Simple Financial Stability Ratio Formula

Updated March 05 2021.

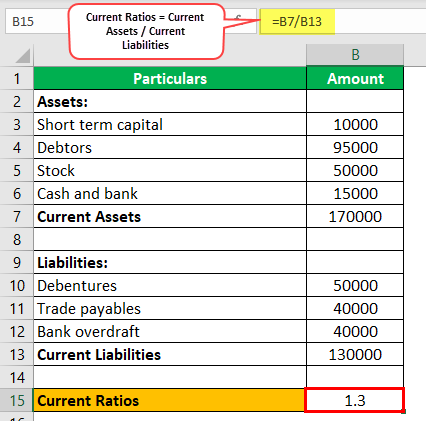

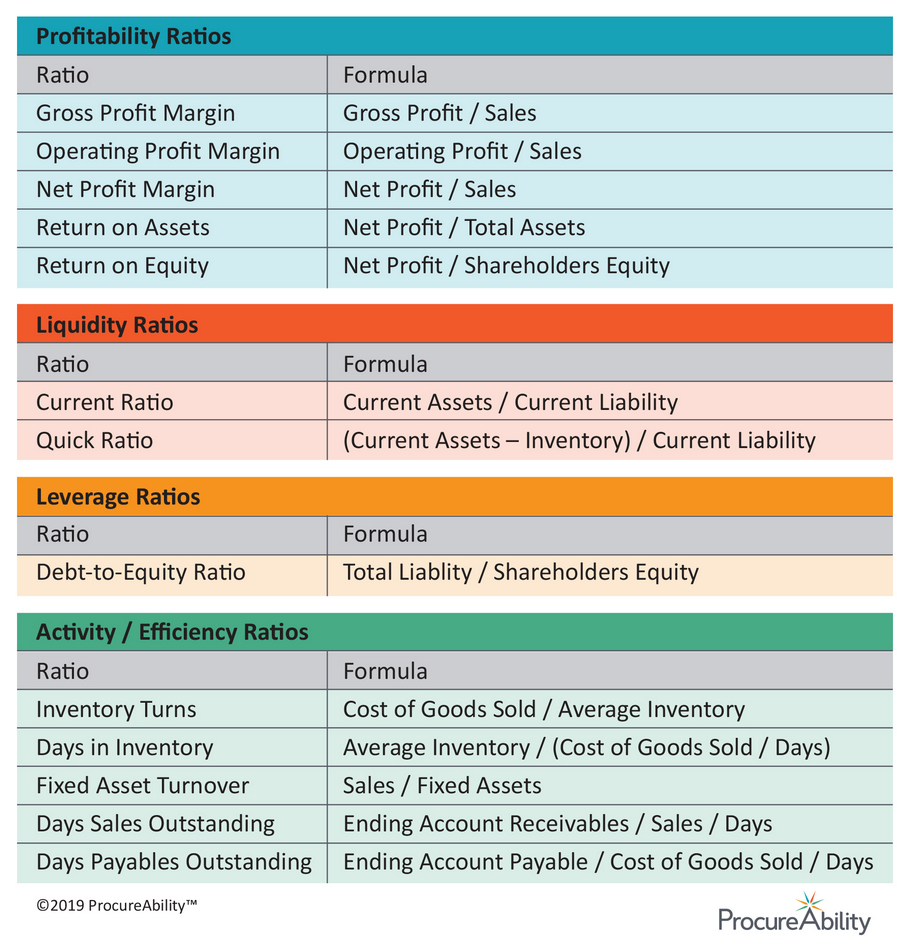

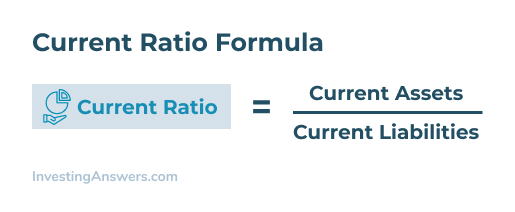

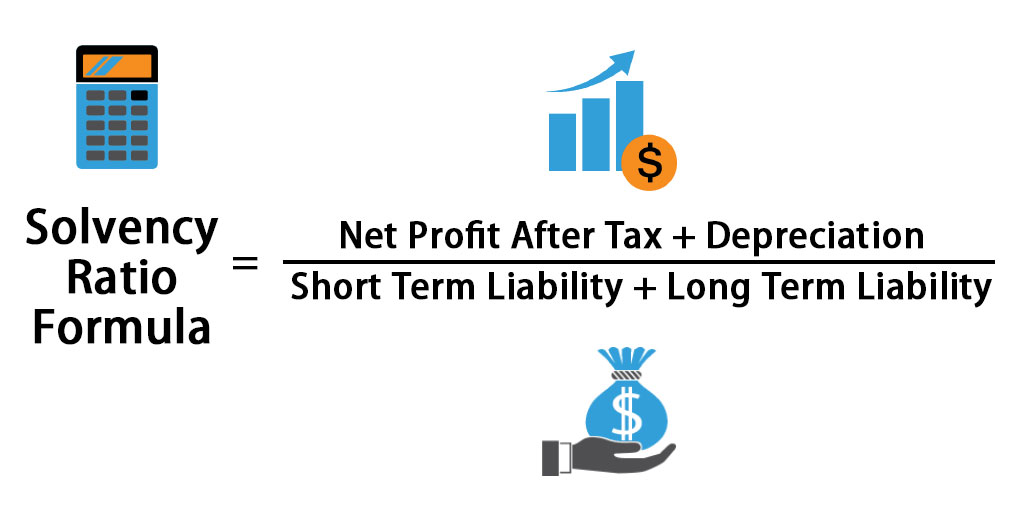

Financial stability ratio formula. Financial stability ratios are tools for gauging ability to meet long-term obligations with enough working capital left to operate. Quick Ratio Cash Marketable Securities Receivables Current Liabilities If inventories are not easily liquidated the quick ratio provides a better indicator of the firms financial solvency vis-à. Income statement formulas are ratios you can calculate using the information found on a companys income statement.

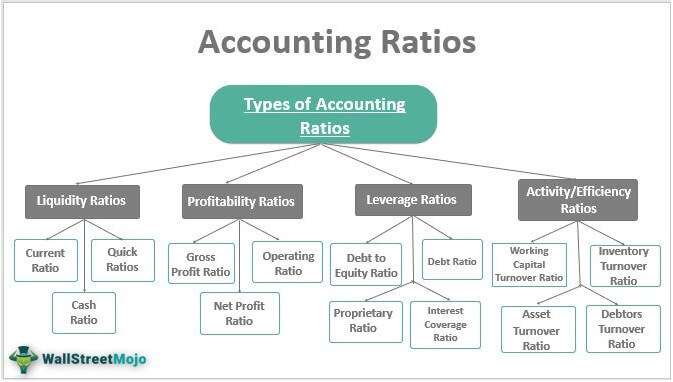

The aim is to obtain a comparison that is easy and beneficial to interpret. We figured out the formula and the indicators necessary for the calculation. An accounting ratio is made by dividing one account item into another.

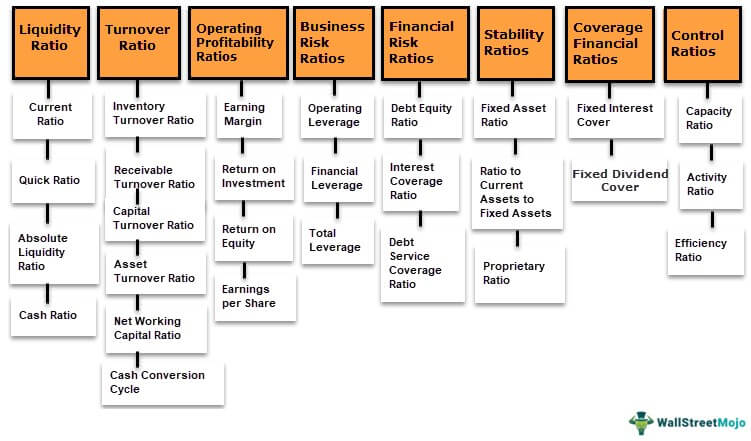

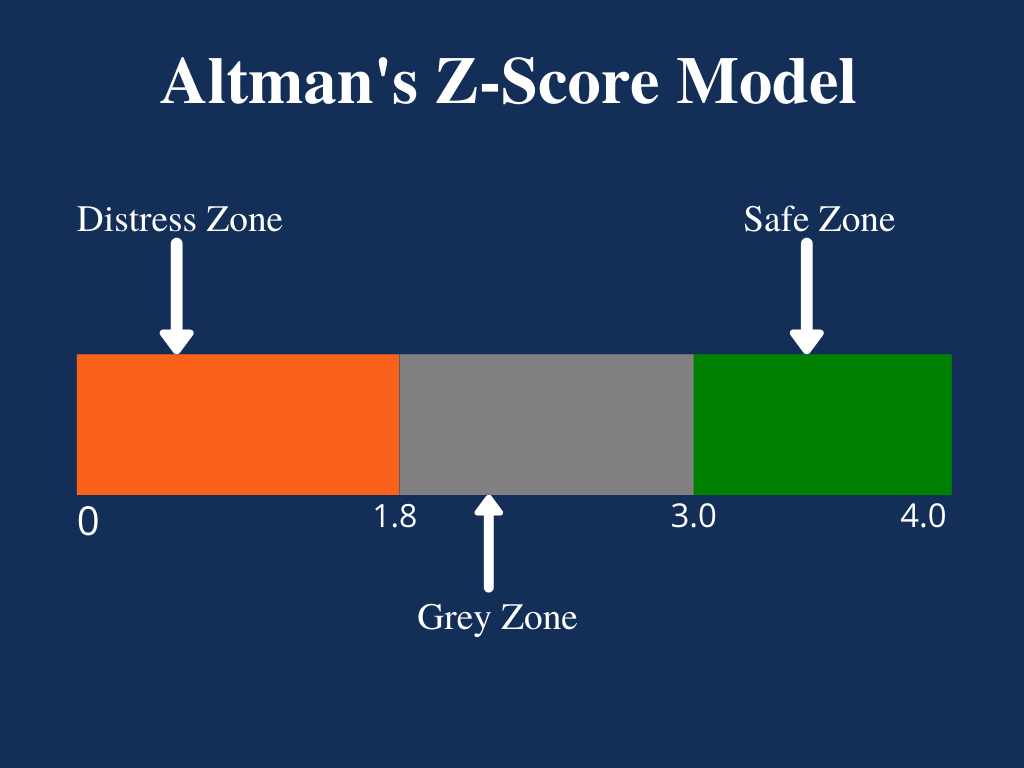

This list is not exhaustive. Schools with scores of less than 15 but greater than or equal to 10 are considered financially responsible. Summary of Financial Ratio Calculations This note contains a summary of the more common financial statement ratios.

When you are making these calculations it can help to have an easy-to-reference summary. Tweet SUMMARY OF FINANCIAL ACCOUNTING RATIO PROFITABILITY RATIO. A score greater than or equal to 15 indicates the institution is considered financially responsible.

Calculations vary in practice. The composite score reflects the overall relative financial health of institutions along a scale from negative 10 to positive 30. Using income statement formulas can help you analyze a companys performance and make decisions about investing.

Profitability ratios are a class of financial metrics that are used to assess a businesss ability to generate earnings relative to its revenue operating costs balance sheet assets or. Financial stability refers to- How stable robust companys capital structure is. Consistency and the intuition underlying the calculated ratio are important.