Top Notch Formula For Ending Retained Earnings

Whenever a company generates a surplus it always has an option to pay a dividend to its shareholders or retain with itself.

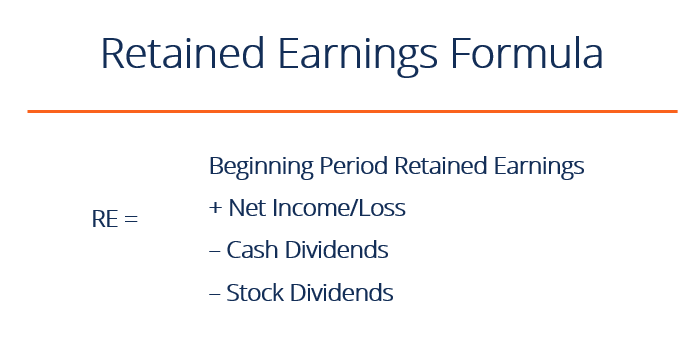

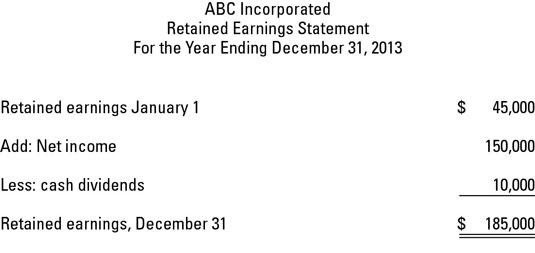

Formula for ending retained earnings. Example of Unappropriated Retained Earnings. Accordingly the retained earnings formula is as follows. One important metric to monitor is the retained earnings calculation which is based on this formula.

Businesses that generate retained earnings over time are more valuable and have greater financial flexibility. For instance Apple Incs balance sheet from fiscal Q3 of 2019 shows that the company had retained earnings of 53724 billion as of the end of the quarter in June 2019. However to fully ensure the most accurate ending balance in the retained earnings account bookkeepers must do all of the following.

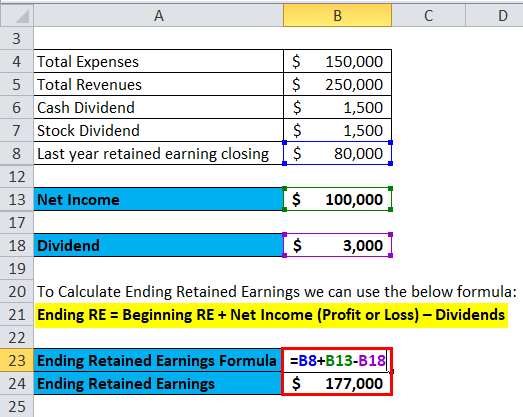

Example of the Retained Earnings Formula ABC International has 500000 of net profits in its current year pays out 150000 for dividends and has a beginning retained earnings balance of 1200000. The retained earnings formula is fairly straightforward. 1200000 Beginning retained earnings.

Theres a bit of financial jargon in. 100000 25000 - 5000 120000. It is also known as plow back or ending retained earnings.

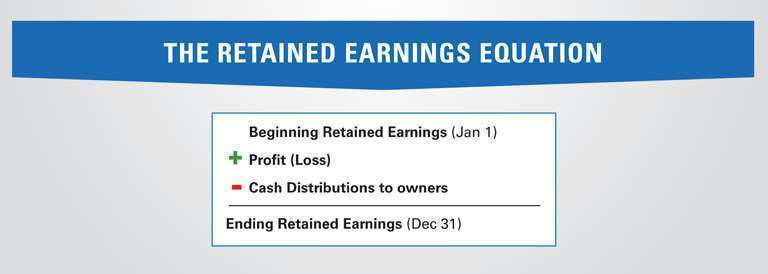

Here is the simple online Retained Earnings calculator to find the ending retained earnings RE of an organization or company based on the beginning balance dividends and the net income. This video shows the formula for Retained Earnings. To calculate Retained Earnings the beginning Retained Earnings balance is added to the net income or loss and then dividend payouts are subtracted.

Retained Earnings Retained Earnings at the beginning of the accounting period Net Profit - or Net Loss during an accounting period Dividends Paid both Cash Dividends and Stock Dividends. The formula for Retained Earnings posted on a balance sheet is. To use the retained earnings formula we need to know the beginning retained earnings net income and dividends of a company.