparation of Cash Flow Statement. Indirect Cash Flow Statement Template.

If net profit or any other irrelevant information is given but sales and other revenues are missing in such case cash flow statement is. Uncollectible Accounts and the Cash Flow Statement Uncollectible accounts being written off as bad debt expense have no impact on cash flow statements except in the most indirect manner. There are two methods to prepare cash flow statement.

Using the indirect method operating net cash flow is calculated as follows. This expense also does not involve cash. The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities.

AC as per the Balance sheet is to be added or subtracted accordingly as Changes in Working capital. It should be noted that bad debts do however form part of the calculation of cash generated from operations when using the indirect cash flow statement which is the preferred method in the US. However many companies still use the direct write-off for small amounts.

The statement of cash flows is prepared by following these steps. It reflects certain captions required by ASC 230 bolded and other common captions. Then you subtract or add parts of the income statement that dont involve cash.