Unique Tax Credit Mismatch 26as

The consequences of the tax credit mismatch 26 AS are.

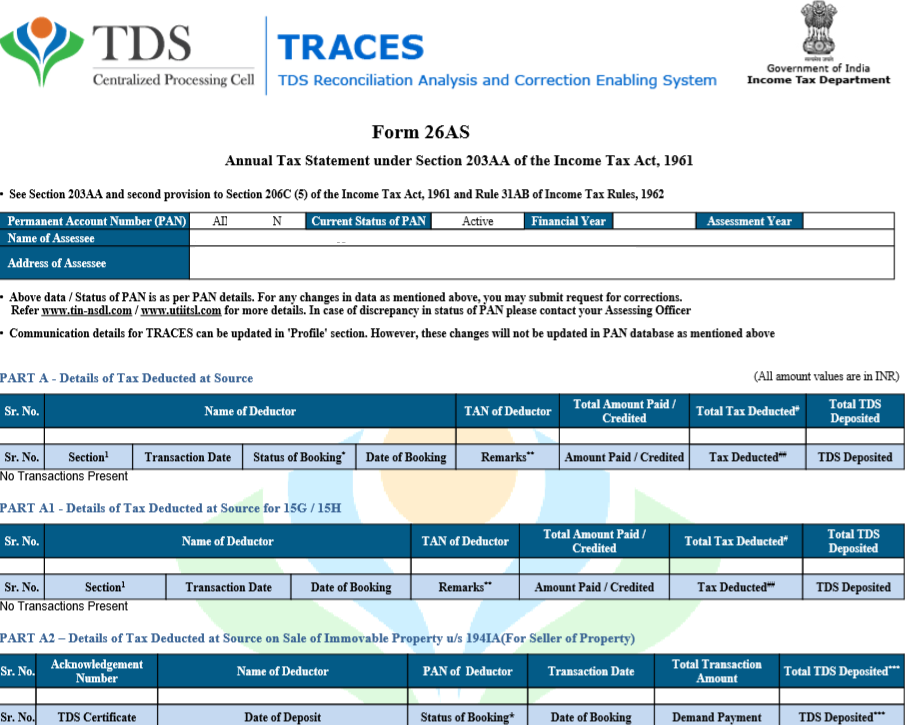

Tax credit mismatch 26as. In the Tax Credit Mismatch page after you enter your details check for any mismatch between respective TDS TCS any other challan amounts and amount as per 26AS. Tuesday December 30 2014. The basis for detecting the mismatch in Form 26AS is your Form 16 and Form 16A.

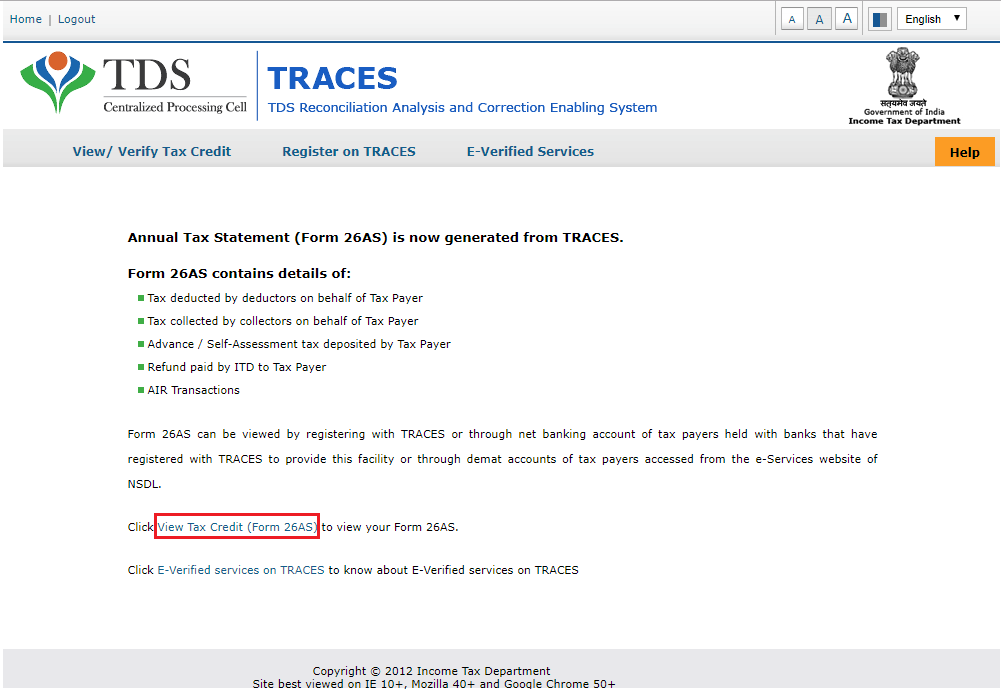

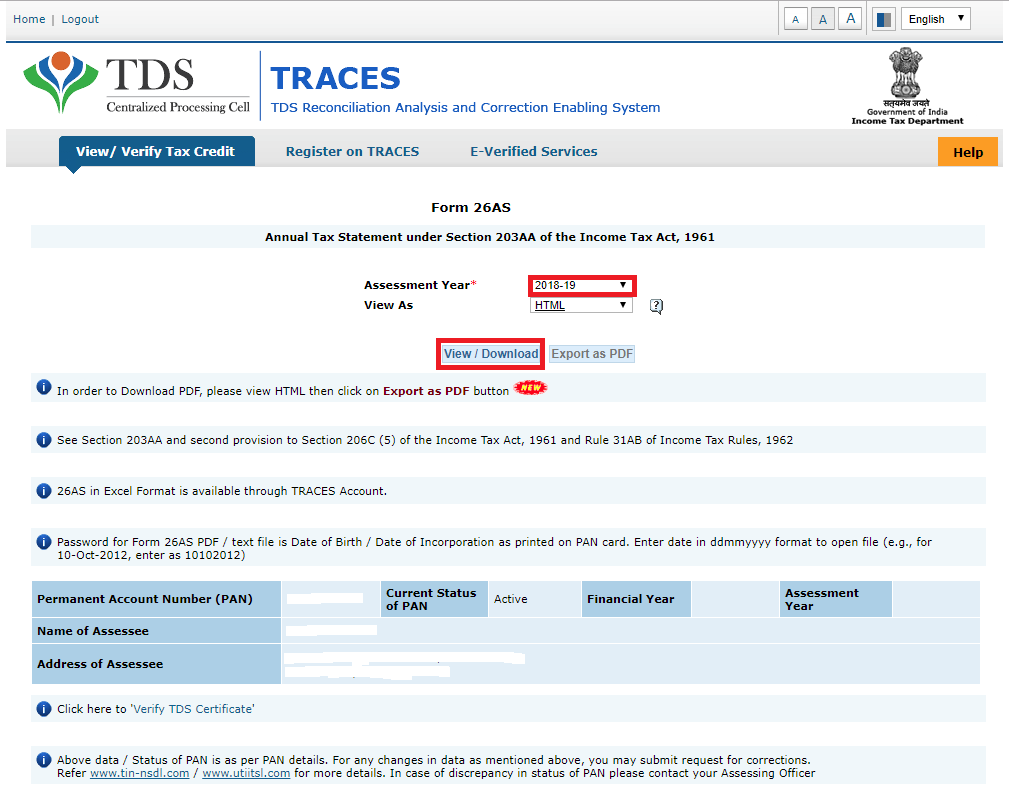

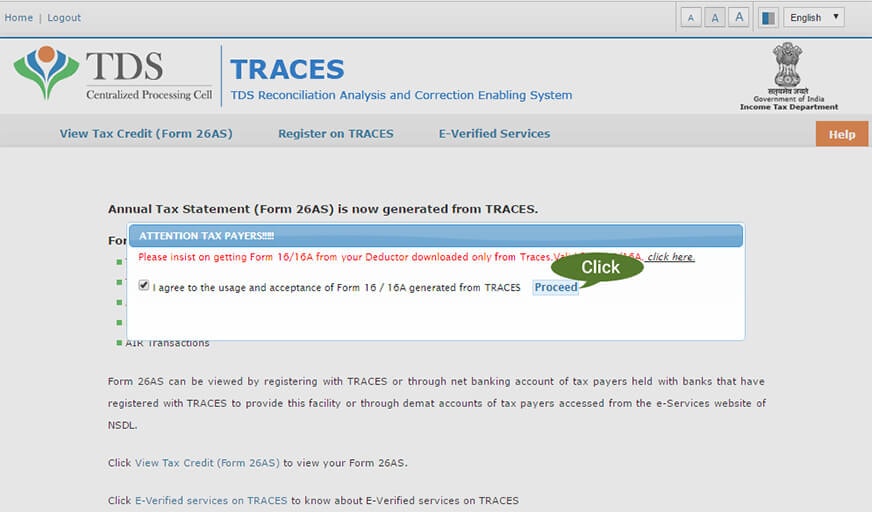

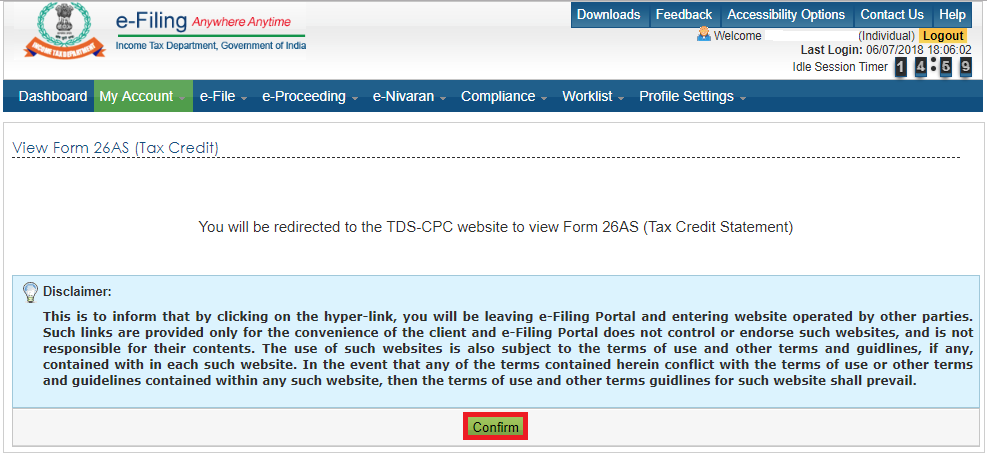

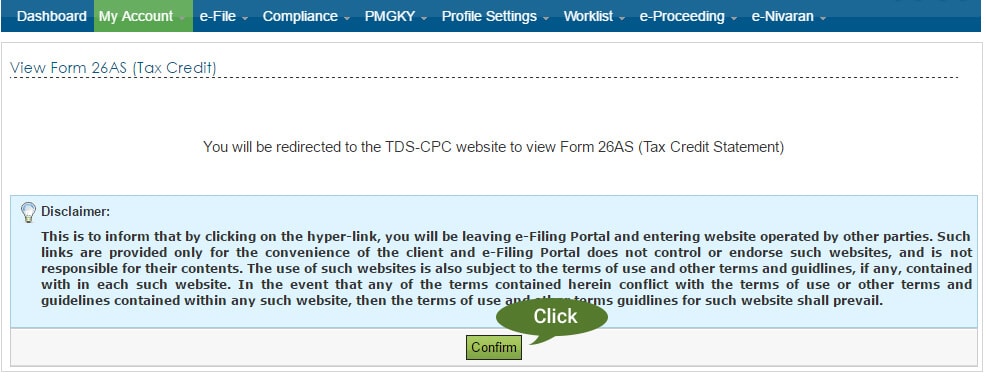

View Tax Credit Statement Form 26AS Perform the following steps to view or download the Form-26AS from e-Filing portal. If the mismatch is due to your employers mistake heshe has to file a revised TDS Return with correct details. Form 26AS which is also known as the passbook for your tax deposits is an important documents and your tax refunds if any after filing of the income tax return ITR depnds on the tax.

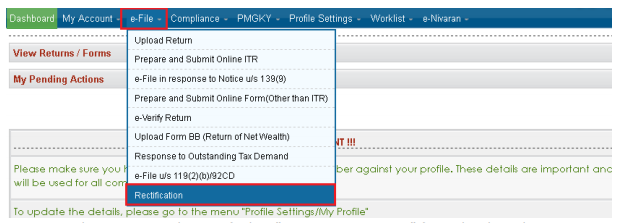

If there is any mismatch in your tax credit statement Form 26AS and actual TDS deduction you need to get it rectified before filing your ITR. If there happens to be a mismatch between the two CPC Bangalore is processing Income Tax Returns by giving credits only for TDS as per online form 26AS and raising income tax intimations under section 1431 with unmatched TDS as payable by the assessee. There are many software and links present by which mismatches can be identified.

While you receive your Form 16 from your employer you are given Form 16A by your bank. Logon to e-Filing Portal wwwincometaxindiaefilinggovin. The Income Tax Department uses Form 26AS as the final and authentic information about tax paid on your behalf by the deductor.

To identify the mismatches in the TDS statement and Form 26as the ITR processing become advanced. Mismatch between TDS statement and Form 26AS. The facility of pre-fill is given to people.

In a recent judgement Honble Allahabad High Court has ruled that credit for tax deducted at source must be given by the Income Tax Department even in case of mismatch of TDS with Form 26AS where assessee produces TDS Certificates. If you are a taxpayers you need to check your Form 26AS to ensure the tax deducted at source TDS is reflected correctly in the income tax records. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal.