Divine Expected Credit Loss Double Entry

They are the weighted average credit losses with the probability of default as the weightBecause ECLs also factor in the timing of payments a credit loss or.

Expected credit loss double entry. In order to adjust this balance a. It is the expected credit loss resulting from default events on a financial instrument that are possible within 12 months after the reporting date. ECLs on trade receivables are measured by applying either the general model or.

Credit losses are not just an issue for banks. Cash flows are discounted by using the original effective interest rate of the financial instrument. The amount of change in fair value attributable to changes in credit risk of the liability presented in OCI and the remaining amount presented in PL.

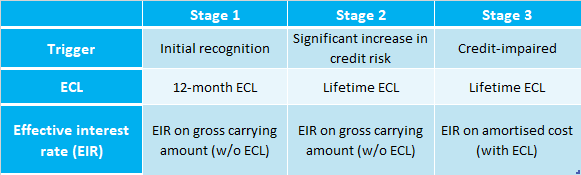

Assets 12-month expected credit losses ECL are recognised and interest revenue is calculated on the gross carrying amount of the asset that is without deduction for credit allowance. Under this standard an entity recognizes its estimate of lifetime expected credit losses as an allowance which the FASB believes will result in more timely recognition of such losses. After this journal entry is recorded Gems July 31 balance sheet will report the net realizable value of its accounts receivables at 220000 230000 debit balance in Accounts Receivable minus the 10000 credit balance in Allowance for Doubtful Accounts.

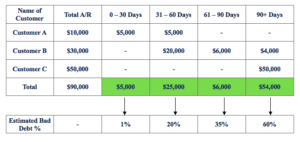

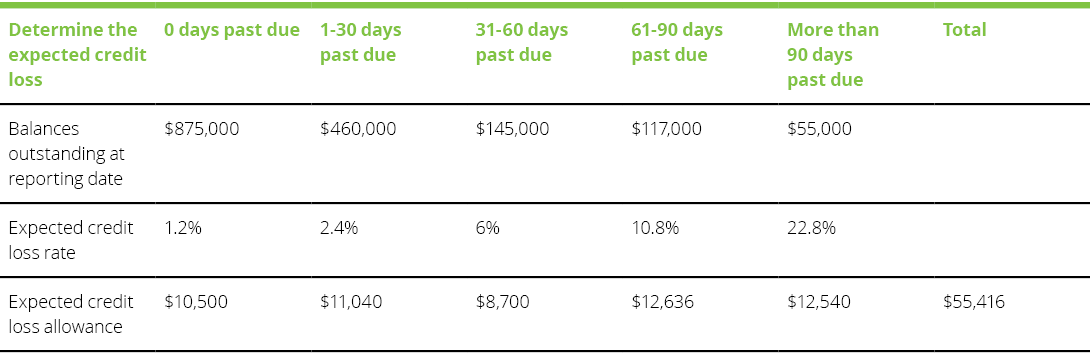

The expected credit loss of each sub-group determined in Step 1 should be calculated by multiplying the current gross receivable balance by the loss rate. The new guidance allows the recognition of the full amount of change in the fair value in profit or loss only if the presentation of changes in the liabilitys credit risk in other comprehensive income would create or enlarge an. The new standard is also intended to reduce the complexity of US GAAP by decreasing the number of credit loss models that entities can use to account for debt instruments.

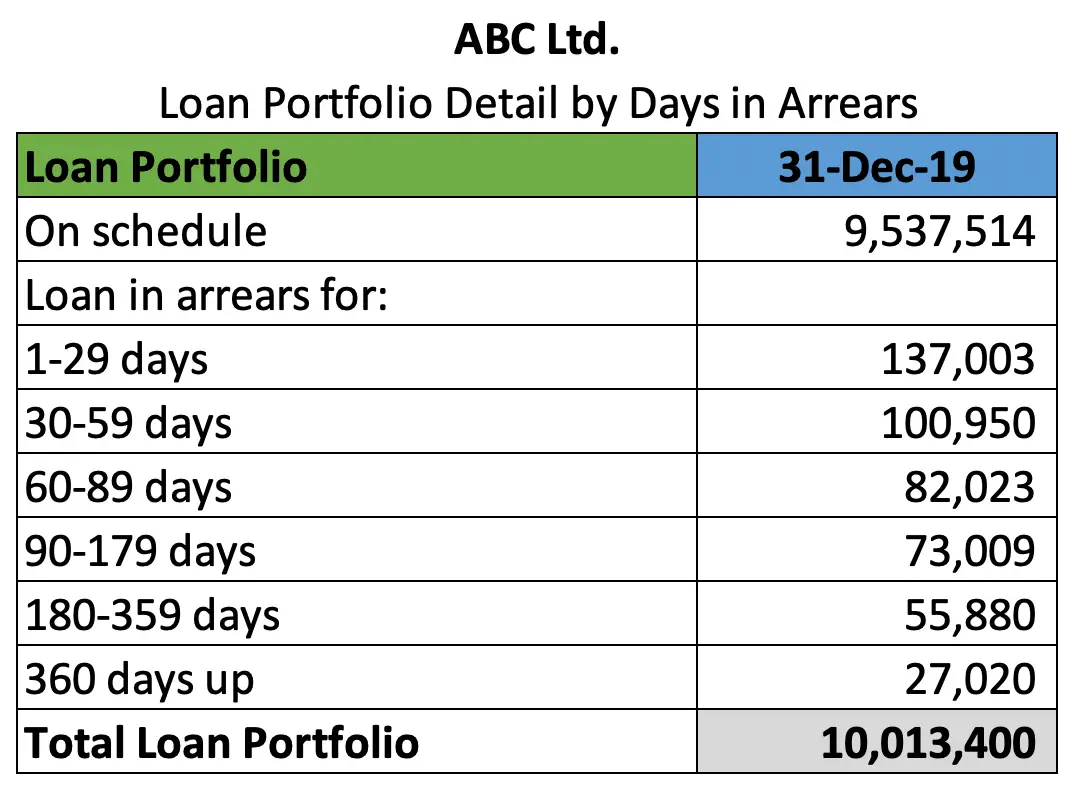

Within maturity 0-30 days 800. Lifetime ECLs are an expected present valuemeasure of losses that arise if a borrower defaults on its obligation throughout the life of the loan. As a result a one-off gain or loss is recognised in PL IFRS 9B546.

Expected Credit Loss ECL model Credit loss is the difference between the present value of contractual cash flows and the present value of expected cash flows associated with a financial asset. Loss rate Expected credit loss. In this case the interest revenue is recognized based on effective interest rate method on gross carrying amount so no loss allowance is taken into account.

/Boeing_Customer_financing-dd3b8773bd8d4654b734575f23d51d62.png)

:max_bytes(150000):strip_icc()/Boeing_Customer_financing-dd3b8773bd8d4654b734575f23d51d62.png)