Casual Indirect And Direct Method Cash Flow

Reading 23 LOS 23g.

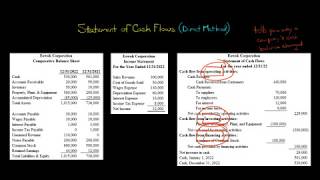

Indirect and direct method cash flow. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. With the indirect cash flow you are reconciling back to cash. The investing and financing sections of the statement are prepared using one single method by directly listing the investingfinancing cash inflows and outflows.

Under this method net cash provided or used by operating activities is determined by adding back or deducting from net. The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities. Cash flow statement indirect method June 23 2021 What is the Cash Flow Statement Indirect Method.

The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. The Direct method discloses major classes of gross cash receipts and cash payments while the Indirect method focuses on net income and non-cash transactions. The indirect method uses net income as the base and converts the income into the cash flow through the use of adjustments.

Direct and indirect cash flow are two methods of arriving at the net cash flow from operating activities in the cash flow statement. Indirect method of cash flow Both methods of cash flow analysis yield the same total cash flow amount but the way the information is presented is different. The indirect method will require additional adjustments to the cash flow statement.

Either the direct or indirect method may be used to report net cash flow from operating activates. The empirical evidence indicates that the direct method is superior over the indirect method in predicting future operating cash flows and future net operating cash flows. Convert cash flows from the indirect to.

The difference however only applies to the operating cash flow. The indirect method works from net income so the bottom of the income statement and adjusts it to the cash basis. For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it.