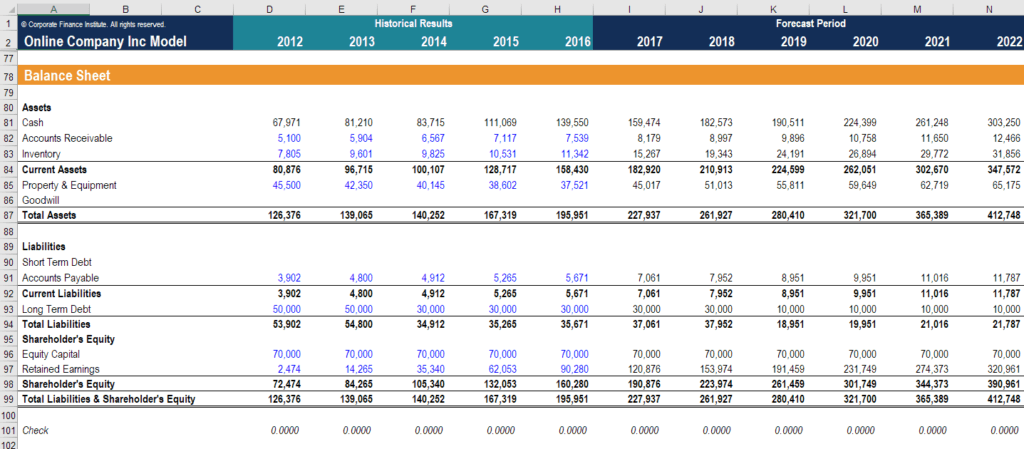

Simple Schedule L Balance Sheet Per Books

Income Tax Return for an S Corporation where the corporation reports to the IRS their Balance Sheet as found in the corporations books and records.

Schedule l balance sheet per books. Schedule L - Book Basis. The Schedule L should be prepared on the accounting basis the business entity uses for its books and records. 6 Other current assets attach statement.

Retained earnings should include current years book. Generally the application uses the amount from the Book column in the asset module. To use a different amount to complete Schedule L enter an amount including 0 zero in the corresponding field in.

Schedule L Balance Sheets per Books for Form 1120-S. Trusted By 200000 Workplaces. In the case of depreciation an allowable method may be used for tax reporting purposes that is disallowed for book purposes.

Schedule L Balance Sheets per Books is the section in Form 1120S US. Ad Everyday Low Prices and Free Delivery On Over 20 Million Titles With Book Depository. However if the book column is blank the application uses the amount from the Tax column.

You must enter both a beginning total column a or b and an ending total column c or d. Last year I wrote a post about the S Corp tax return aka IRS Form 1120-S. Easily Create Shifts Using Deputys Drag Drop Interface.

Schedule L Balance Sheets per Books is the section in Form 1065 US. Income Tax Return for an S Corporation where the corporation reports to the IRS their Balance Sheet as found in the corporations books and records. Ad Everyday Low Prices and Free Delivery On Over 20 Million Titles With Book Depository.

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)