Ideal Ifrs 16 Disclosure In Financial Statements

IFRS 16 Example Disclosures How early adopters disclosed IFRS 16 in the 2018 Financial Statements 2019 KPMG Advisory NV registered with the trade register in the Netherlands under.

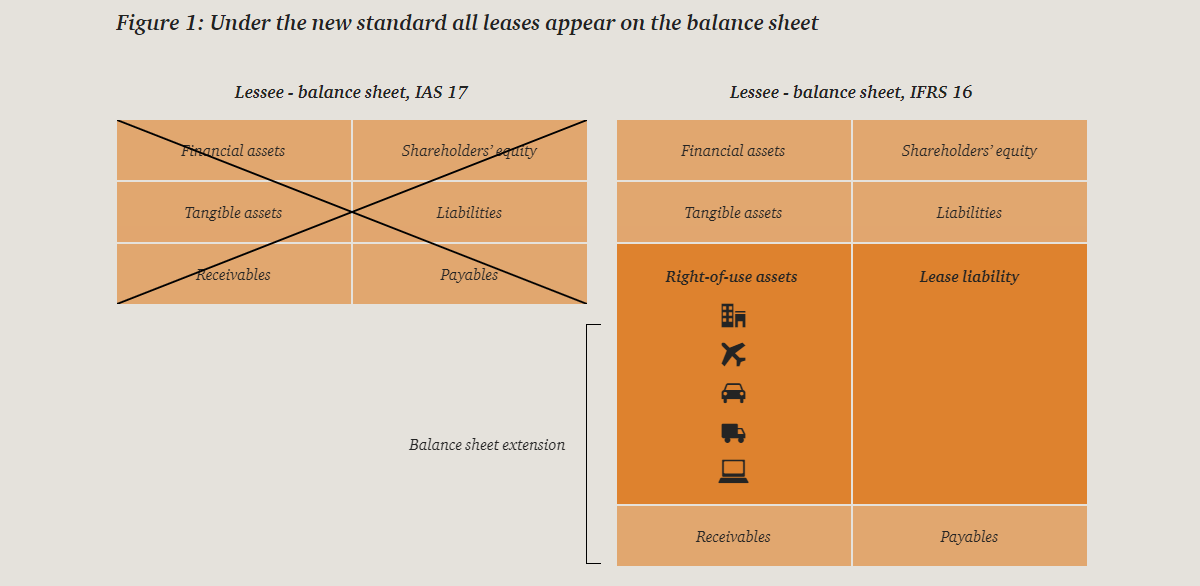

Ifrs 16 disclosure in financial statements. Impact of IFRS 16 on Lessees financial statements The most significant effect of IFRS 16 requirements will be an increase in lease assets and financial liabilities. Accordingly for companies with material off-balance sheet leases there will be a change to key financial metrics derived from the companys reported assets and liabilities. The objective of the disclosures is to provide users of financial statements with a basis to assess the effect of leasing activities on the entitys financial position performance and cash flows.

Disclosures under IFRS 16 This overview of the disclosure requirements under the new leases standard highlights similarities to and differences from the existing disclosure requirements. Ad Discover our tailor-made solutions adapted to your company and your sector. An entity must not describe financial statements as complying with IFRS Standards unless they comply with all the requirements of the Standards.

Entities should focus on. The purpose of this article is to present the most important changes brought by IFRS 16 with the focus on the financial statements disclosures and to analyze the IFRS 16 disclosures from the financial statements of top five credit institutions operating in the Romanian banking sector. IFRS 16 disclosures in interim financial statements.

Now lets cover the disclosure requirements for lessees under IFRS 16. IFRS 16 contains both quantitative and qualitative disclosure requirements. Disclosures IFRS 16 requires different and more extensive disclosures about leasing activities than IAS 17.

A Right-of-use assets separately from other assets. A separate section sets out the disclosures that an entity is required to make on transition to IFRS 16. Need reliable software to perform your financial forecasts or KPI monitoring.

In the first year of applying IFRS 16 this means that additional. Companys background followed by IAS17 disclosures and then presented extracts from the 2019 financial statements that incorporate the requirements of IFRS16. The significant changes that IFRS 16 brings is likely to be a focus area of investors regulators and other key stakeholders.

.png.aspx?lang=en-NZ)