Sensational Fifo Income Statement

This does not necessarily mean the company sold the oldest units but is using the cost of the oldest ones.

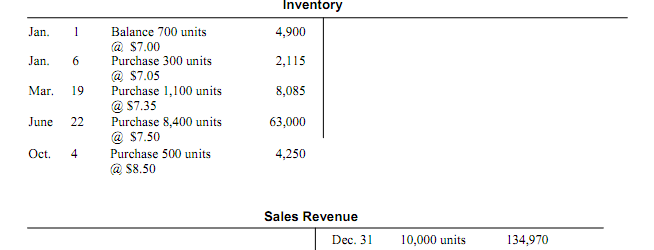

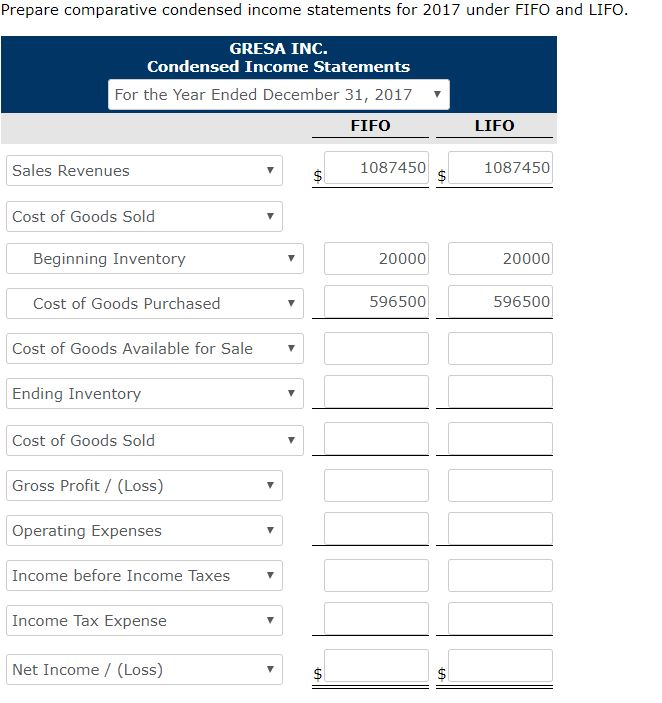

Fifo income statement. Show the balances of the following items on December 31 2013 under FIFO LIFO and average costing method. The financial statements of any business are greatly affected by the choice of the inventory valuation method. I have completed most of the project but I need help with the Cash Budget COGS Calculation using FIFO Budgeted Income Statement and Budgeted Balance Sheet.

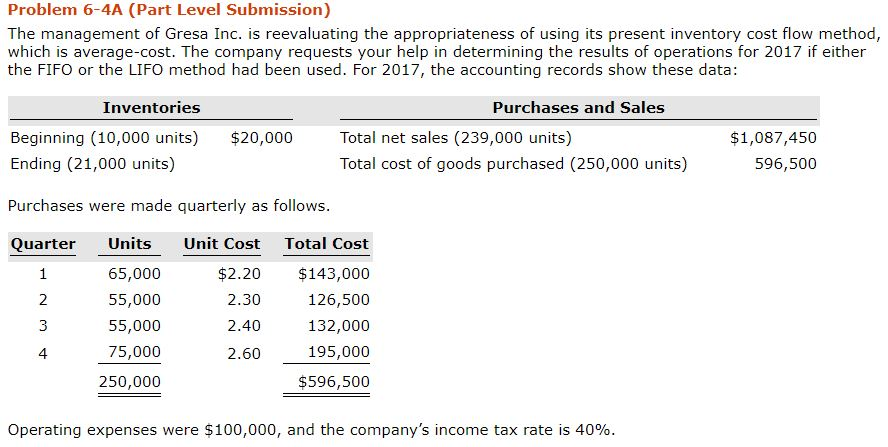

The company presently uses the LIFO method of pricing its inventory and has decided to switch to the. The FIFO First-In First-Out method means that the cost of a companys oldest inventory is used in the COGS Cost of Goods Sold calculation. When a company uses LIFO the income statement reports both sales revenue and cost of goods sold in current dollars.

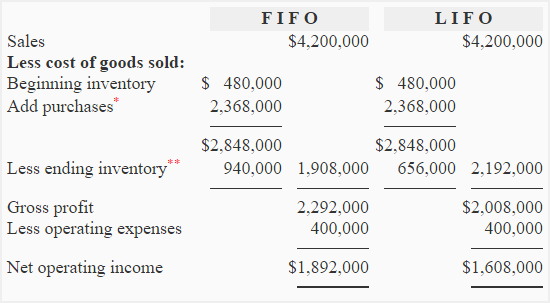

The balance sheet income statement cash flow statement and other key financial ratios reflect the choice and impact stakeholders decisions. Presented below are income statements prepared on a LIFO and FIFO basis for Kenseth Company which started operations on January 1 2019. The FIFO income statement is computed in accordance with the requirements of GAAP.

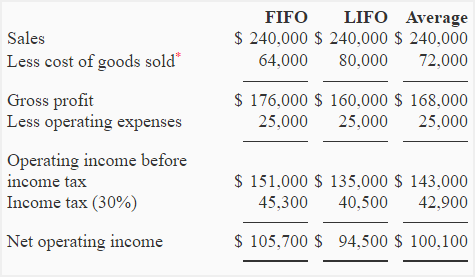

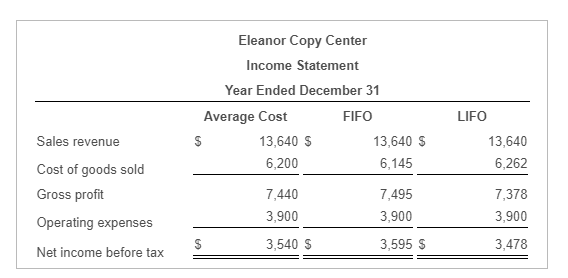

Prepare a comparative income statement using FIFO LIFO and average costing method to show the effect of each on net operating income of HPL Inc. A lower inventory valuation LIFO or higher inventory valuation FIFO would affect the cash flow statement balance sheet and income statement differently and will apply a different value to the inventory in each case. Ferguson concluded that FIFO is the preferable inventory method because it reflects the current cost of inventory on the statement of financial position.

The cells in yellow require formulas so please include those the ones in pink do not require formulas. Heres What Well Cover. The following table presents the effects of the change in accounting policy on inventory and cost of goods sold.

For example lets say that a bakery produces 200 loaves of bread on Monday at a cost of 1 each and 200 more on Tuesday at 125 each. LIFO Last-In First-Out means that the cost of a companys most recent inventory is used instead. To see the income statement effects and the cash effects of FIFO and LIFO assume the 70 units sold by the merchandise company discussed above had a sales price of 38 per unit.