Fun Note Receivable Cash Flow Statement

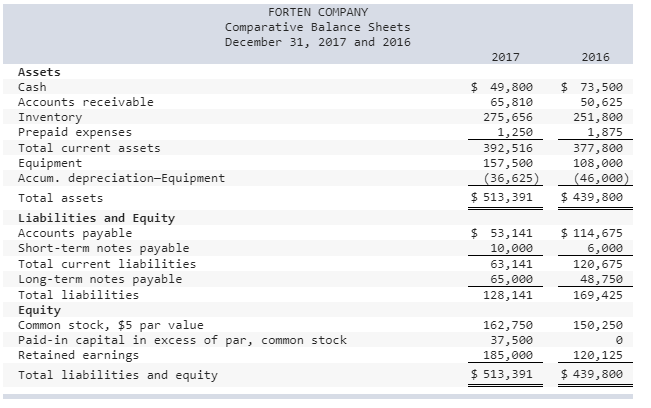

The financial statement that reports activity in cash and cash equivalents for a period of time is called the statement of cash flows.

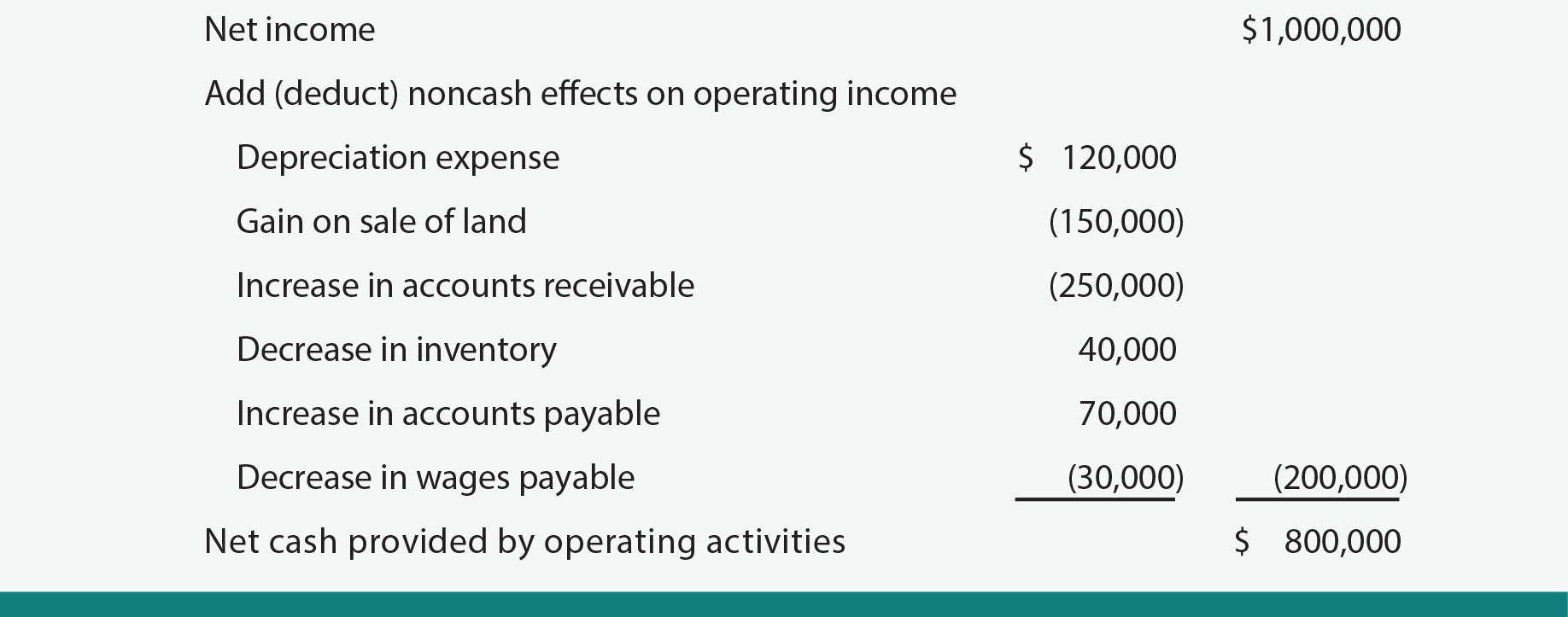

Note receivable cash flow statement. When a cash account or bank account is debited against accounts receivables then only the accounts receivable impact the cash movement. Investing and financing activities that do not involve cash are presented in. If the direct method is used to report cash flows from operating activities in the body of the statement of cash flows a reconciliation of net income to net cash flows from operating activities also is required.

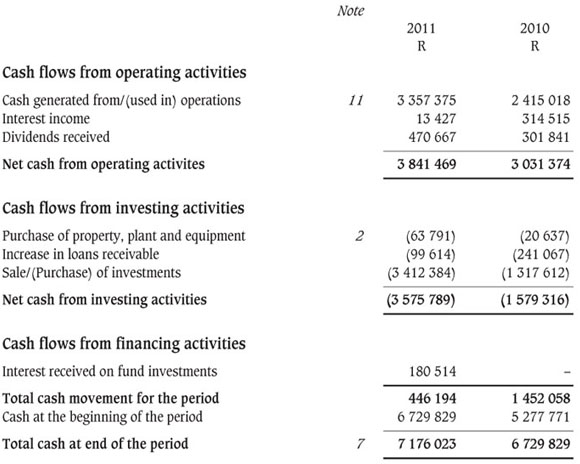

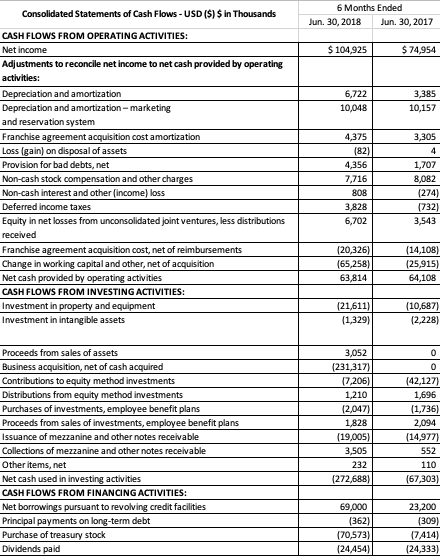

What Does the Increase in Notes Receivable Do to Cash Flow. Presentation in Cash Flow Statement. The statement of cash flows primarily that in ASC 2301 The accounting principles related to the statement of cash flows have been in place for many years.

The cash flow statement is divided into three parts. The cash flow of a company is found on the cash flow statement. However errors in the statement of cash flows continue to be causes of restatements and registrants continue to receive comments from the SEC staff on cash flow presentation matters.

The financing section of the cash flow statement may have a separate notes payable section to capture this information. The increase in accounts receivables is deducted from Net Profit and the decrease in accounts receivables is added to Net Profit. While income statements are excellent for showing you how much money youve spent and earned they dont necessarily tell you how much cash you have on.

Operating investing and financing. Statement of Cash Flows. Notes receivable is an account on the balance sheet.

The cash flow statement is divided into three. To put it simply if we RECEIVE CASH in the transaction we ADD the cash amount received and if we PAY CASH in. Since most corporations report the cash flows from operating activities by using the indirect method the interest expense will be included in.