Fine Beautiful Provident Fund Balance Sheet

The purpose of this fund is to create a long-term savings Ac to support an employee upon retirement.

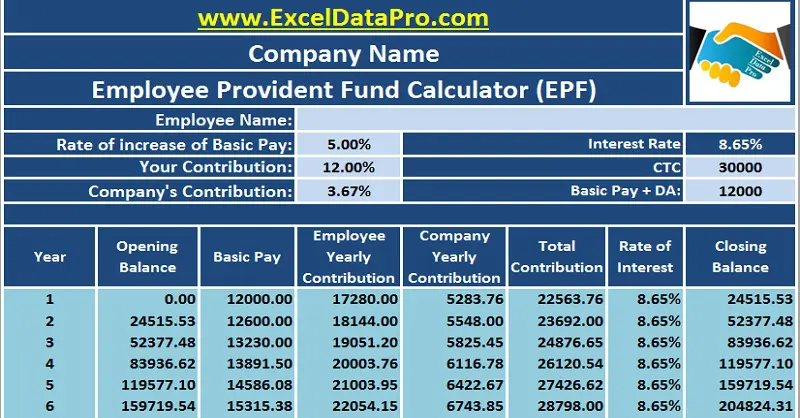

Provident fund balance sheet. Total employees provident fund Now total is equal to Employees contribution Employers contribution Total provident fund 1361 on basic salary Pension 833 or 541- which ever less. Hopefully this EPF calculator excel sheet will help you understand the retirement savings product Employee Provident Fund EPF better and also act as a decision-making tool to make informed investment decisions about how much you can save in EPF corpus for retirement savings using this Provident Fund Calculator. When salaries are paid employees share is deducted 2.

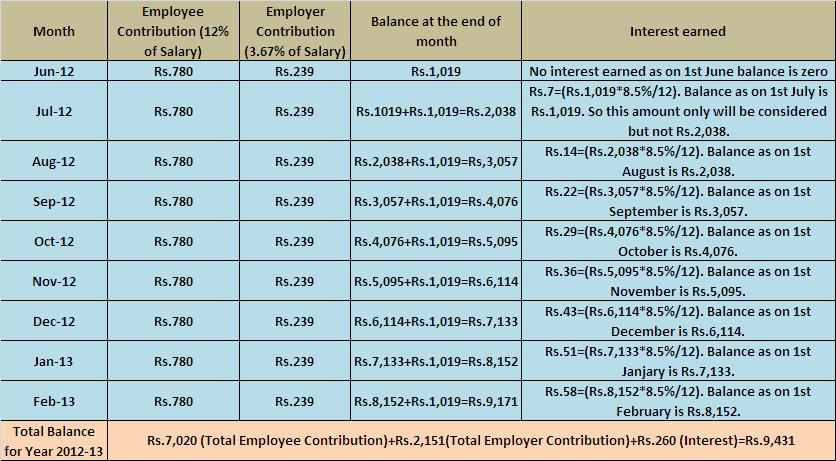

You just need to enter a few details and the sheet automatically calculates the PF up to 35 years. Notes To The Financial Statements. Employee Contribution is 12 833-Pension Fund 367 - Provident Fund Employers Contribution is 12 05 EDLI 110 PF Admin.

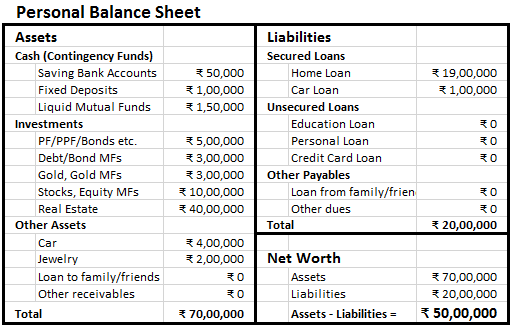

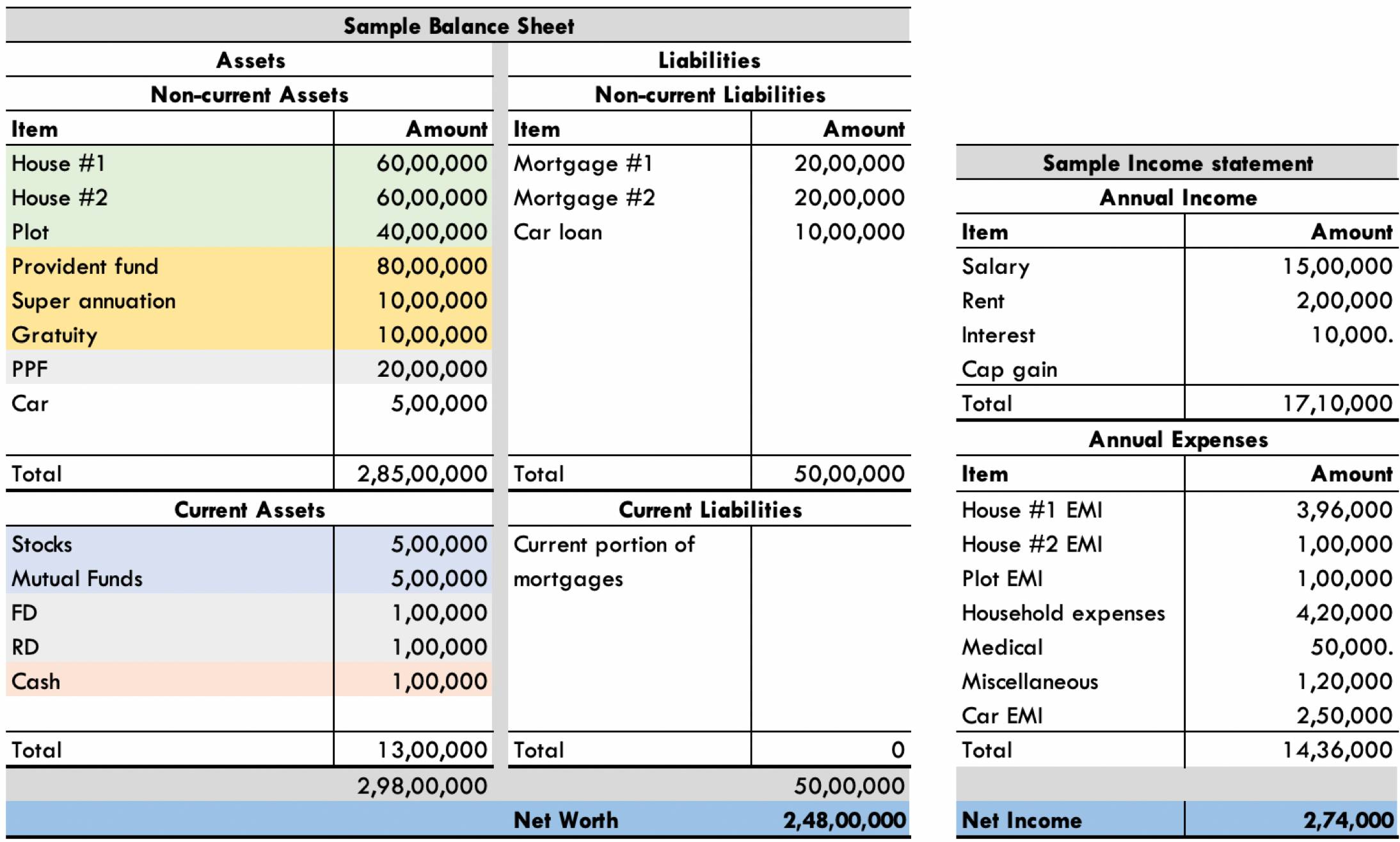

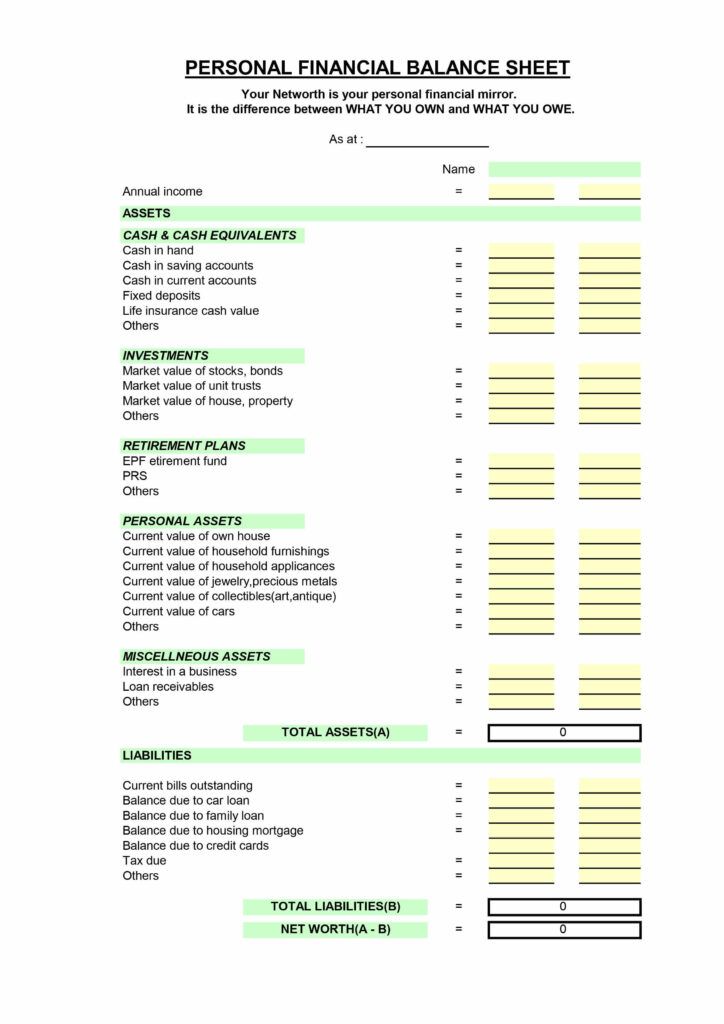

6th July 2009 From India Mumbai. Balance sheet is not an account it is only a statement. At the end of the year the balances of all accounts relating to income and expenditures are transferred to profit and loss account and the balances of remaining accounts are shown in the balance sheet.

Designed and Developed by National Informatics Centre Bangalore. Data Provided by Principal Accountant General OfficeBangalore. BALANCE SHEET OF ABHIR AND DIVYA as on 31st March 2017.

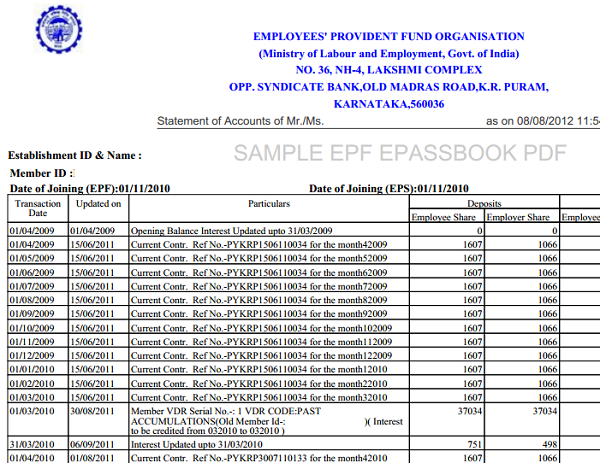

Rest of the provident fund amount Rs3000 - 1250 1750 is paid towards employees provident fund. SERIES IASPWD ACCOUNT NO only digits PASSWORD. To do this subscribers have to log into the governments EPF website click on the tabs for Know Your EPF Balance and Member Balance Information select the state enter the name registered mobile number and PF account number and submit the information whereupon the PF balance will be shown on the screen.

Audited balance sheet should be submitted to the RPFC concerned by the auditors directly within 6 months of the closing of the financial year from 1st April to 31st March. Data La st Updated Upto. In particular funds which are invested in emerging markets and smaller companies may involve a higher degree of risk and are usually more sensitive to price movements.