Fantastic 26as Tds Return Meaning

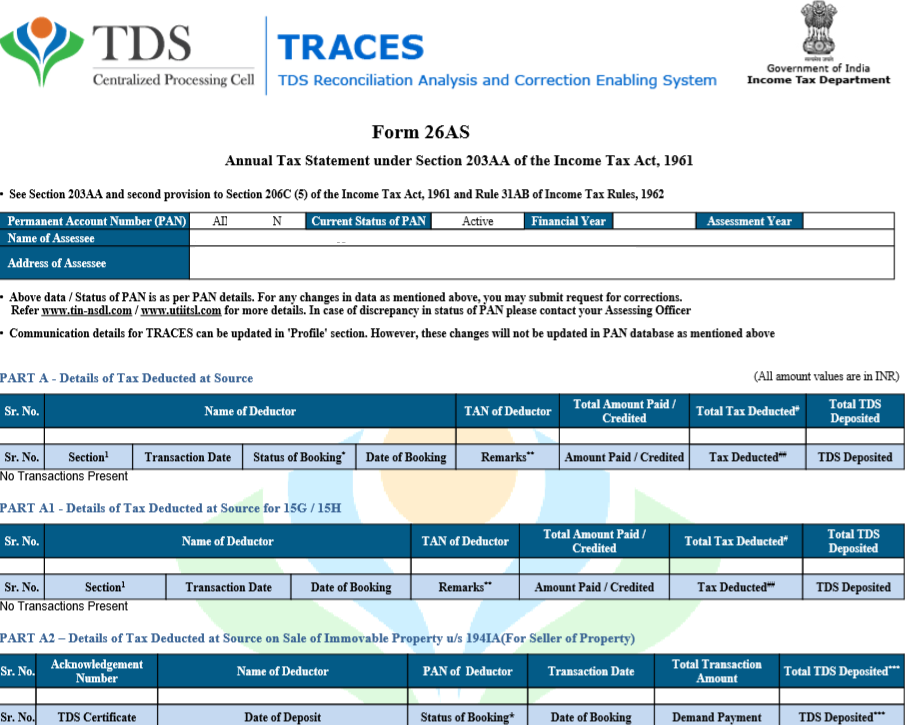

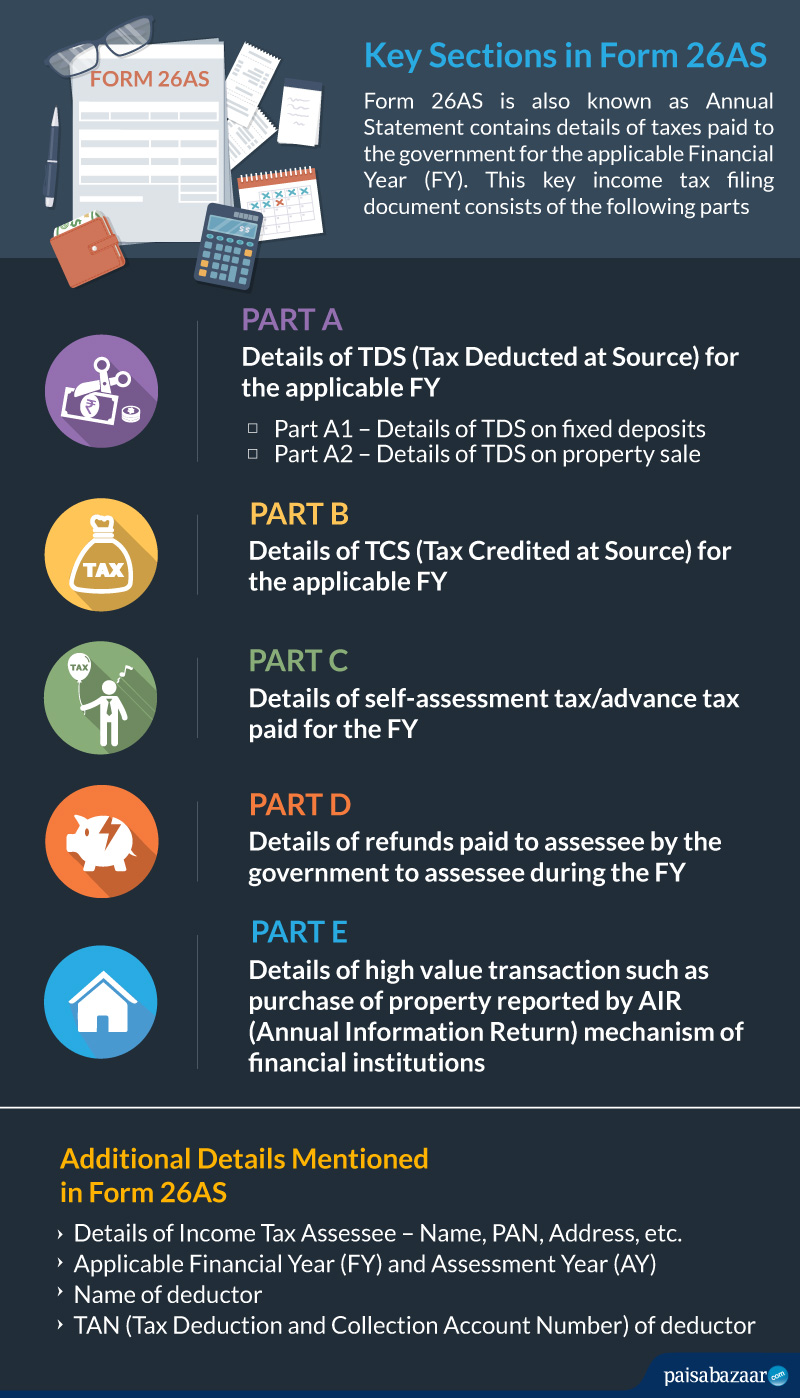

Form 26AS is also known as annual statement which contains all tax related information of a taxpayer.

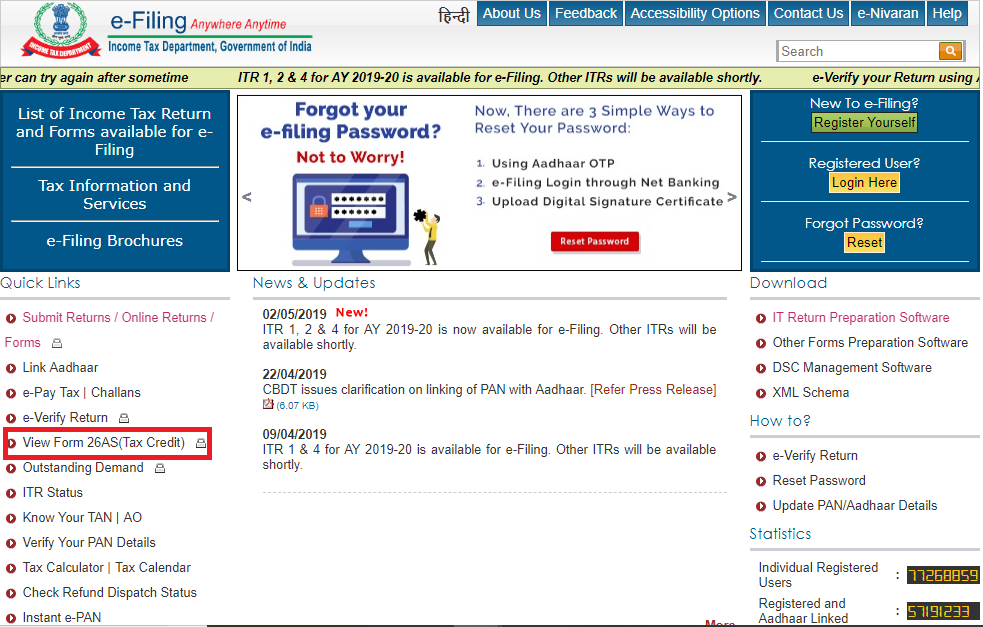

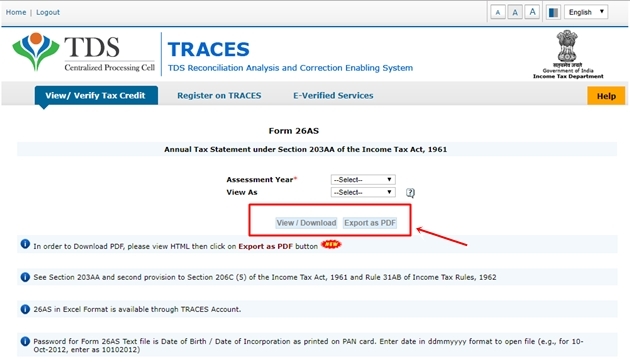

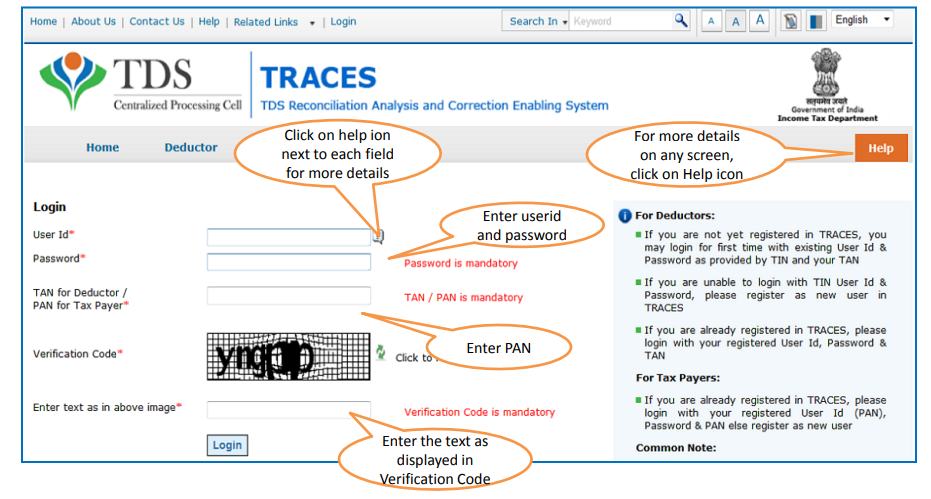

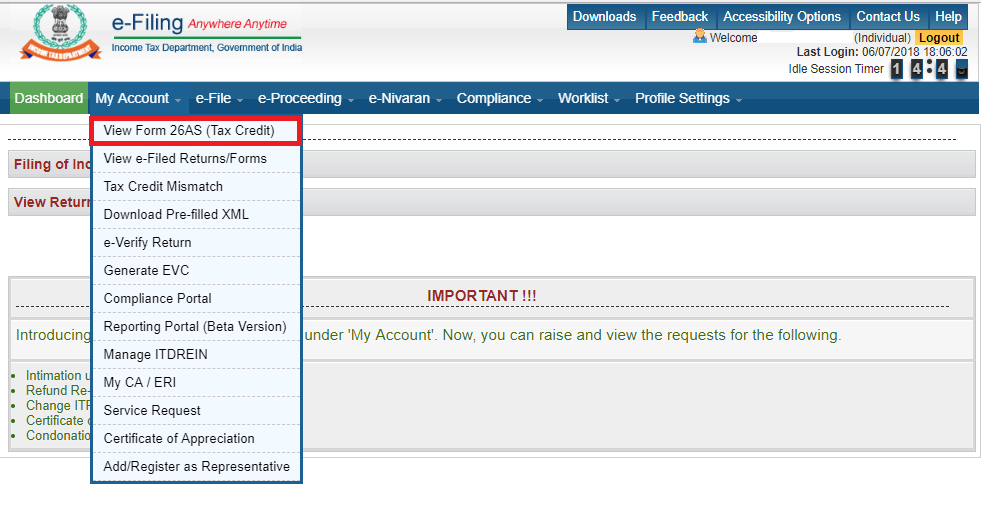

26as tds return meaning. The details give a clearer picture of the tax commitments of a taxpayer. Go to the My Account menu click View Form 26AS Tax Credit link. Form 26AS enables an individual to check whether all instances of TDS deduction from the salary.

Form 26AS is a consolidated tax deduction statement which keeps all your annual record of any tax paid by you or on your behalf. Therefore it is important that the tax payer should compare the. Form 26AS is introduced by income tax department and tdscpcl.

Any mismatch or discrepancy between the high-value transaction viz-a-viz the tax return filed by the assessee can trigger the issuance of notices by the IT officers. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. For TDSTCS the entities and persons deductingcollecting tax are required under the IT Act to.

Income Tax department keeps all your tax-related data in their database through 26AS. Besides income from sources such as investment in. Form 26AS confirms that your tax deducted tax paid by you is received by the government.

February 19 2016. Click View Tax Credit Form 26AS Select the Assessment Year and View type HTML Text or PDF. The objective of improving the Form 26AS is to enable a taxpayer to file his income tax return correctly and smoothly without missing any financial transactions carried out by the taxpayer during a financial year.

Form 26 AS contains the details of the tax credit in an account or appearing in the Permanent Account Number of the respective assessee as per the records of the Department of Income Tax which can later be claimed by the taxpayer. Please request your client to keep TDS return for Q4 for FY 2012-13 same as it was before and remove the entries from FY 2013-14. It is a really useful tool which not only gives you annual tax related information but also saves you from income tax noticesIn this part we will analysis each part of.