Heartwarming Ratio Analysis Of Tcs

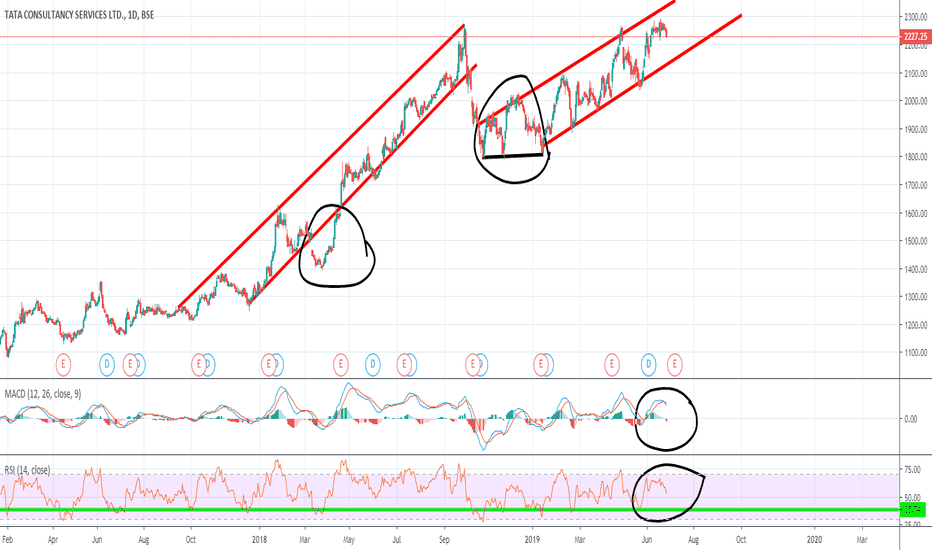

Net Profit Margin 2277.

Ratio analysis of tcs. Book NAVShareRs 23137 22221 23801 44614 43490 36050. In other words the return on equity ratio shows how much profit each rupee of common stockholders equity generates. Mar 2008 - Apr 2009 Mar 2009 - Apr 2010 Interest-coverage Ratio 78441 68443 13.

Alternatively the interest coverage ratio is a measurement of the number of times a company could make its interest payments with its earnings before interest and taxes. Tax Rate 2559 2320 2406 2409 2363 2356. The current ratio measures the companys ability to pay short-term and long-term obligations.

Tata Consultancy Services Q4 PAT seen up 97 QoQ to Rs 95425 cr. Key Financial Ratios of Tata Consultancy Services in Rs. TCS is second among most valuable it firms in the world.

TCS has a ROE of 420184034092451 higher is better. Operational. Core EBITDA Margin 2835 2683 2697 2641 2739 2824.

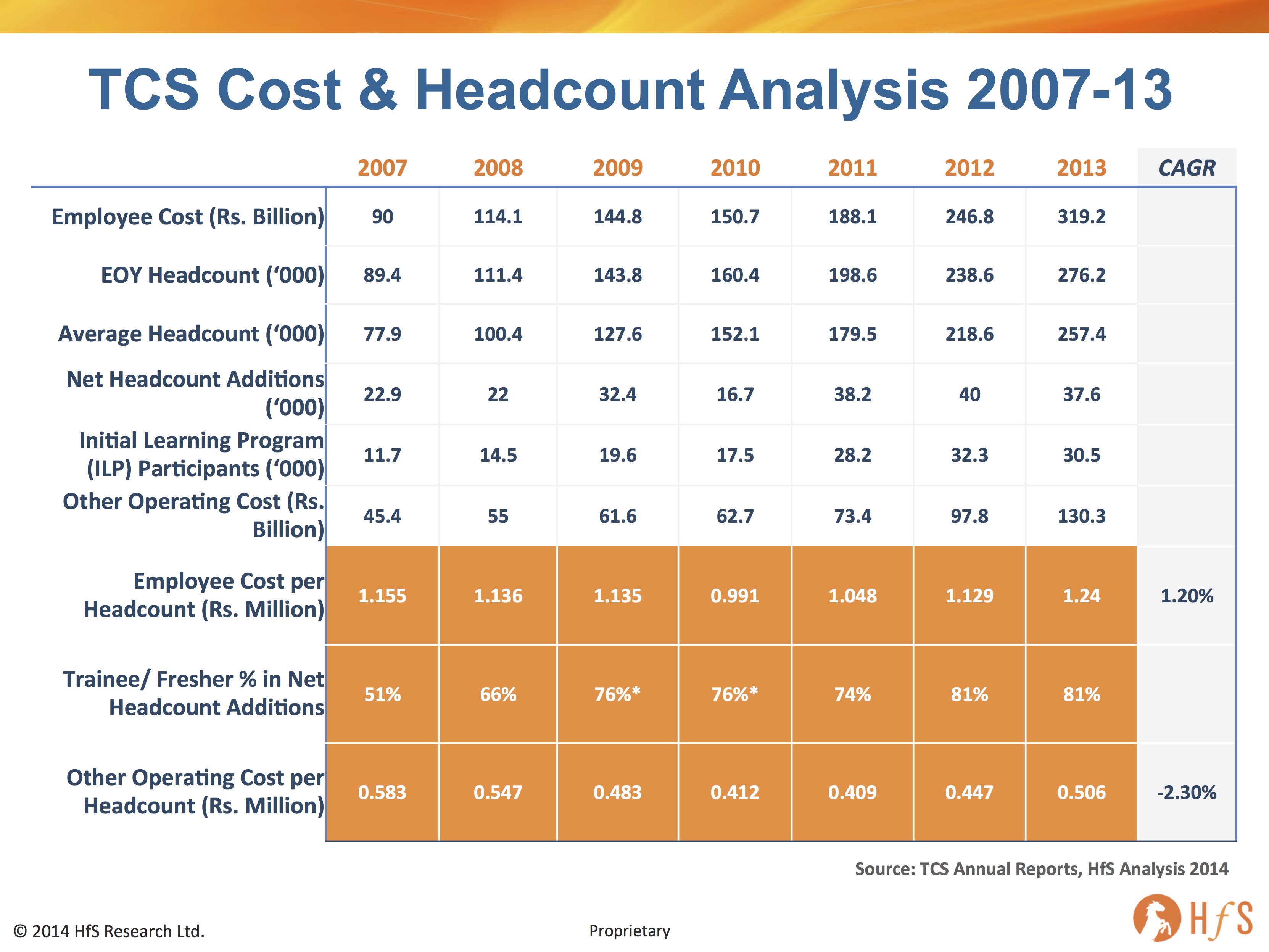

Up 156 fiscal year ending March 31 2013. The ROE after subtracting preferred shares tells common shareholders how effectively their money is being employed. The companys current ratio deteriorated and stood at 33x during FY20 from 42x during FY19.

TCS Ratios Financial summary of TCS TCS Profit Loss Cash Flow Ratios Quarterly Half-Yearly Yearly financials info of TCS. TCS had dividend coverage ratio of 295 and dividend payout ratio of 33 in fiscal year ending March2014. Per Share Ratios.