Amazing Income Tax Expense On Income Statement Elements Of Accounting Equation And Examples

Primary tax accounting terminology Before embarking on the tax provision process it is helpful to understand the objective of the accounting for income taxes standard.

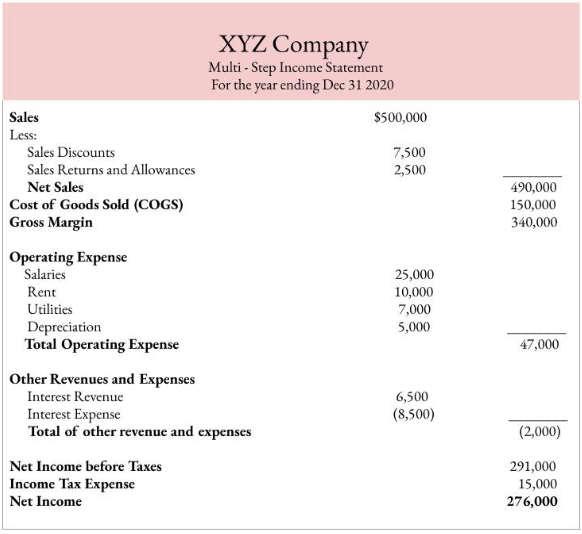

Income tax expense on income statement elements of accounting equation and examples. The income statement also called a profit and loss statement is a statement that is prepared to know the result of the companys income whether it is a profit or loss during a specific time period by matching the revenue to expenses and the difference between them. Tax in the financial statements. Net Income Revenue - Expenses Taxes gains - losses.

Revenues and expenses are the elements of income statement. 300 Current Tax will be payable on 300 Tax Rate. A company that pays its taxes monthly or quarterly must make adjustments during the periods that produced an income statement.

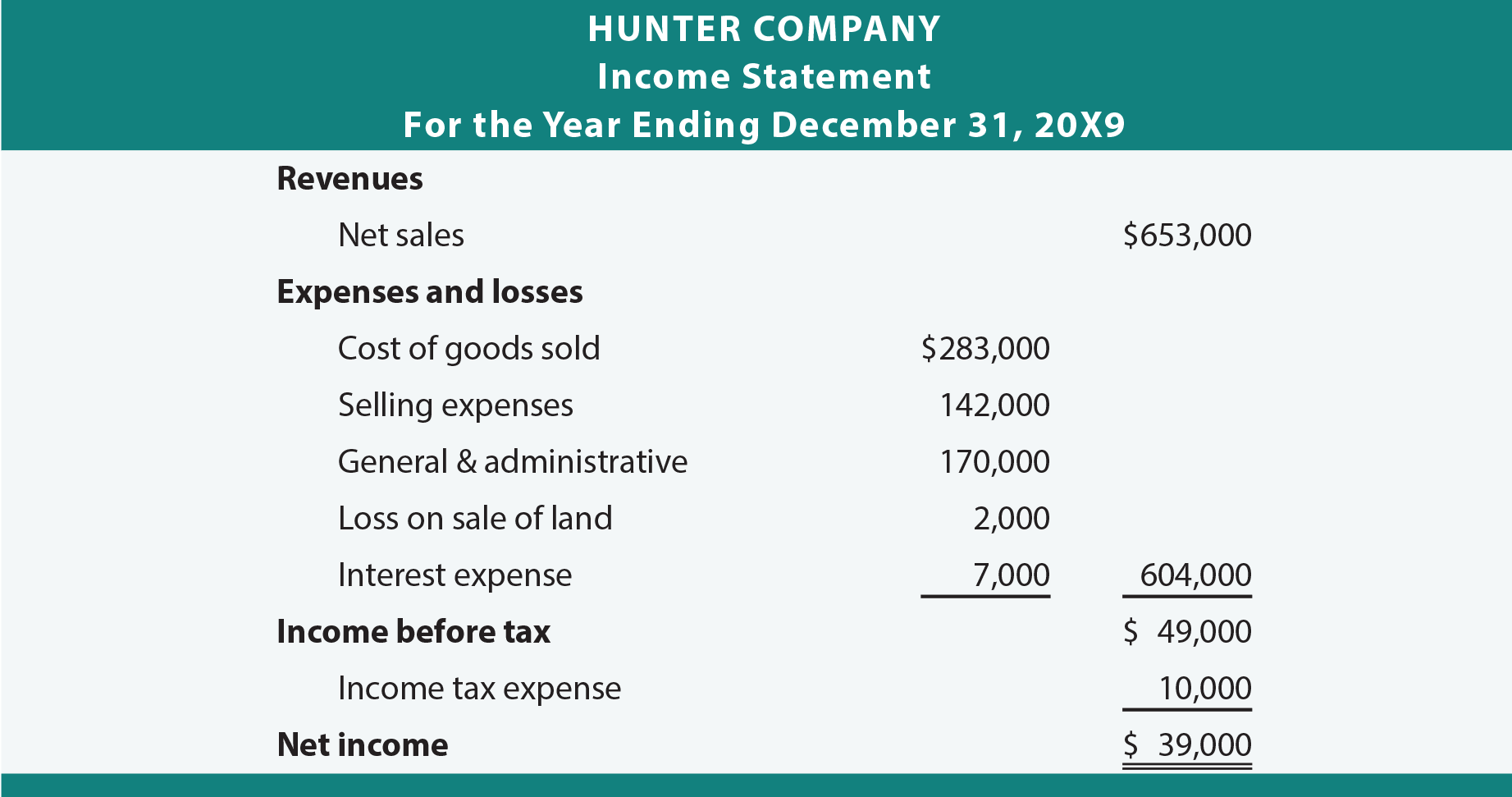

Income tax expense can be used for recording income tax costs since the rule states that expenses are to be shown in the period during which they were incurred instead of in the period when they are paid. Cost of goods sold selling general and administrative expenses Interest expense Income tax expense. Elements of Income Statement.

Accounting profit will be 500 Depreciation as per accounting 100010 100 ie. Expenses and examples of expenses cash or resources consumed or given up liabilities incurred in the course of providing goods or services. Revenue represents an increase in resources from the operations of an entity.

The three main elements of income statement include. Accounting for Deferred Taxes Deferred Method. The International Financial Reporting Standards3 explicitly state that their purpose is to pre-scribe the accounting treatment for income.

Definition of Income Statement Basics. Total income tax expense equals current income tax obligation adjusted for the effect of transfer of income tax between different periods ie. The following article provides an outline for income statement basics.