Fantastic Loss On Disposal Of Equipment Cash Flow

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Company Z depreciated the asset.

Loss on disposal of equipment cash flow. The cash proceeds from the sale of the fixed asset are sho. Loss on asset write off also has an impact on a liquidity report because accountants add it back to net income when preparing a statement of cash flows under the indirect method. This means that it does not affect the companys operating income or operating margin.

In theory that loss or gain should have been reflected on the income statement during the assets serviceable life. Add any gain on disposal or take away any loss on disposal this should equal the cash received If you cant figure out the carrying amount of the asset take the cost of the asset and deduct any accumulated depreciation. Cost less accumulated depreciation.

Loss on Disposal of Assets. Disposal of a Fixed Asset with Zero Gain or Loss. If the carrying amount of a fixed asset at the date of disposal is equal to the sale proceeds from disposal there is neither gain nor loss.

Disposal of an Asset with Zero Book Value and Salvage Value. In practice the gain or loss appears in the current accounting period. The loss or gain is reported on the income statement.

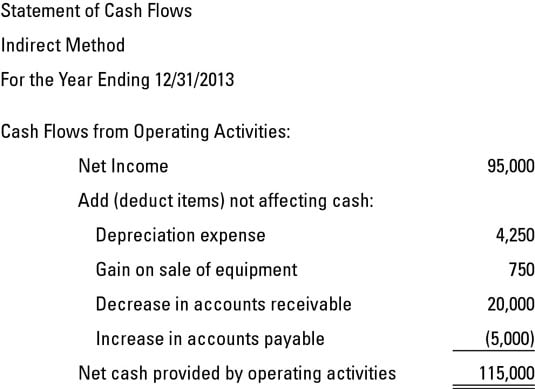

When a company sells fixed assets such as property and equipment and collects proceeds amounting to less than the assets book value a loss on the disposal of assets is recorded as a nonoperating loss on the. Also it is a non-cash expense. Net income 260500 Depreciation expense 79500 Loss on disposal of equipment 36300 Increase in accounts receivable 20800 Increase in accounts payable 12600 Prepare the Cash Flows from Operating Activities section of the statement of cash flows Question.

This is because the company incurs a loss but doesnt pony up any cash for it the way it. Loss on Disposal of Assets and EBITDA Depreciation Expense. The loss reduces income while the gain increases it.