Beautiful Work Balance Sheet Items Explained

Assets liabilities and equity.

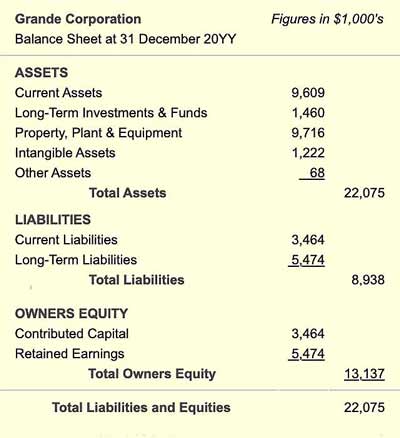

Balance sheet items explained. The balance sheet is so named because the two sides of the balance sheet ALWAYS add up to the same amount. The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. A balance sheet gives a snapshot of your financials at a particular moment incorporating every journal entry since your company launched.

Assets liabilities and shareholder equity. These are prepared at the end of an accounting period like. Audit Assertions are a representation by management that is embodied in the financial statements.

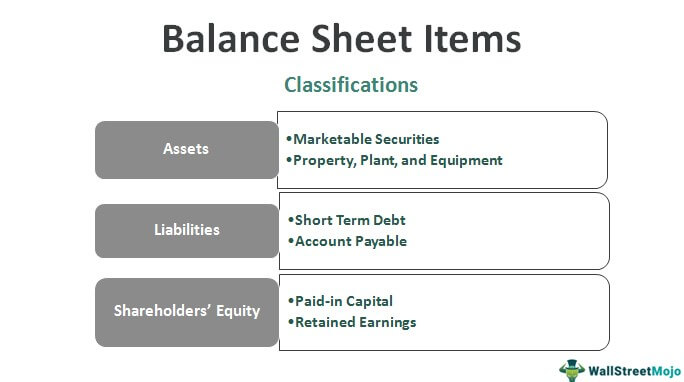

A balance sheet is divided into three main sections. What is Balance Sheet Items. The balance sheet is one of the three main financial statements along with the income statement and cash flow statement.

Anatomy of a balance sheet. The balance sheet has three sections each labeled for the account type it represents. The balance sheet is separated with assets on one side and liabilities and owners equity on the other.

The balance sheet which is also known as the statement of financial position reports a corporations assets liabilities and stockholders equity account balances as of a point in time. Balance Sheet and PL assertions explained. It is important to note that the balance sheet is one of the three fundamental financial statements the other two being the income statement and cash flow statement.

Assets what it owns liabilities what it owes owners equity net worth - whats left over for the owners The balance sheet shapshot is at a particular point in time such as at the close of business on December 31. It provides a snapshot of a business at a point in time. The balance sheet provides a snapshot of the organizations financial state each year.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)