Heartwarming Uses Of Ratio Analysis In Accounting

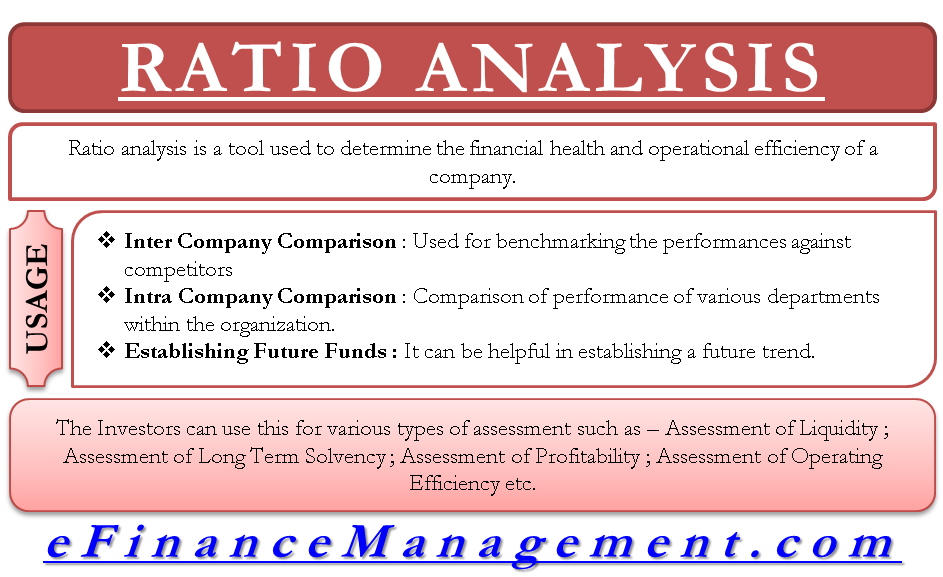

The ratio analysis is one of the most powerful tools of financial analysis.

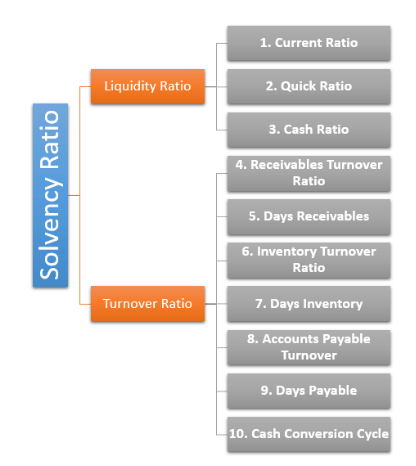

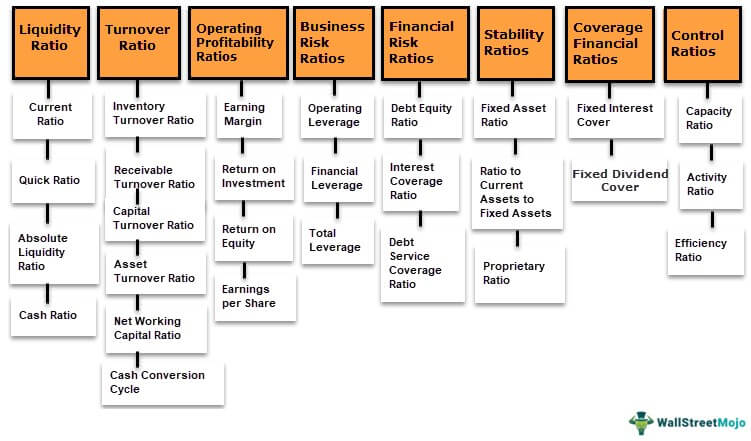

Uses of ratio analysis in accounting. Ratio analysis is really all about the use of relationships among financial statement accounts to gauge the financial condition and performance of a company. Ratio analysis involves comparing information taken from the financial statements to gain a general understanding of the results financial position and cash flows of a business. The Analysis and Use of Financial Ratios.

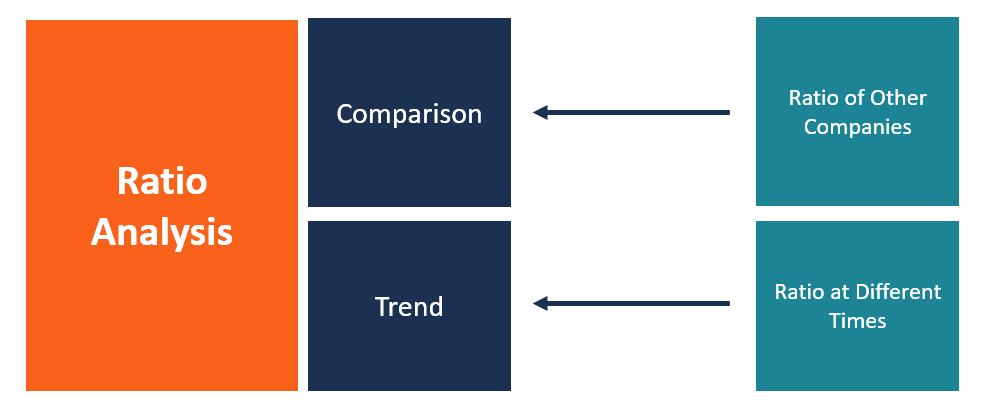

Basis for comparison of two or more entities. The first chapter briefly introduced the topic by looking at the definition of accounting ratio. Ratio analysis of a firms financial statements is of interest to a number of parties mainly share-holders creditors debtors firms own management etc.

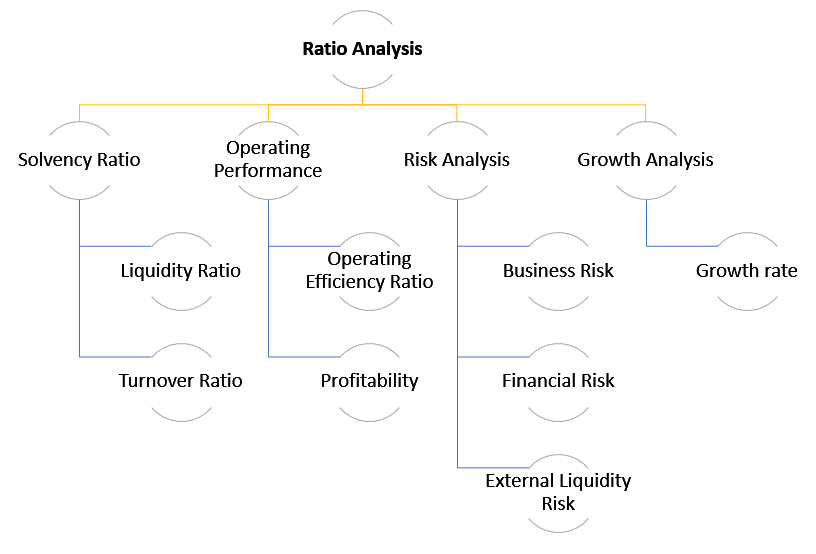

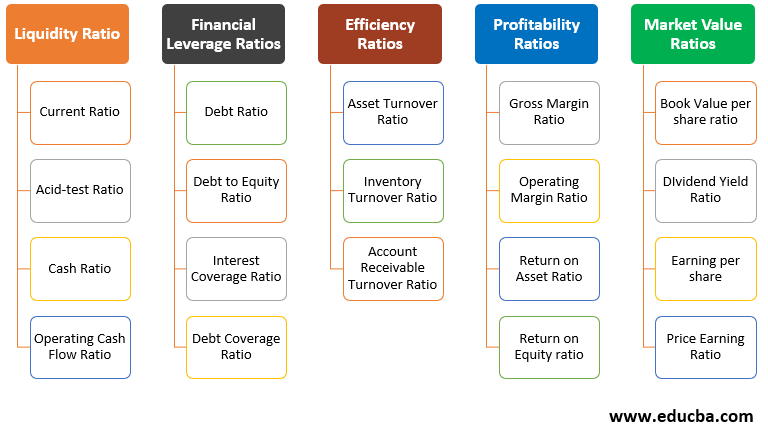

Ratio analysis is used to evaluate relationships among financial statement items. The ratios are used to identify trends over time for one company or to compare two or more companies at one point in time. PAULBARNES INlRODUCTION Financial ratios are used for all kinds of purposes.

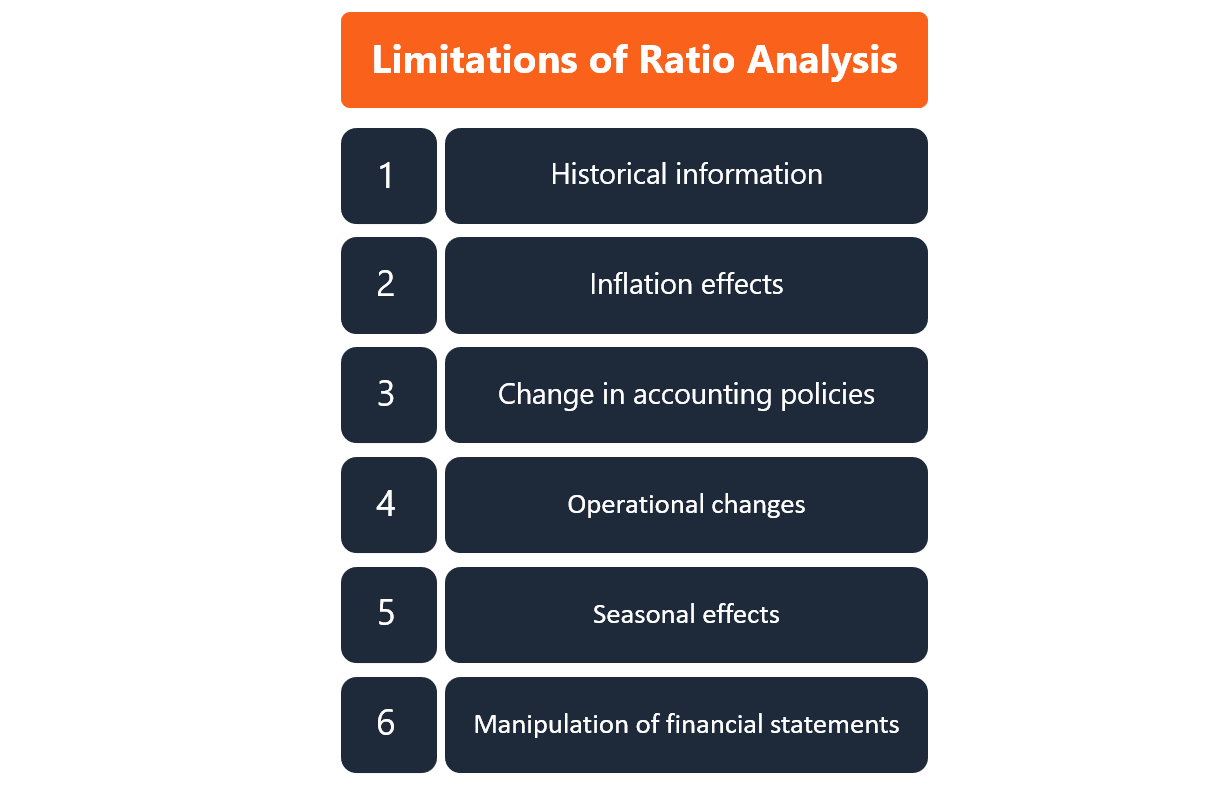

It contains the statement of problems the objective of the study and the limitation of the studyThe second chapter which contains the profile of Nigerian. Accounting ratios may be very useful for forecasting likely events in the future since past ratios indicate trends in costs sales profit and other relevant facts. Some key ratios investors use are the net profit margin and price-to-earnings PE ratios.

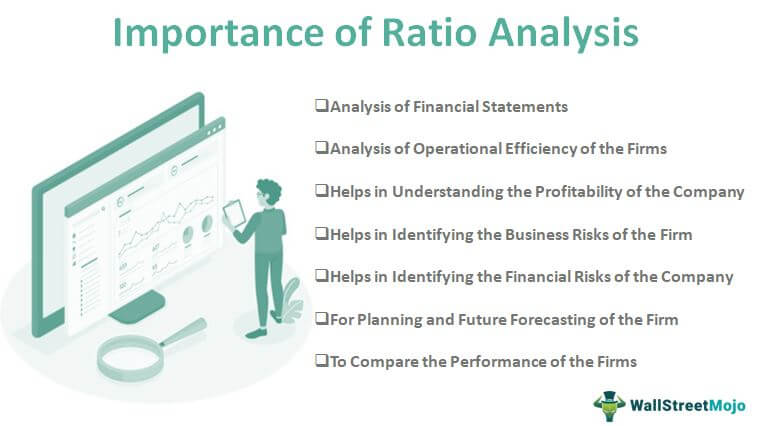

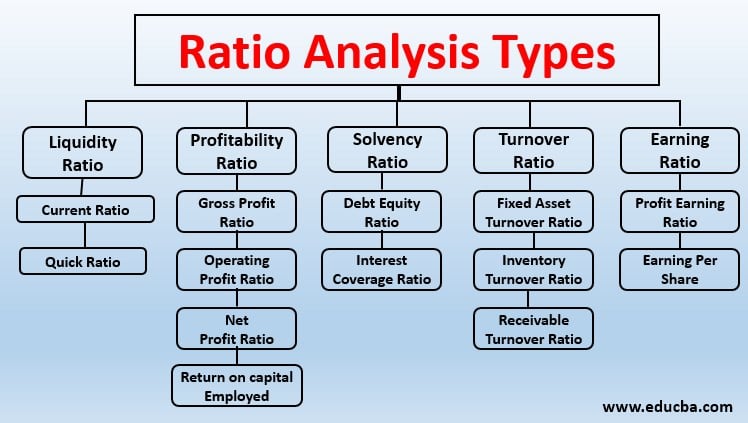

The most important uses and advantages of accounting ratios are given below. Financial statement ratio analysis focuses on three key aspects of a. Uses of Accounting Ratios 2.

Key Takeaways Ratio analysis is a method of analyzing a companys financial statements or line items. It is used as a device to analyze and interpret the financial health of enterprise. Accounting ratios are a very powerful tool for evaluating the performance of a business unit.