Favorite Debt Repayment In Cash Flow Statement

The bad debt provision reduces your accounts receivable to allow for customers who dont pay up.

Debt repayment in cash flow statement. Exemptions from presenting a statement of cash flows. Because bad debts are generally not included in the cash flow statement - at least not when using the direct method. Example of a Loan Principal Payment.

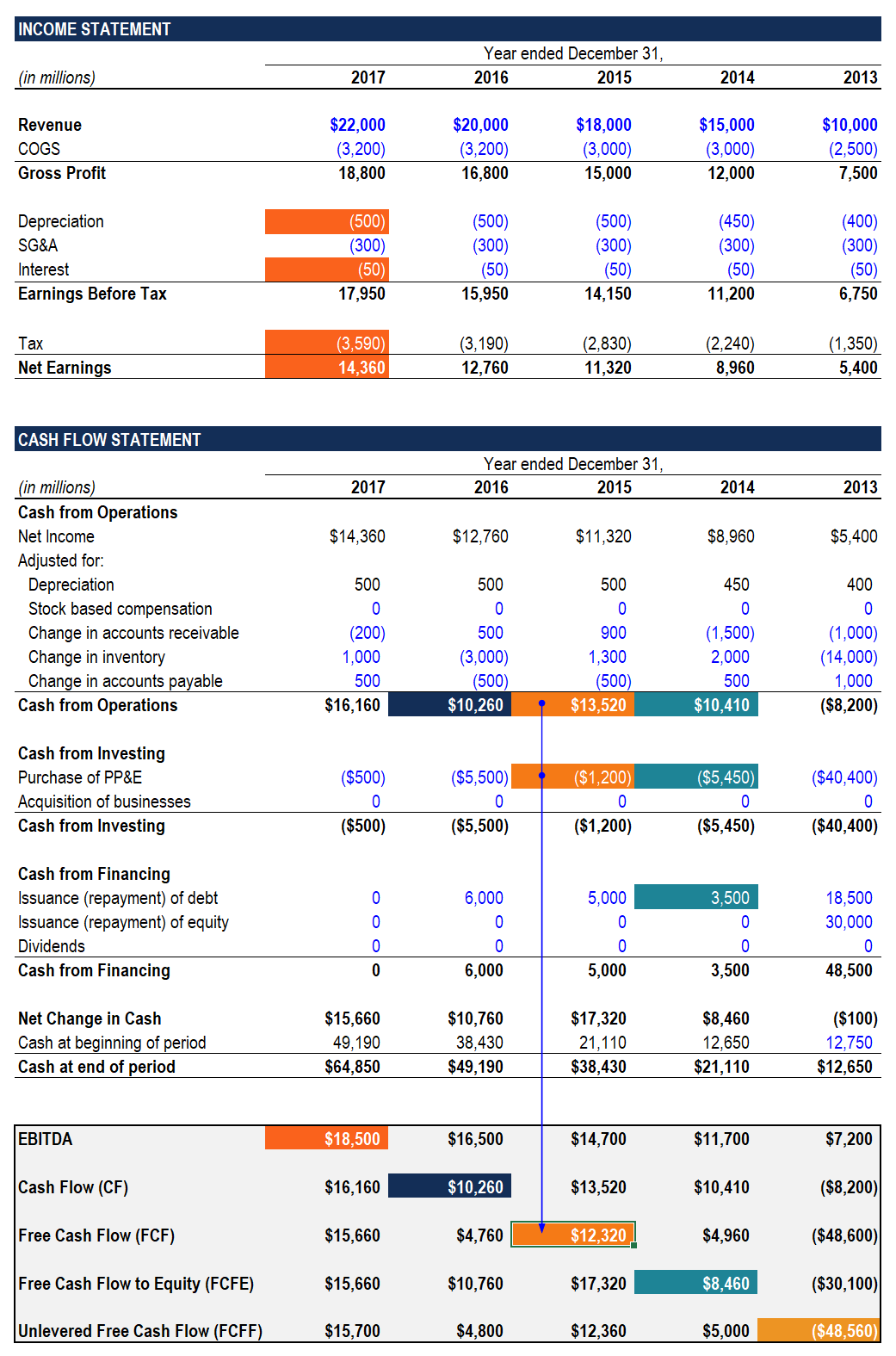

First things first a loan can be repaid in number of ways for example in cash by handing over certain asset or converting debt to shares etc. These line items impact the net income on the income statement but do not result in a movement of cash in or out of the company. Illustrative statement of cash flows.

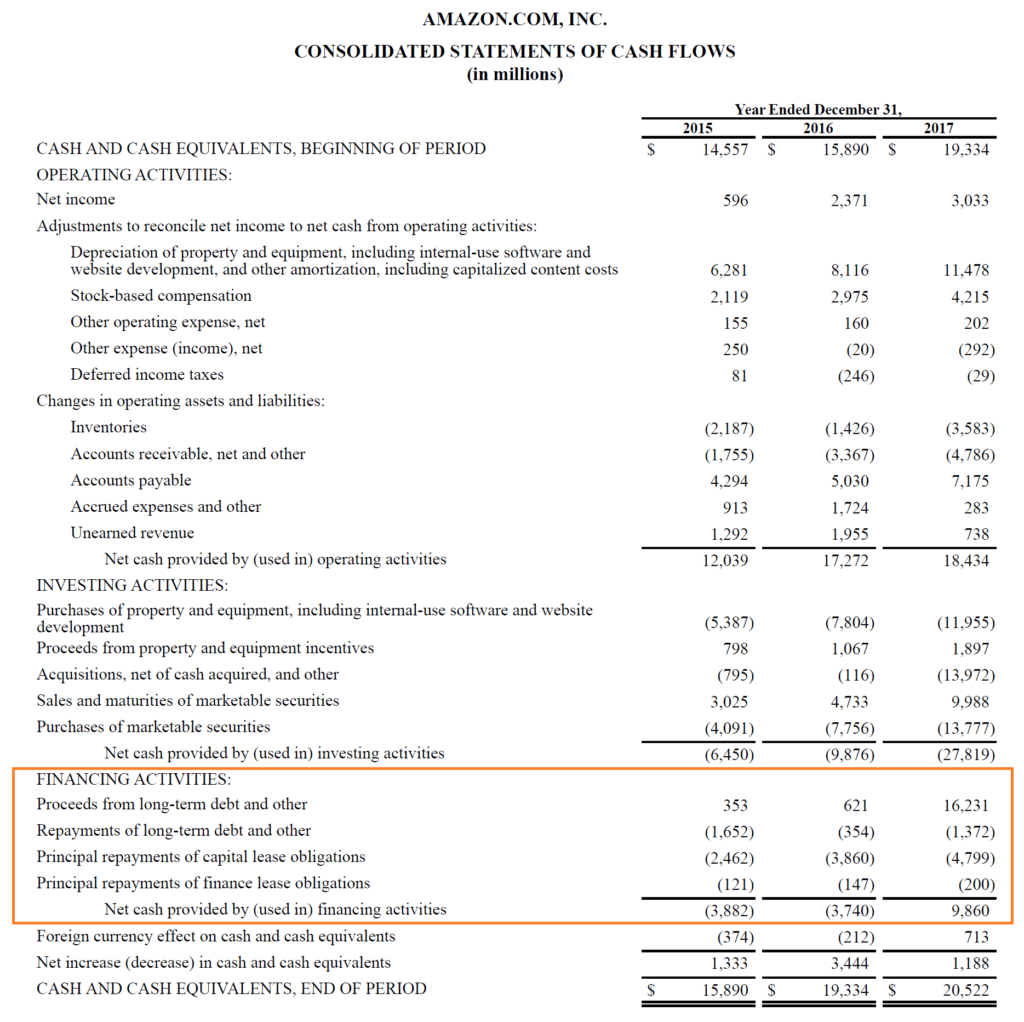

Proceeds from issuing long-term debt debt repayments and dividends paid out are accounted for in the cash flow from financing activities section. But if the repayment does not involve cash outflow then such transaction will not be disclosed in the statement of cash flows. One of the keys to using this tool to produce accurate statements of cash flows is to capture and list in the net asset column.

The interest paid on short-term bank loans is included in the operating activities section of the statement of cash flows. Dividends and interest expense. CADS is considered a better indicator of a.

The largest line items in the cash flow from financing activities statement are dividends paid repurchase of common stock and proceeds from the issuance of debt. Cash outflow on the repurchase of share capital and repayment of debentures loans. A loan installment mostly has two components or elements in it.

Lets assume that a company borrows 10000 from its bank. In each period calculate the Cash Flow Available for Debt Repayment CFADR also known as the Cash Flow Surplus or. Likewise subsequent principal and interest payments on the refunding debt are also reported as cash outflows in the capital and related financing category.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)