Fabulous Gross Profit Income Statement Deferred Tax Example

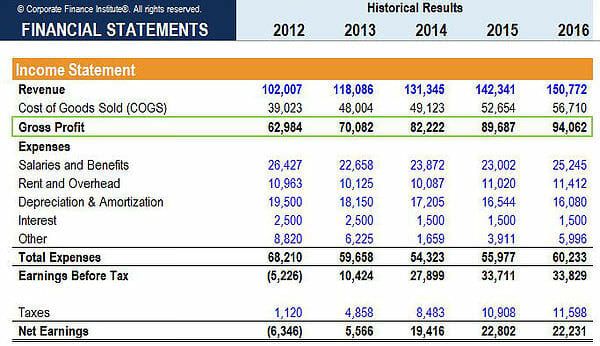

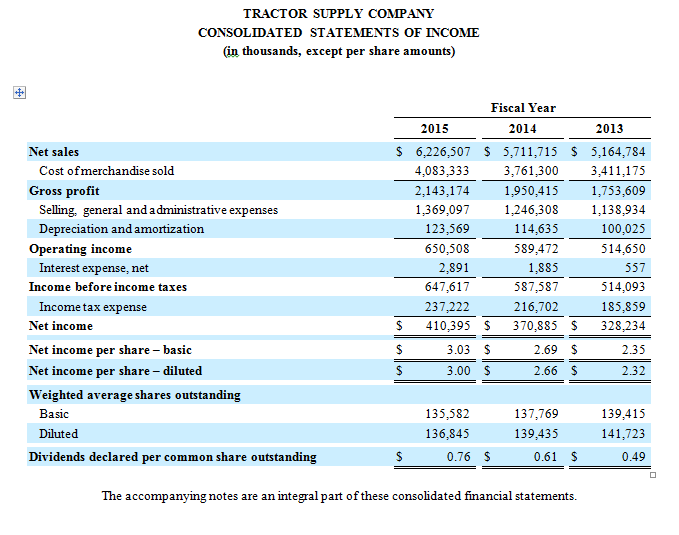

Gross Income for a Business.

Gross profit income statement deferred tax example. The differences can be classed as permanent or temporary timing differences. The carrying value of trade receivables for the year ended 2019 is 3000 and 2018 is 5000 whereas the tax base for the year 2019 is 5000 and 2018 is 6000. These differences arise from the treatment of a transaction differing within the financial and taxation accounts.

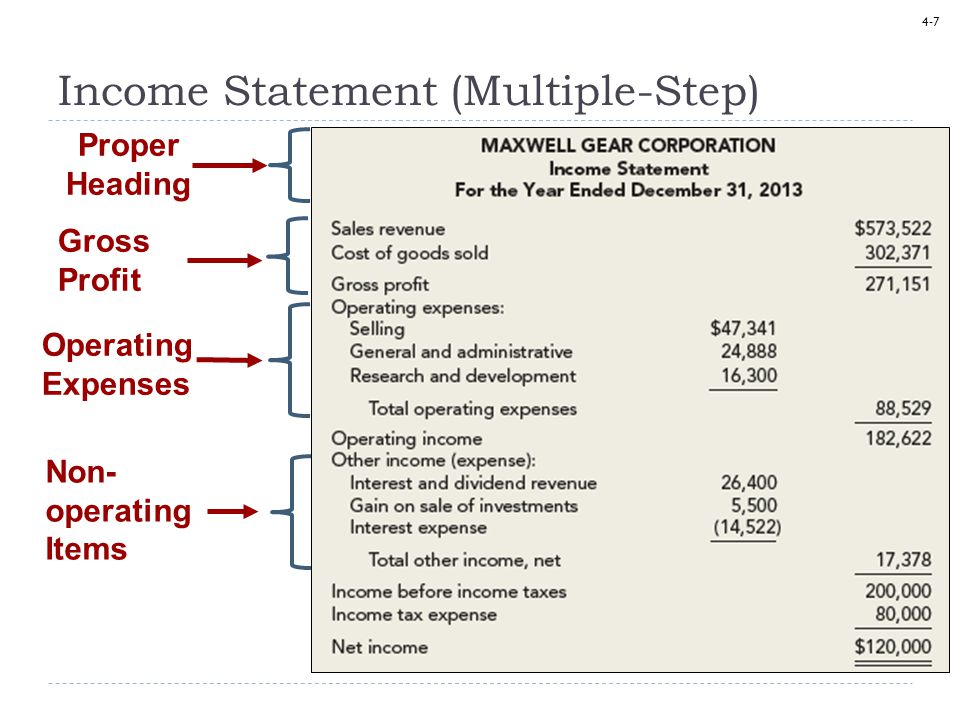

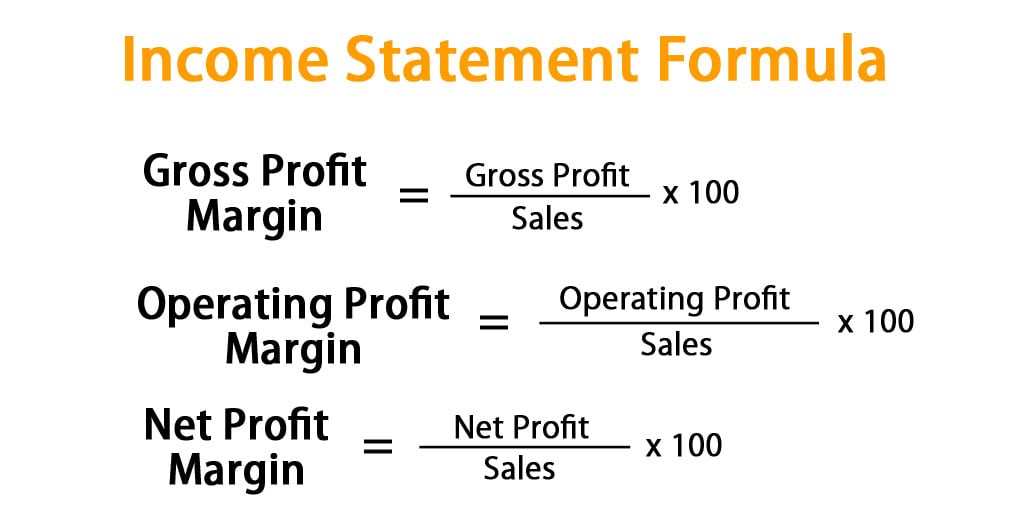

Gross profit is an item in the income statement of a business and it is the companys gross margin for the year before deducting any indirect expenses interest and taxes. Deferred Income Tax Definition. The effective tax rate incorporating both cash taxes and the deferred tax asset reversal is equal to 20 of pre-tax profit in each of years 2 to 6.

Assume for example that a business uses an accelerated depreciation method for taxes and the straight-line method for accounting purposes. Suppose taxable income is 5000. Calculating a deferred tax balance the basics IAS 12 requires a mechanistic approach to the calculation of deferred tax.

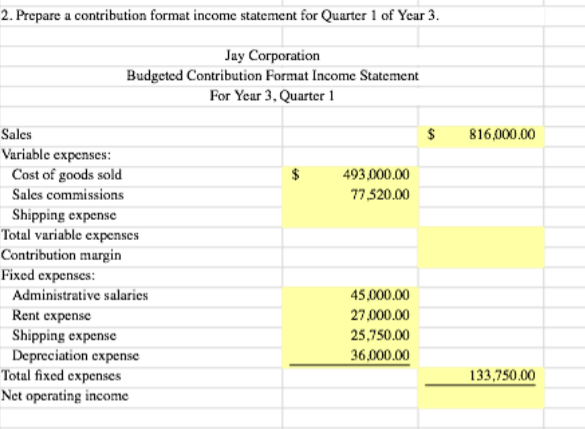

The effective tax rate and post-tax profit is the same in years 2 to 6 as it would have been had the company not made the loss in year 1. On August 1 the company would record a revenue of 0 on the income statement. In the above two examples ie deferred tax assets are arising due to depreciation and carry forward losses.

Differences in revenue recognition give rise to deferred tax liability. Gross Income 100000 70000 10000 5000 185000. Hence there will be a DTA of 1000 750 250 due to the difference in depreciation rates.

If the tax rate is 20 and tax rules require first years depreciation to be 1500 calculate the deferred tax liability amount to be recognized. Example Calculating deferred tax liability Entity bought an asset for 5000 and estimated the useful life to be 5 years and depreciate the asset on straight-line basis. Liability giving rise to future tax consequences Solution B At the end of 2015 the company had a liability of R50 000 for income received in advance.