Fabulous Uses Of Trial Balance In The Accounting Process

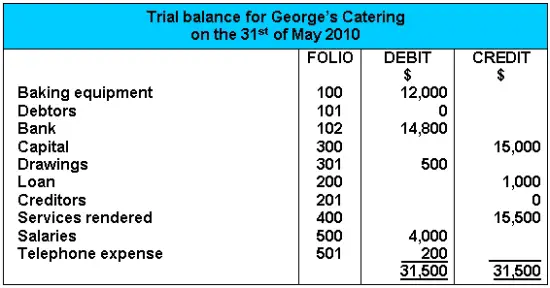

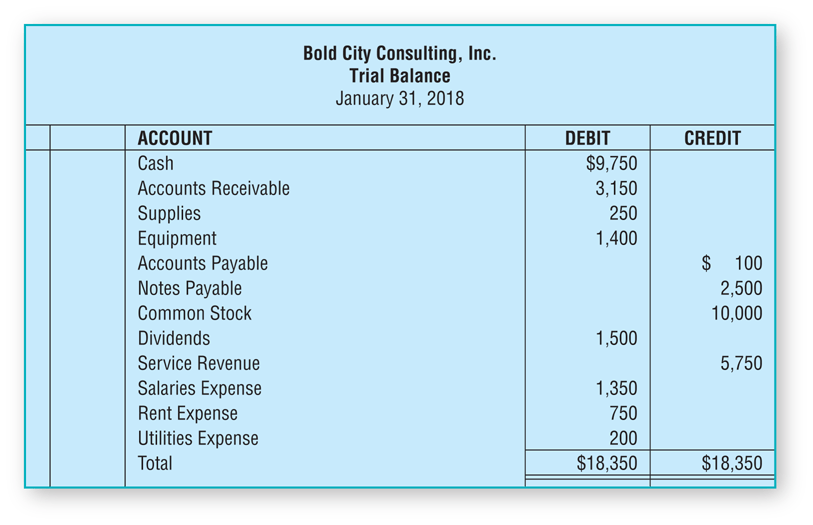

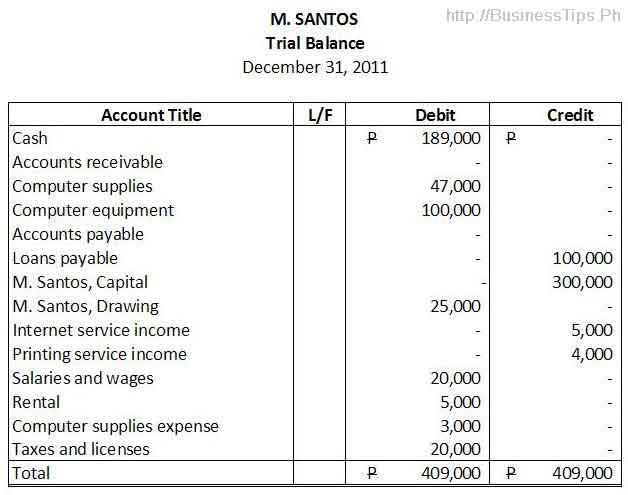

The title of each general ledger account that has a balance.

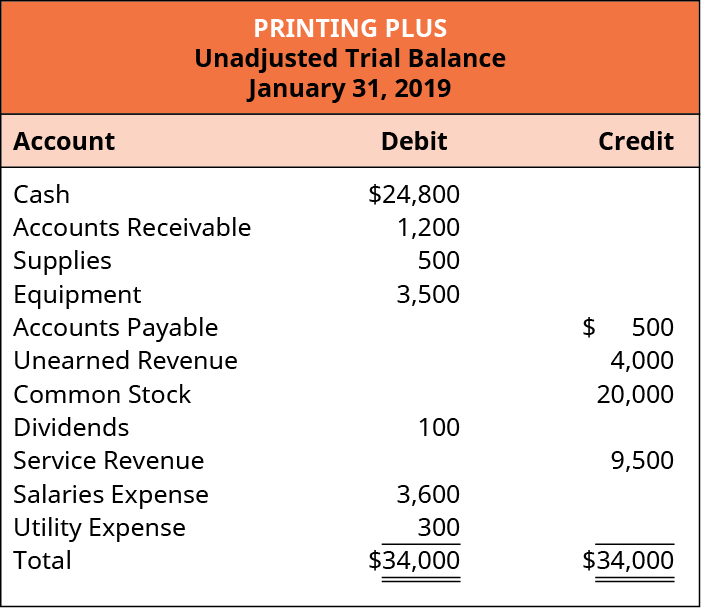

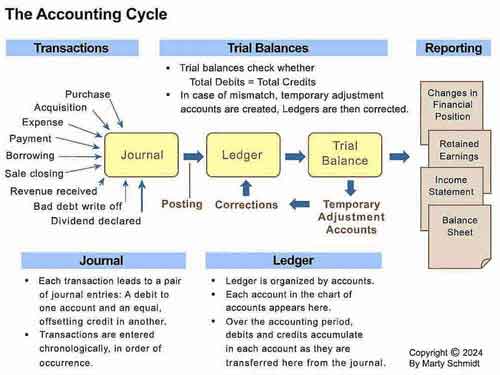

Uses of trial balance in the accounting process. Ad 1800 Templates to Choose From Simply Fill-in the Blanks Print. Double-entry accounting is exactly what it sounds likeequally recording transactions in two or more accounts. Trial Balance aside from general ledger accounts is also useful to check the accuracy of special-purpose accounting books.

One column is headed Debit and the other column is headed Credit. Steps to prepare Income Statement from Trial Balance. Your trial balance and general ledger both use double-entry accounting.

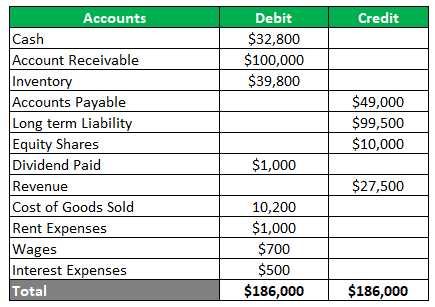

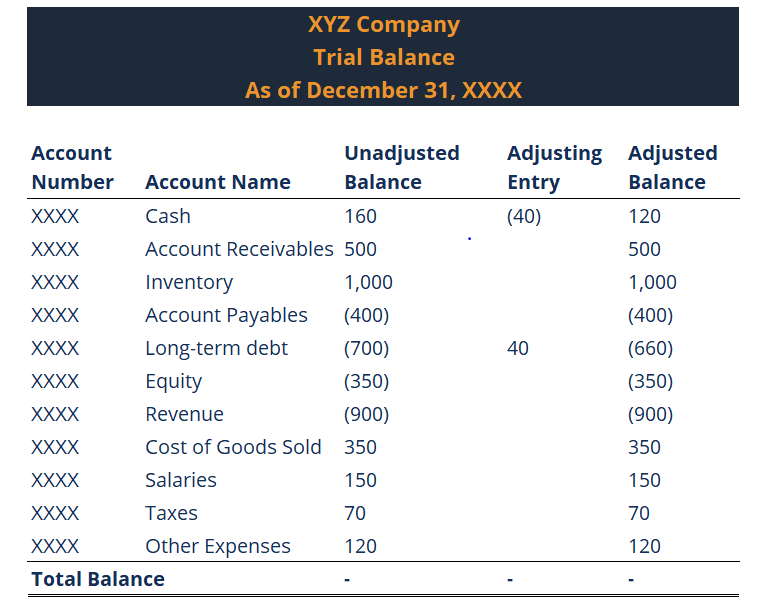

A trial balance is made in accordance with the double-entry concept of bookkeeping. The trial balance is used to verify the actual amount entered on the right side of the current account while migrating the figures from various ledger books like purchase books sales books cash books etc. If we balance all the ledger accounts at a particular instance and then prepare a statement of balances we get the Trial Balance.

The report is primarily used to ensure that the total of all debits equals the total of all credits. In double-entry accounting a credit is made in at least one. Essentially a trial balance is to be used internally and the balance sheet is to share with external shareholders.

To the right of the account titles are two columns for entering each accounts balance. The total dollar amount of the debits and credits in each accounting entry are supposed to match. Though not a conclusive proof the agreement of the trial balance is a prima facie evidence of the absence of mathematical errors.

Usually you need to prepare trial balance at the end of the said accounting period. Since we follow double entry system of accounts the total of all the debit and credit balance as appeared in trial balance remains equal. The purpose of a trial balance is to ensure that all entries made into an organizations general ledger are properly balanced.