Great Trade Receivables In Trial Balance

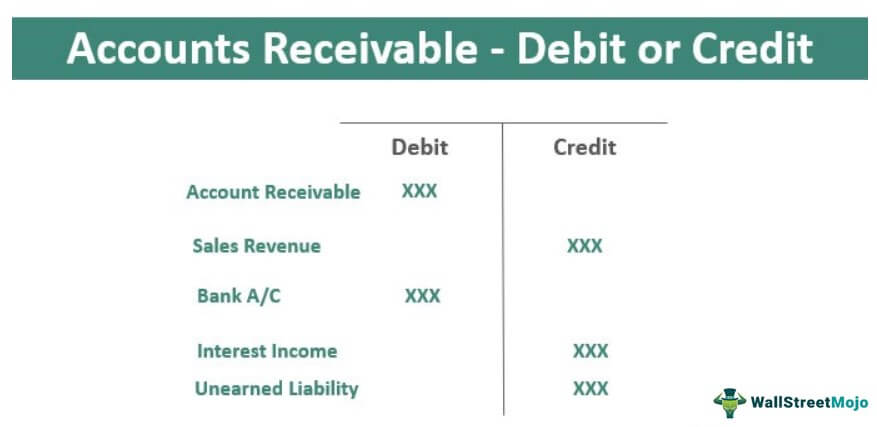

It is very rare for a company that deals in sales to receive all of its payments at exactly the time that purchases are made.

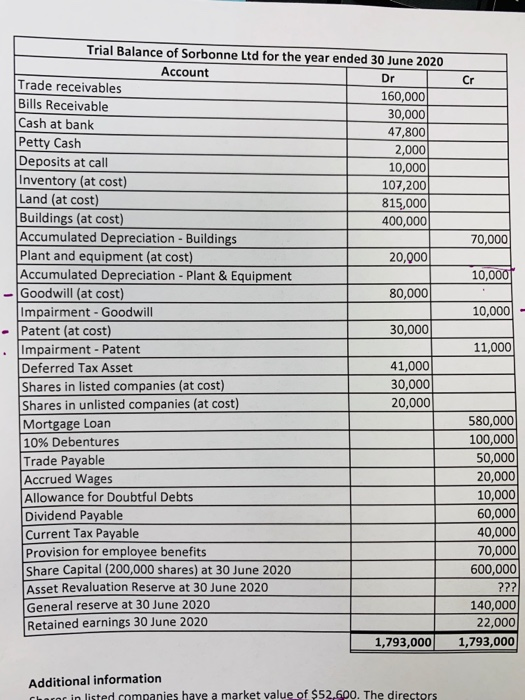

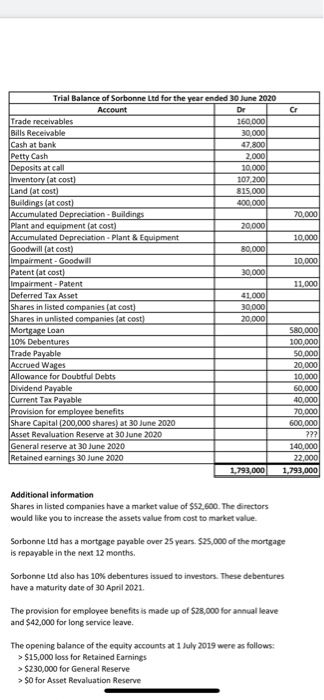

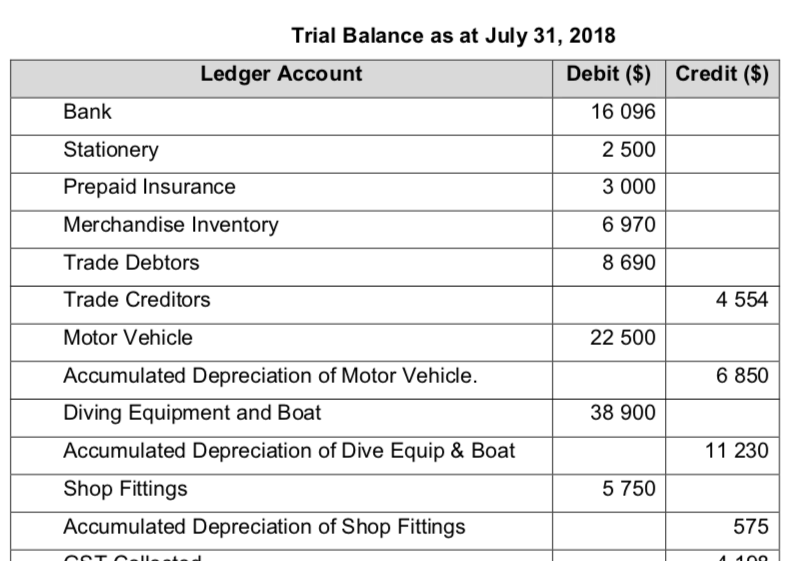

Trade receivables in trial balance. Trade receivables 5000 Drawings 500 Cash 12200 Total 27200 24200 3000 The business has made a profit of 2000 5000 - 3000. Irrecoverable debts and the allowance for receivables. The balance on the accounts receivable control account at any time reflects the amount outstanding and due to the business by customers for credit sales.

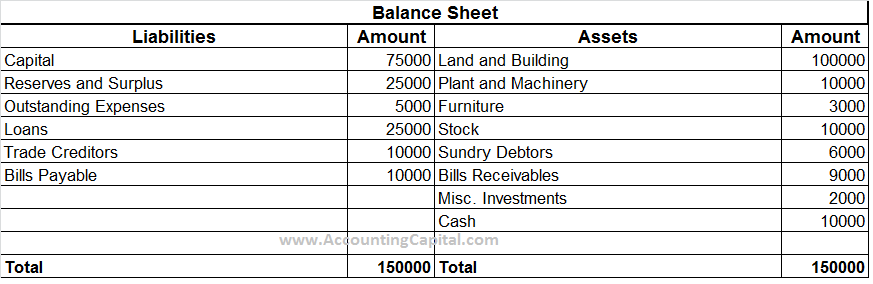

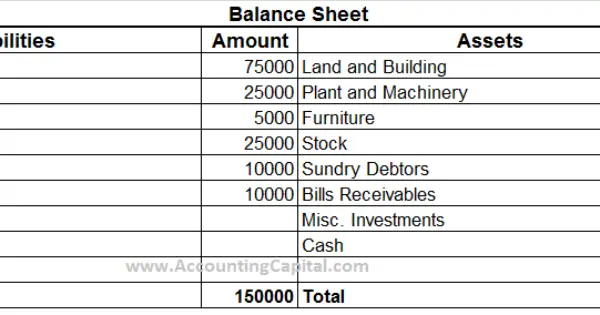

Accounts Receivable in Trial Balance and Balance Sheet. Trade receivables arise due to credit sales. This help article Receivables payables or inventory out of balance has information on what can cause your issue and how to fix it.

The period of credit given. This will involve adjusting for the following items. The greater the value of credit sales then other things being equal the greater the total of trade receivables.

Remember a JE or bank entry only affects the GL not the subledger and this will definitely cause an issue. Since an Entity has a legal claim over its customer for this amount and the customer is bound to pay the same it classifies as Current Asset in the Balance sheet of the entity. They are treated as an asset to the company and can be found on the balance sheet.

An accounts receivable trial balance is an accounting tool used to total up all of the credits and debits pertaining to a companys accounts receivables. It is clear that Receivables is already less IRR written off 2 when I have Trade Receivables and IRR in the Trial Balance for calculating the final Receivables in SPF I have to proceed. It reflects that the company is able to realize the cash in good fashion.

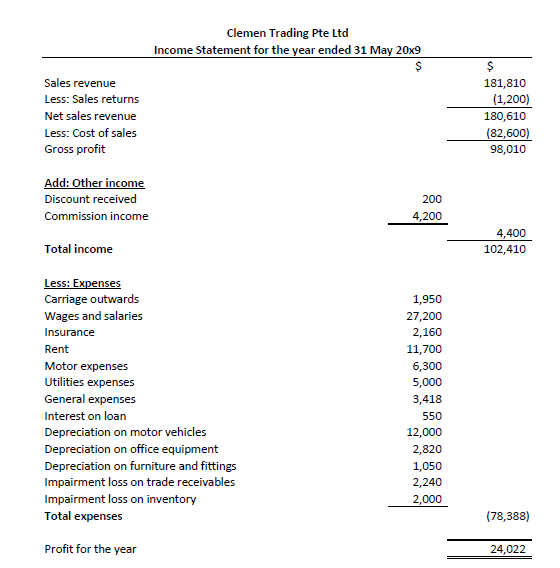

Upon completion of this chapter you will be able to. Trade receivables 180000 4000 176000 The figures in brackets are a working not part of the statement of financial position. For example A Ltd sold goods to B Ltd.