Exemplary 199a Safe Harbor Statement

20198 applies solely for purposes of section 199A.

199a safe harbor statement. But you may not want to use the safe-harbor rules because they contain some onerous provisions. First remove the trigger for the form. Section 199A safe harbor for rental real estate has been finalized TAX ALERT September 26 2019 The determination as to whether a rental real estate enterprise rises to the level of a trade or business under section 162 is difficult and in many cases unclear.

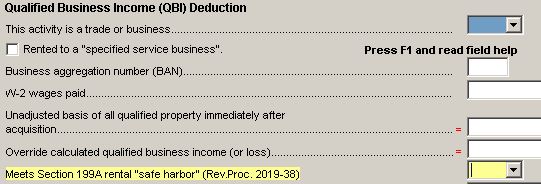

A safe harbor is a set of requirements which if satisfied automatically qualify a taxpayer for a particular benefit. Sample Safe Harbor Election Statement. This safe harbor is available to taxpayers who seek to claim the deduction under section 199A with respect to a rental real estate enterprise.

A - Separate rental enterprise. Where is the signature line on the Section 199A rental real estate safe harbor statement this year. Section 199A safe harbor for rental real estate The IRS today released an advance version of Rev.

Also you may not qualify to use the safe harbor. B - Residential rental enterprise grouping for safe harbor. They meet the Rev.

IR-2019-158 September 24 2019 The Internal Revenue Service today issued Revenue Procedure 2019-38 that has a safe harbor allowing certain interests in rental real estate including interests in mixed-use property to be treated as a trade or business for purposes of the qualified business income deduction under section 199A of the Internal Revenue Code section 199A deduction. 199a real estate activity safe harbor the IRS guidance identifies the following records that must be kept. 199A Signed Safe Harbor Statement Must be Attached as a PDF to an E-Filed Return March 09 2019 by Ed Zollars CPA If a taxpayer is electing making the safe harbor election for a real estate enterprise under Notice 2019-07 and electronically filing hisher return a signed copy of the election must be submitted as a PDF attachment to e-filed return reports Tax Notes Today.

The IRS and Treasury issued Notice 2019-7 and Revenue Procedure 2019-38 providing a safe harbor under which rental real estate activity can qualify for the Section 199A deduction. To qualify for the Sec. How a business might qualify for this exemption off a businesss net profit though was not clearly defined when the law passed.