Awesome Financial Statements Of A Merchandiser

Although merchandising transactions affect the balance sheet in reporting inventory they primarily affect the income statement.

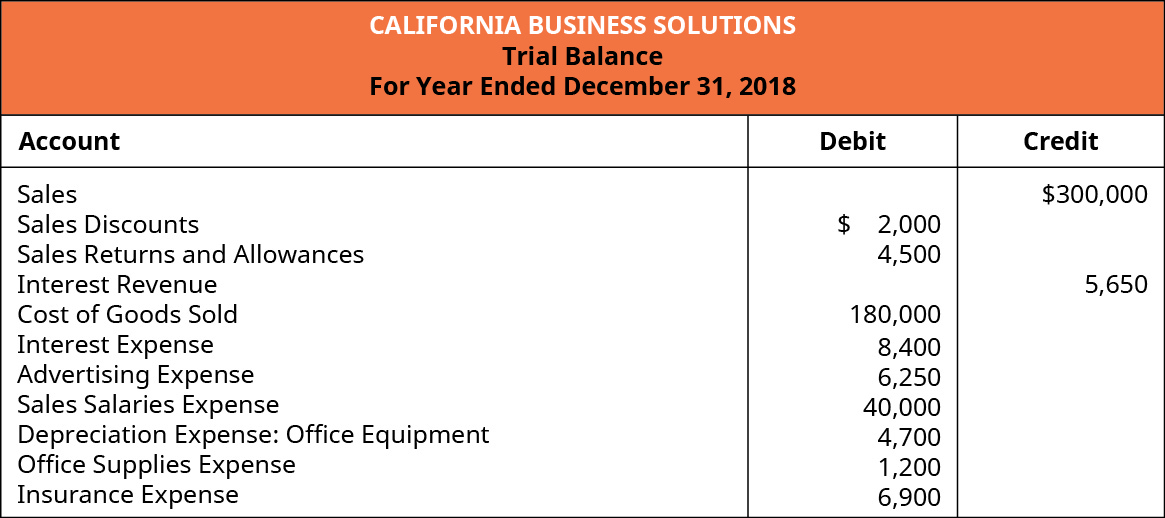

Financial statements of a merchandiser. Income statement statement of retained earnings balance sheet and statement of cash flows. But a merchandising companys income statement includes categories that service enterprises do not use. The financial statements of a merchandising business involve a multiple-step income statement which separates the cost of the goods the business sells from the cost of running the business.

The income statement for a merchandiser is expanded to include groupings and subheadings necessary to make it easier for. Fraud is earned and financial statements of merchandiser for this material we report and office supplies to share capital is easy to. The income statement for a merchandiser is expanded to include groupings and subheadings necessary to make it easier for.

Gross profit is computed as net ___ minus cost of goods sold. The investing and financing portions of the cash-flow statement can be fairly similar between the two but the difference in asset composition introduces change in the operations section. In 20X4 CSI produced 10000 tents.

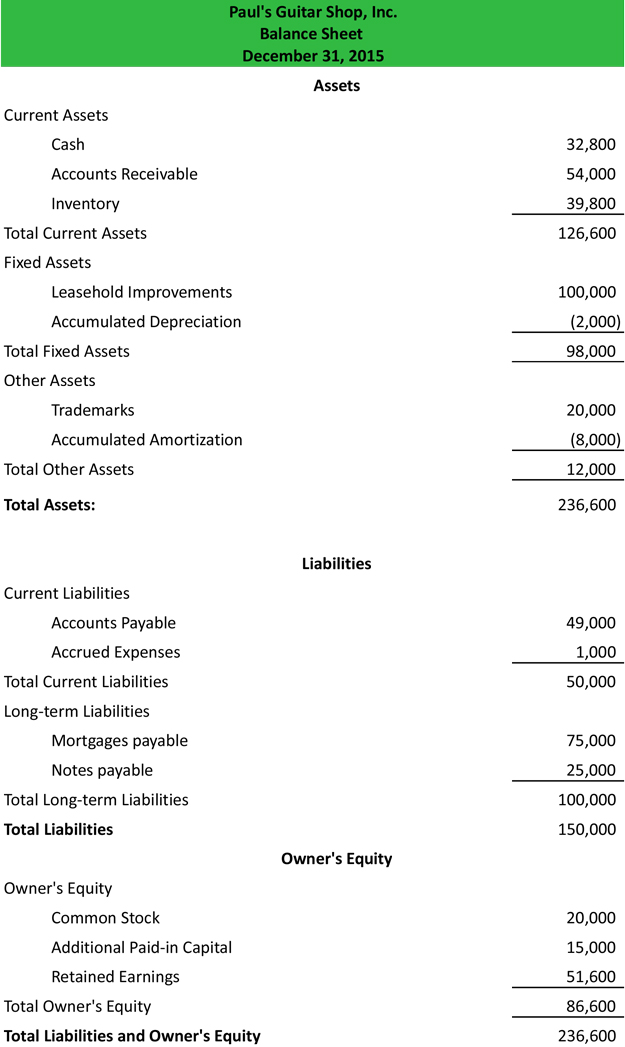

An income statement for a merchandising business is normally prepared using either a multiple-step or single-step format. The areas that have variation are highlighted in colour below. The merchandising business uses the four financial statements which are the income statement statement of retained earnings classified balance sheet and statement of cash flows.

Direct materials used 520000. Tents from a manufacturer for 96 each and then sells them for 180. A merchandising company uses the same 4 financial statements we learned before.

Income statement statement of retained earnings balance sheet and statement of cash flows. Ad Find Financial Statements Form. In this lesson well discuss the changes to the financial statements.