Formidable Off Balance Sheet Items Of A Bank

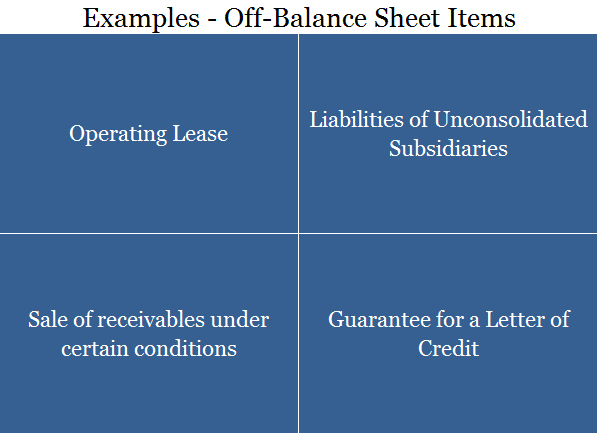

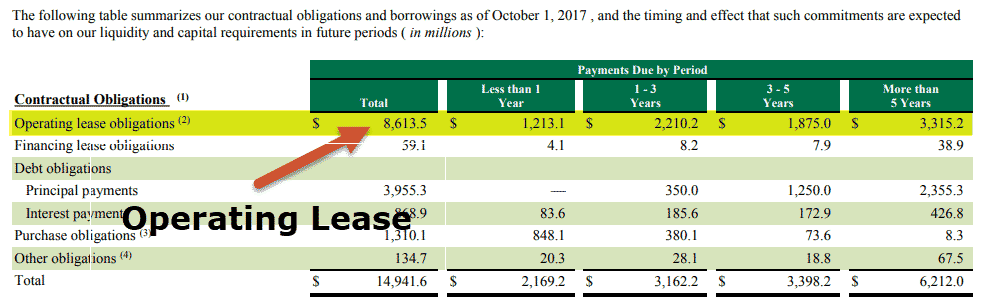

Contingent liabilities such as guarantees.

Off balance sheet items of a bank. Those commitments give rise to new types of credit risk from the possibility of default by the counter party. Both are triggered by default of direct obligor resulting in credit exposure to guarantor whether it is. Foreign exchange risk 15.

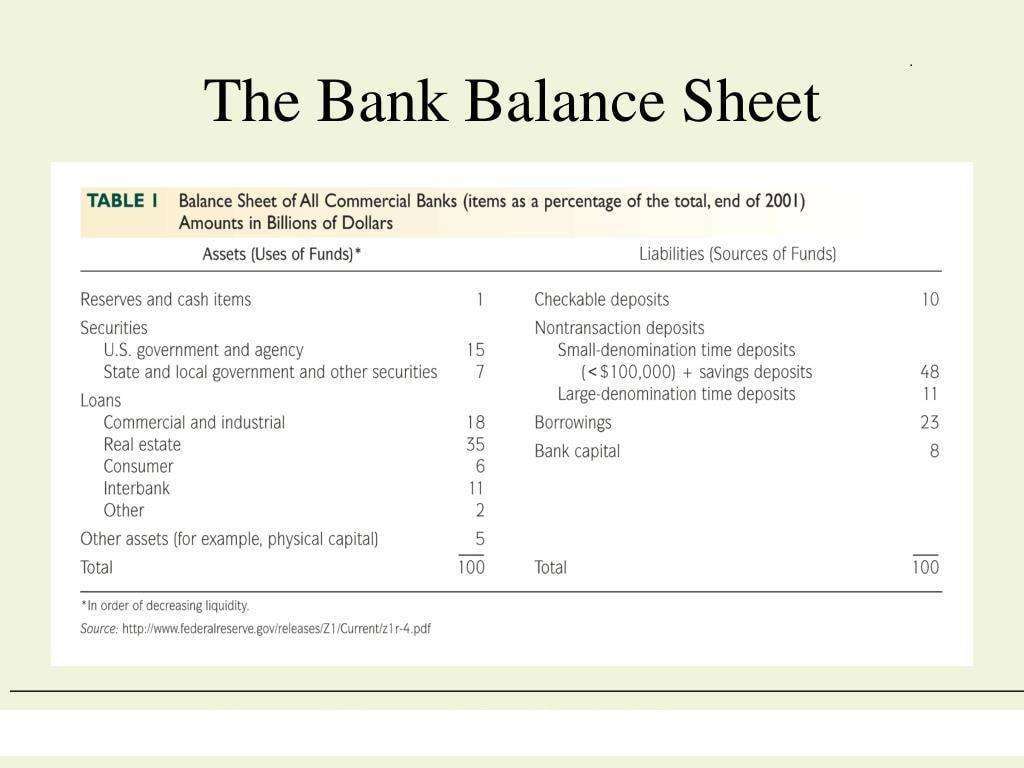

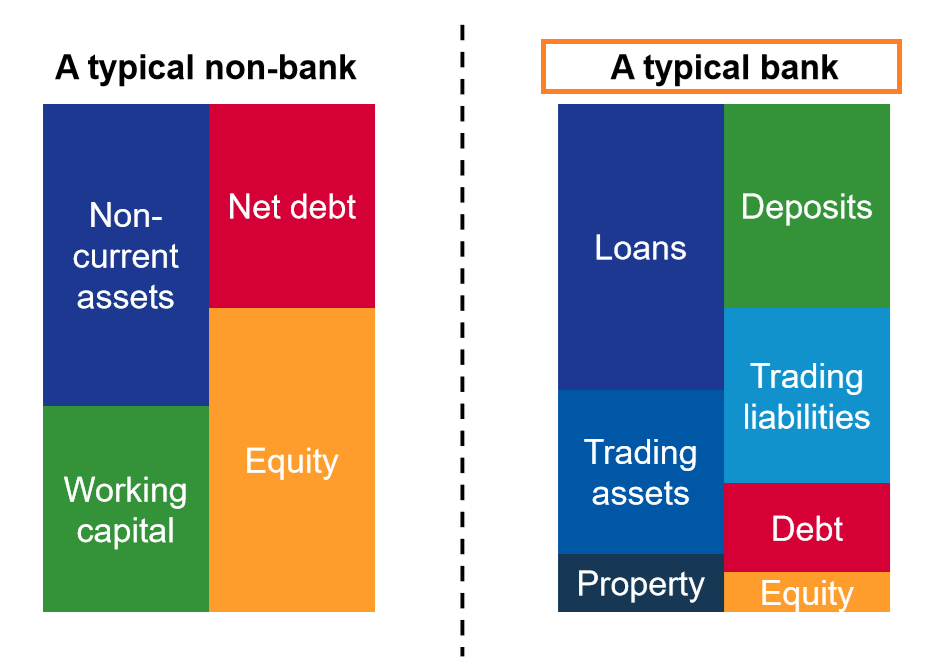

SLR Tier 1 Capital Total Leverage Exposure. Off-balance sheet items refer to those assets and liabilities that arent shown on a balance sheet. Off-Balance Sheet OBS Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage.

The non-fund based facilities like Issuance of. They are either a liability or an asset which are not shown on a companys balance sheet as the business is not a legal owner of the respective item. Off-balance sheet OBS items are an accounting practice whereby a company does not include a liability on its balance sheet.

The off-balance sheet exposures in banking activities refers to activities that do not involve loans and deposits but generate fee income to the banks. The use of off-balance sheet may improve activities earnings ratios because earnings generated from the. Foreign exchange rate contracts.

What is the Off-Balance Sheet. They include contingencies given and received. Off balance sheet items are anticipatory items.

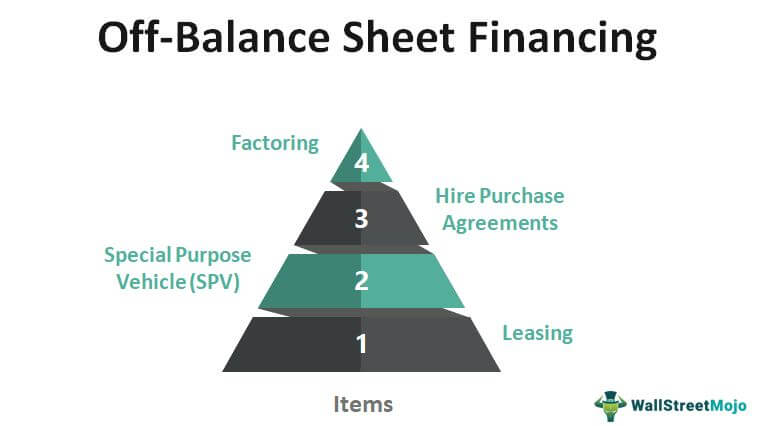

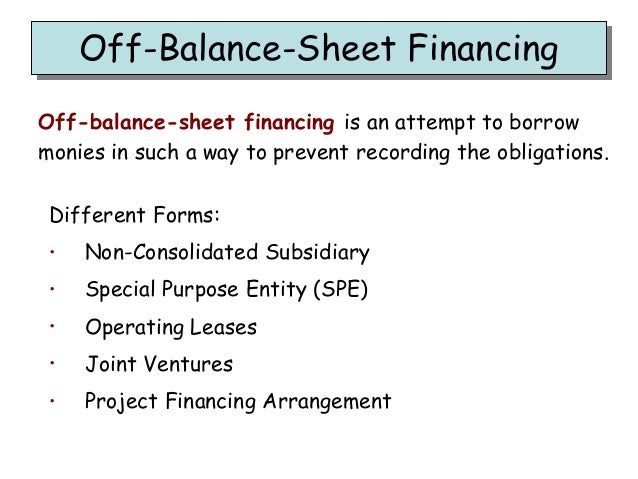

Off-balance sheet exposures refer to activities that are effectively assets or liabilities of a company but do not appear on the companys balance sheet. The formula for SLR. Off-balance sheet financing is the companys practice of excluding certain liabilities and in some cases assets from getting reported in the balance sheet in order to keep the ratios such as debt-equity ratios low to ease financing at a lower rate of interest and also to avoid the violation of covenants between the lender and the borrower.

:max_bytes(150000):strip_icc()/dotdash_Final_Tier_1_Leverage_Ratio_Definition_Nov_2020-01-4741405e9a8f49b79939f1a51fc3de54.jpg)

:max_bytes(150000):strip_icc()/GettyImages-172940273-28a7232c2a9149a9a191440b7b8a397c.jpg)