Beautiful Change In Accounting Estimate Note Disclosure Example

List the name of standard and interpretation which causes the change to company policy.

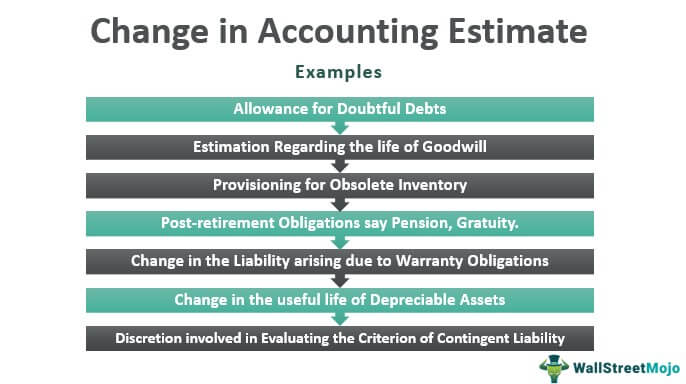

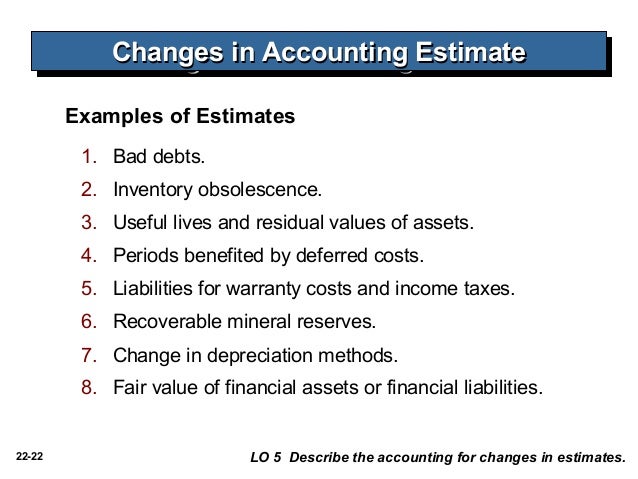

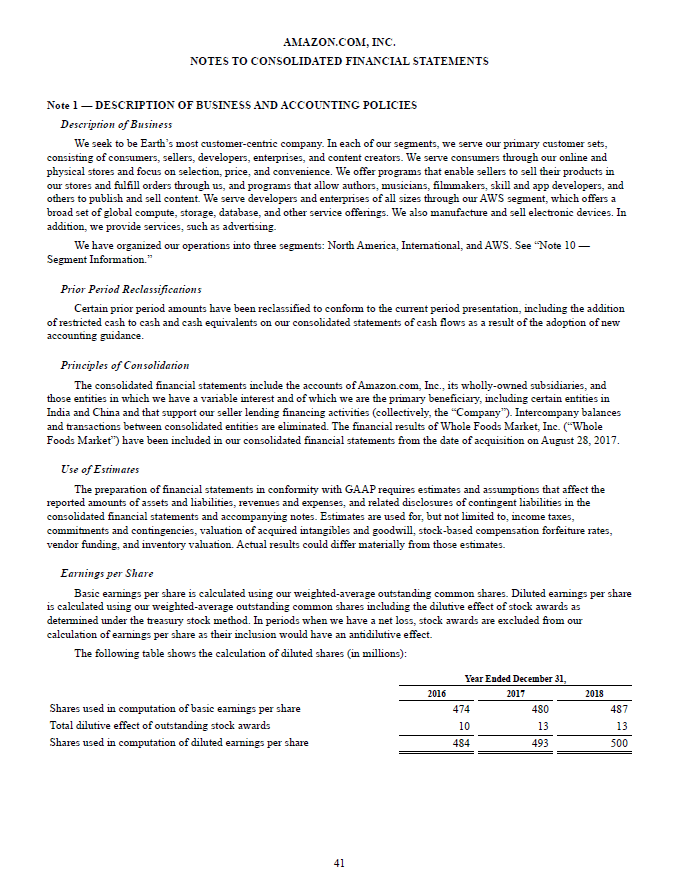

Change in accounting estimate note disclosure example. The amounts and timing of recorded expenses for any period would be affected by changes in these factors and circumstances. It requires companies to reflect changes in estimates prospectively. Sometimes a change in estimate is affected by a change in accounting principle eg a change in the depreciation method for equipment.

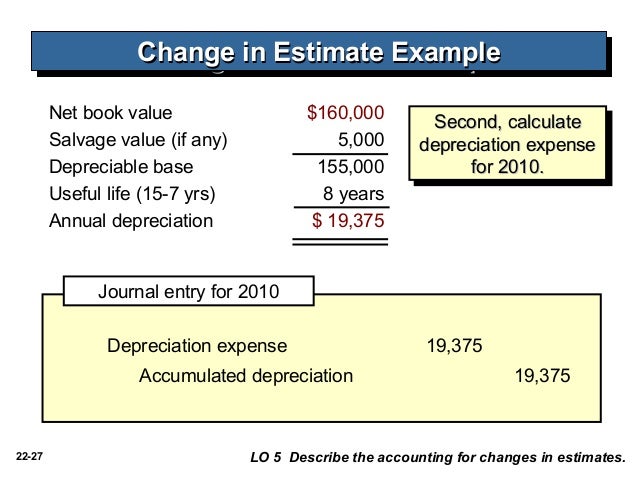

Change in defined benefit obligation. Taking an example lets say that depreciation would be debited for machinery the company has just bought. 291 X Example disclosures for entities that require going concern disclosures 299 XI Example disclosures for distributions of non-cash assets to owners 301.

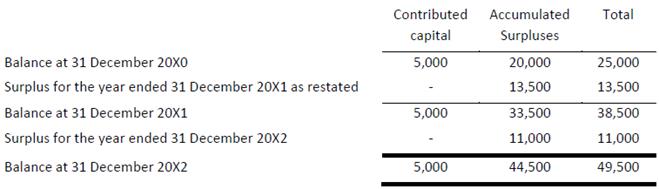

The nature of the change in accounting policy must be disclosed in the financial statements of ABC LTD. Please refer to Notes 23aiii for the revised accounting policy on changes in ownership interest that results in a lost of control and 23b for that on changes in ownership interests that do not result in lost of control. A detailed explanation of the change and the amount previously recorded as an unrecognized tax.

In practice the effects of changes in accounting policy may be hard to determine. The sample disclosures in this document reflect accounting and disclosure requirements outlined in SEC Regulation. To be able to pass that journal entry the accountant needs to estimate an approximate amount and then she can pass the entry.

Practical example 3 - change in an accounting estimate. A reduction in the estimated useful lives of the property plant and equipment would increase the recorded expenses and decrease the non-current assets. If the effect of a change in estimate is immaterial as is usually the case for changes in reserves and allowances do not disclose the alteration.

Changes in Accounting Estimates Estimates must be revised when new information becomes available which indicates a change in circumstances upon which the estimates were formed. Accounting Policies Changes in Accounting Estimates and Errors. Pretransition disclosures about the possible impact of new standards that are required under the existing requirements of IAS 8.