Casual Common Base Year Financial Statements

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

In 2010 Coca-Cola acquired the remaining 67 percent of Coca-Cola Enterprises Incs CCE.

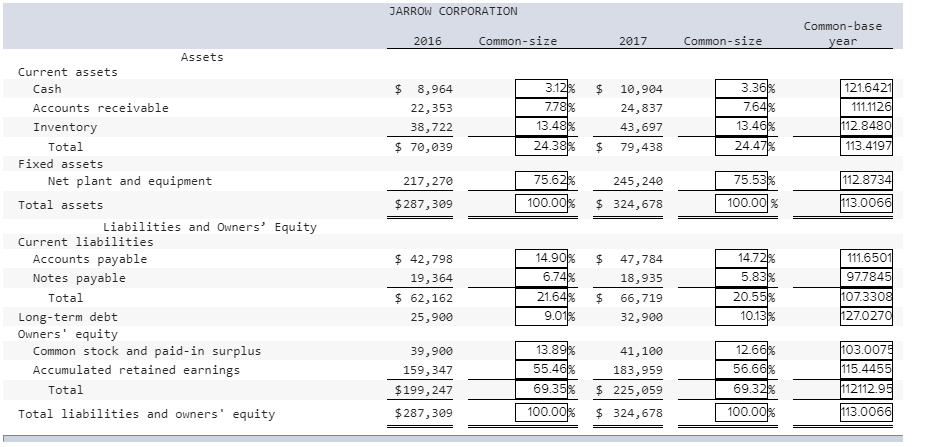

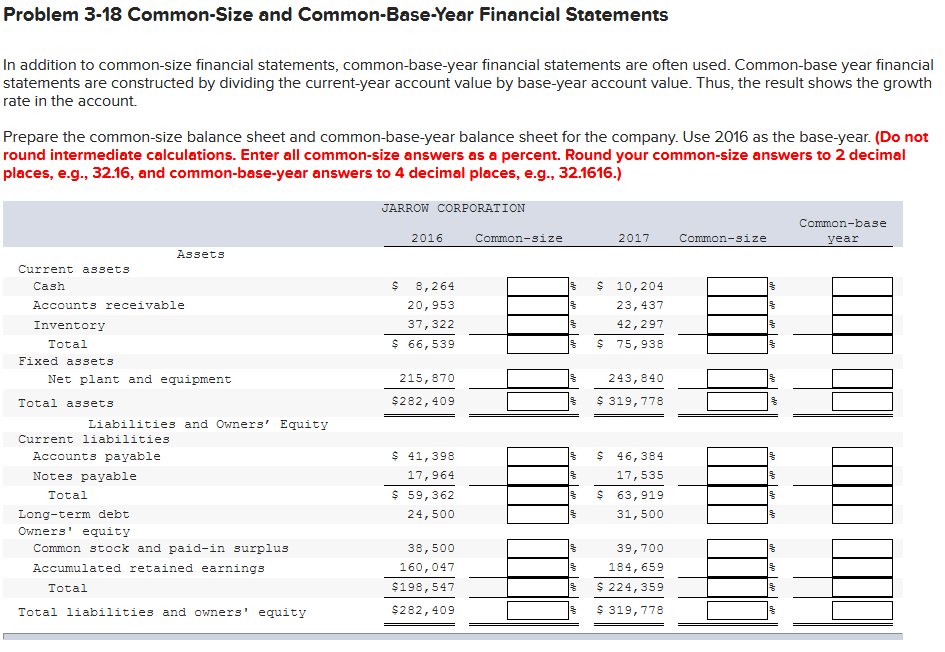

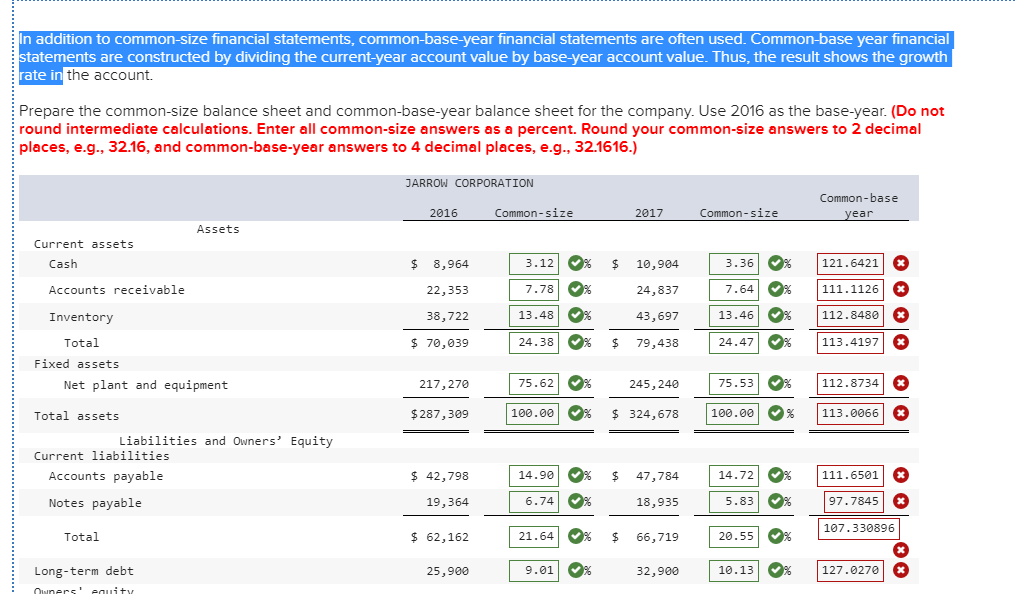

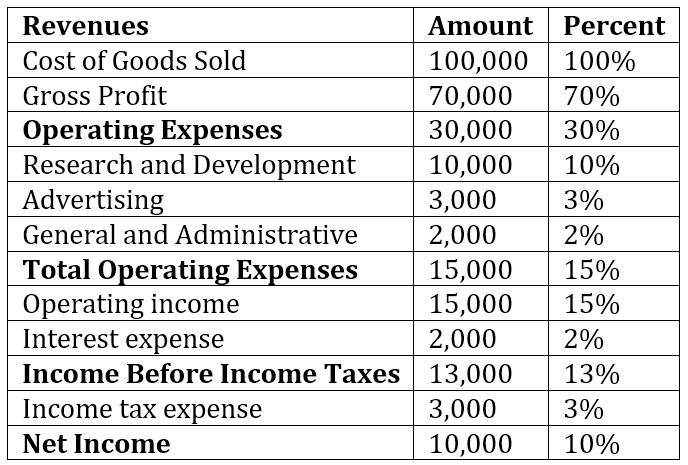

Common base year financial statements. A common approach is to establish the oldest year as the base year and compute future years as a percentage of the base year. Thus the result shows the growth rate in the account. This statement is a useful way of standardizing financial statements in this case is to choose a base year and then express each item relative to the base year.

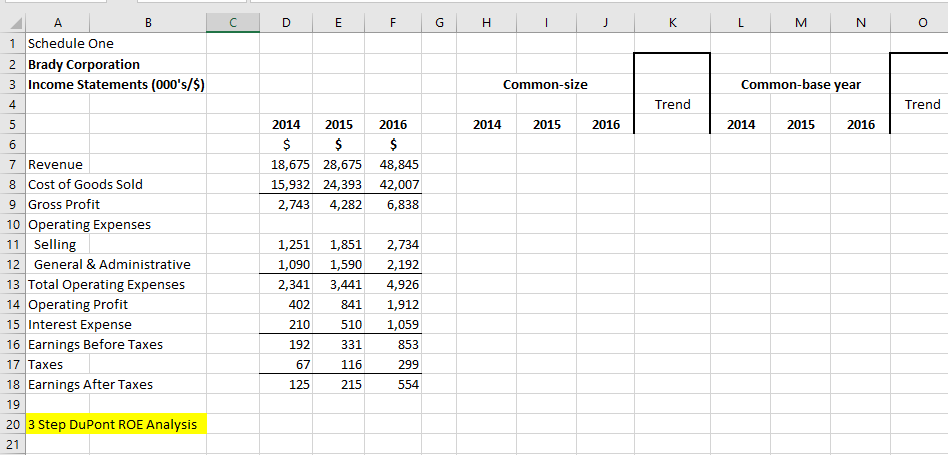

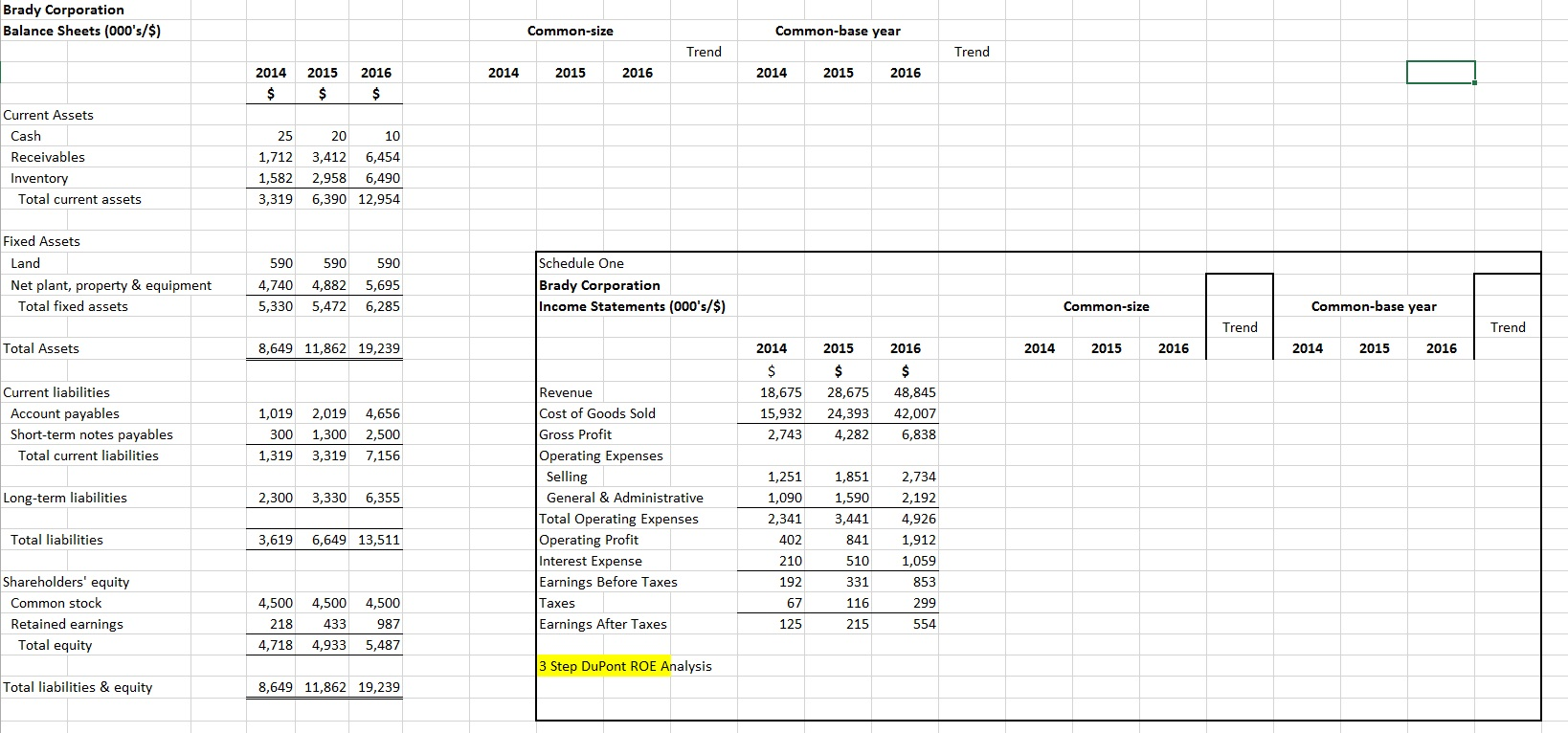

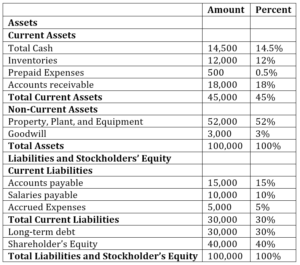

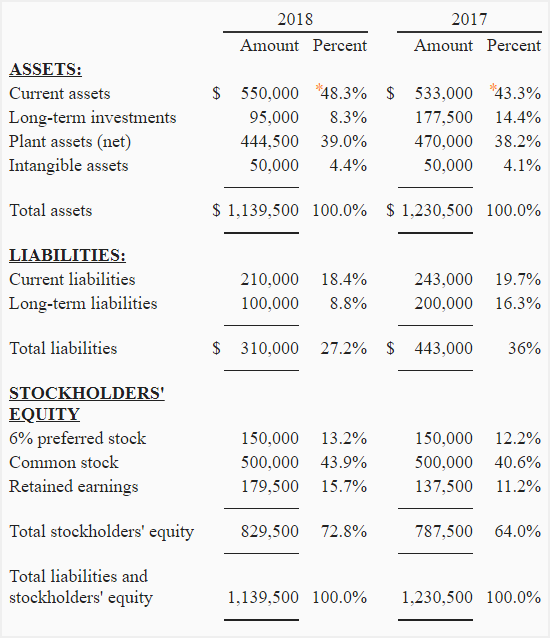

On a common-size balance sheet all accounts for the current year are expressed as a percentage of. Be sure to include spark lines to easily show the trends. Common-base year financial statements are constructed by dividing the current year account value by the base year account value.

This type of financial statement allows for easy analysis between. Thus the result shows the growth rate in the account. Commonbase year financial statements are constructed by dividing the current year account value by the base year account value.

Total assets for the current year On a common-base year financial statement accounts receivables for the current year will be expressed relative to which one of the following. For example from 2005 to 2006 MAKI inventory rose from 41500 to 61500. Common size financial statements reduce all figures to a comparable figure such as a percentage of sales or assets.

Prepare the common-size balance sheet and commonbase year balance sheet for the company. A common size financial statement displays items as a percentage of a common base figure total sales revenue for example. If we pick 2005 as our base year then we set inventory equal to 148 for that year.

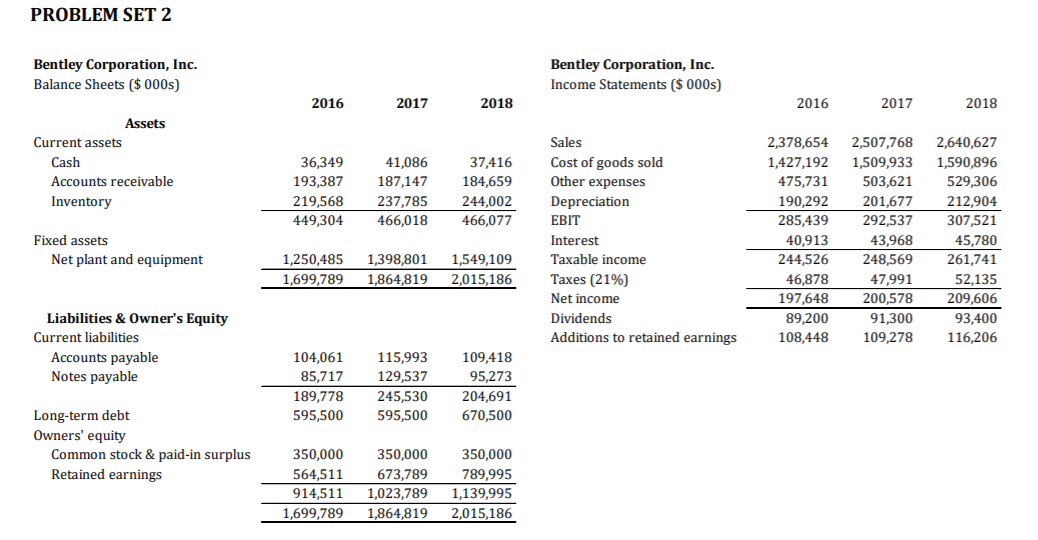

For the balance sheet and income statement prepare and analyze common base-year financial statements percentage of assets and sales respectively a comparative financial statement horizontal analysis. Ie trend year over year for every item on the financial statement compared to base year. We calculate common-base year by this formula.