Beautiful Compiled Financial Statements Income Tax Basis

Omission of the Display of Comprehensive Income in Compiled Financial Statements.

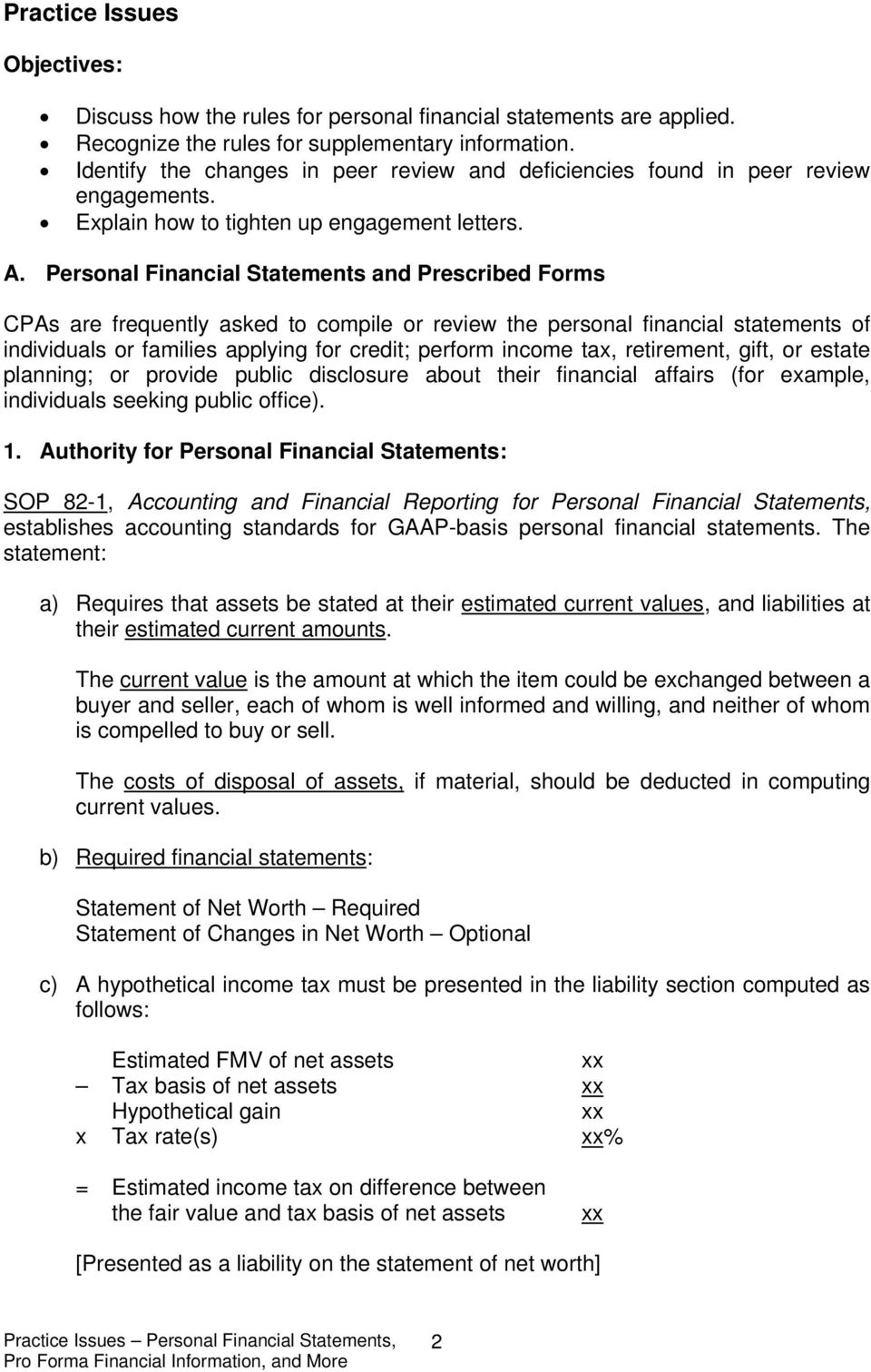

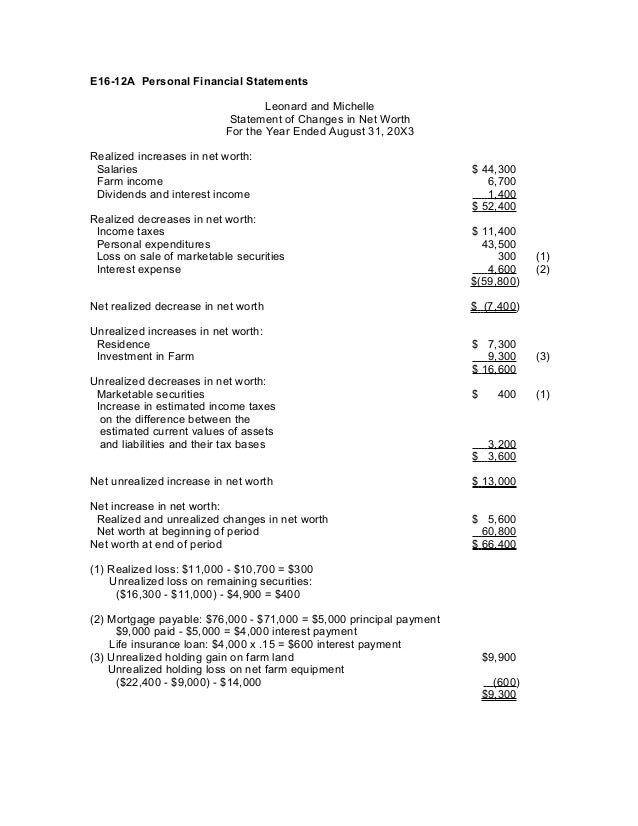

Compiled financial statements income tax basis. If a contractor chooses to present its financial statements on the income tax basis of accounting it could continue to account for long-term contracts using the percentage of completion method. Personal financial statements which are often underestimated in importance serve a similar purpose by reporting the assets liabilities and net worth of an individual married couple or family at a point in time. Recognize the general reporting considerations for income tax basis financial statements and determine how compilation and review reports are affected by use of the income tax basis.

The financial statements can. Reporting on Tax Returns. Some bases of accounting eg tax-basis do not require the issuance of a cash flow statement.

Financial Statements Prepared on a Basis of Accounting Prescribed in a Contractual Agreement or Regulatory Provision That Results in an. The accountant can if directed by management create and issue just one financial statement eg income statement. Accountants performing review or compilation engagements also may consider adding an explanatory paragraph for these basis changes.

However the entity must also report the rest of the balance sheet and income statement using the income tax basis. The financial statements for 20X3 have been restated to reflect the income tax basis of accounting accrual method adopted in 20X4. In compiling a financial statements you must adhere to the AICPAs Standards for Accounting and Review Services SSARS that dictate the terms under which an acceptable compilation can be prepared.

The financial statements are prepared in accordance with the tax basis of accounting which is a basis of accounting other than accounting principles generally accepted in the United States of America. The financial statements are prepared in accordance with the tax basis of accounting which is a basis of accounting other than accounting principles generally accepted in the United States of. Presentation of financial statements and report in accordance with this sec-tion withoutundertaking to obtain or provide any assurance that there are no material modifications that should be made to the financial statements.

The Accountants Compilation Report on Financial Statements. If a financial statement audit is required investors and lenders may be willing to accept financial statements on the income tax basis of reporting. The financial statements are prepared in accordance with the income tax basis of accounting which is a basis of accounting other than accounting principles generally accepted in the United States of America.