First Class Provision For Doubtful Debts Is An Expense

200000 is doubtful and estimates a 50 chance of recovery in case of doubtful debts.

Provision for doubtful debts is an expense. The provision is a future loss - a future loss that must be recorded as soon as it becomes likely to. 19 rows Provision for bad and doubtful debts general note impairment loss on trade debts. 100000 through following entry.

It is identical to the allowance for doubtful accounts. Every year the amount gets changed due to the provision made in the current year. Provision for doubtful debts acts as a liability for the business and is shown on the liability side of a balance sheet.

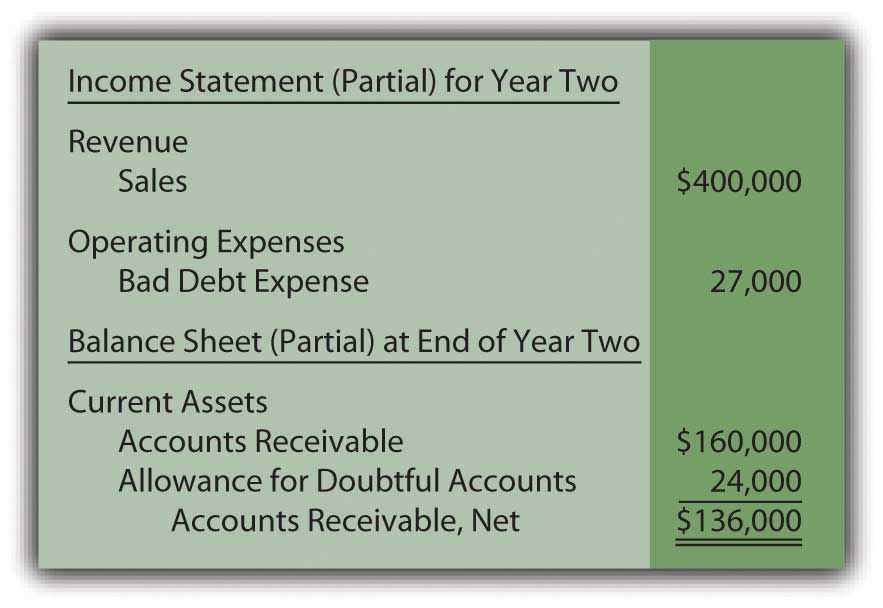

The provision for doubtful debts is an accounts receivable contra account so it should always have a credit balance and is listed in the balance sheet directly below the accounts receivable line item. Allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables appearing in the balance sheet. Doubtful debts or bad debts is an expense and has already occurred.

The effects of provision for doubtful debts in financial statements may be summed up as follows. When increase then expense deducted from profit and when decrease then income added in. The provision is a future loss - a future loss that must be recorded as soon as it.

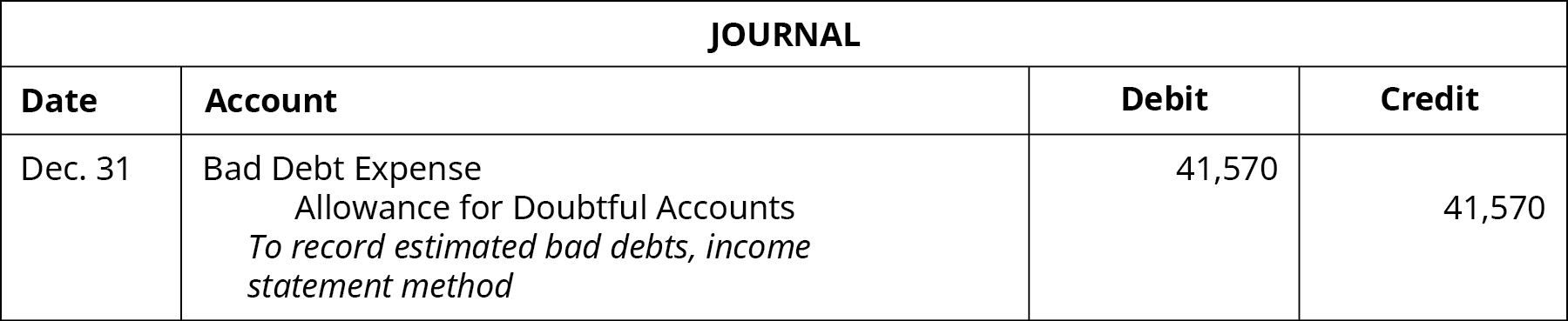

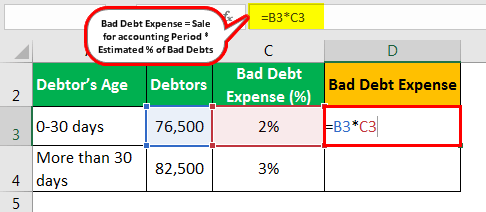

Various organizations create a provision for all the future expected expenses and losses which may arise due to the credit sales so the organization needs to create a percentage of such provision on the net value of sundry debtor for complying with all the future uncertainties. In this example management needs to recognize provision for doubtful debts amounting to Rs. A corresponding debit entry is recorded to account for the expense of the potential loss.

Accounting entry to record the allowance for receivable is as follows. According to ATO legislation this doesnt happen just because time has passed and its overdue but because you have tried your best to recover the debt and been unable to do so. Doubtful debt is a provision a prediction of future debt more so than a debt itself.