Simple Cowboy Law Firm Income Statement

During the year Buffalo reports net income of 7500 and pays dividends of 2200.

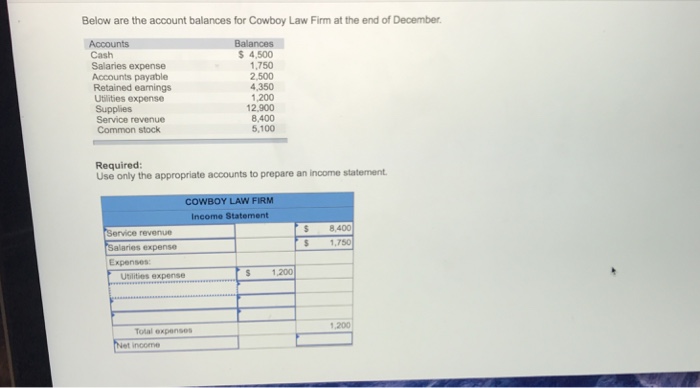

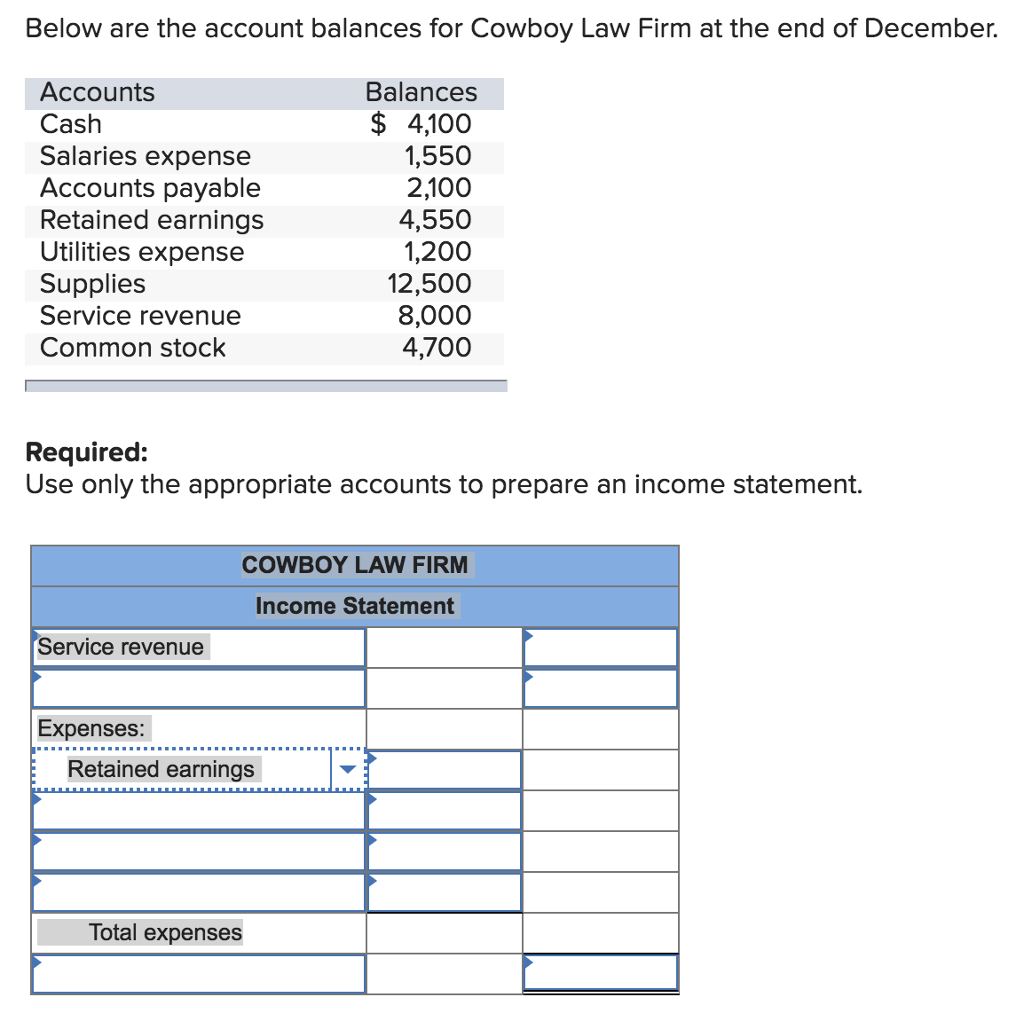

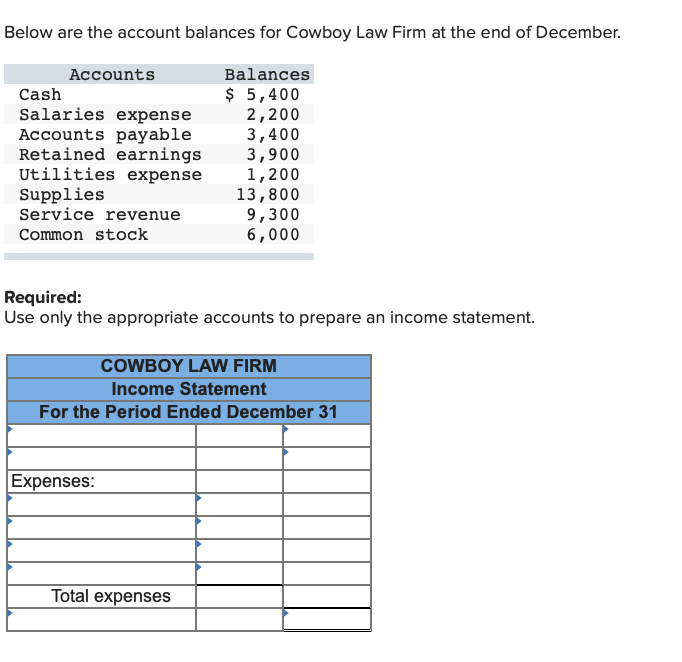

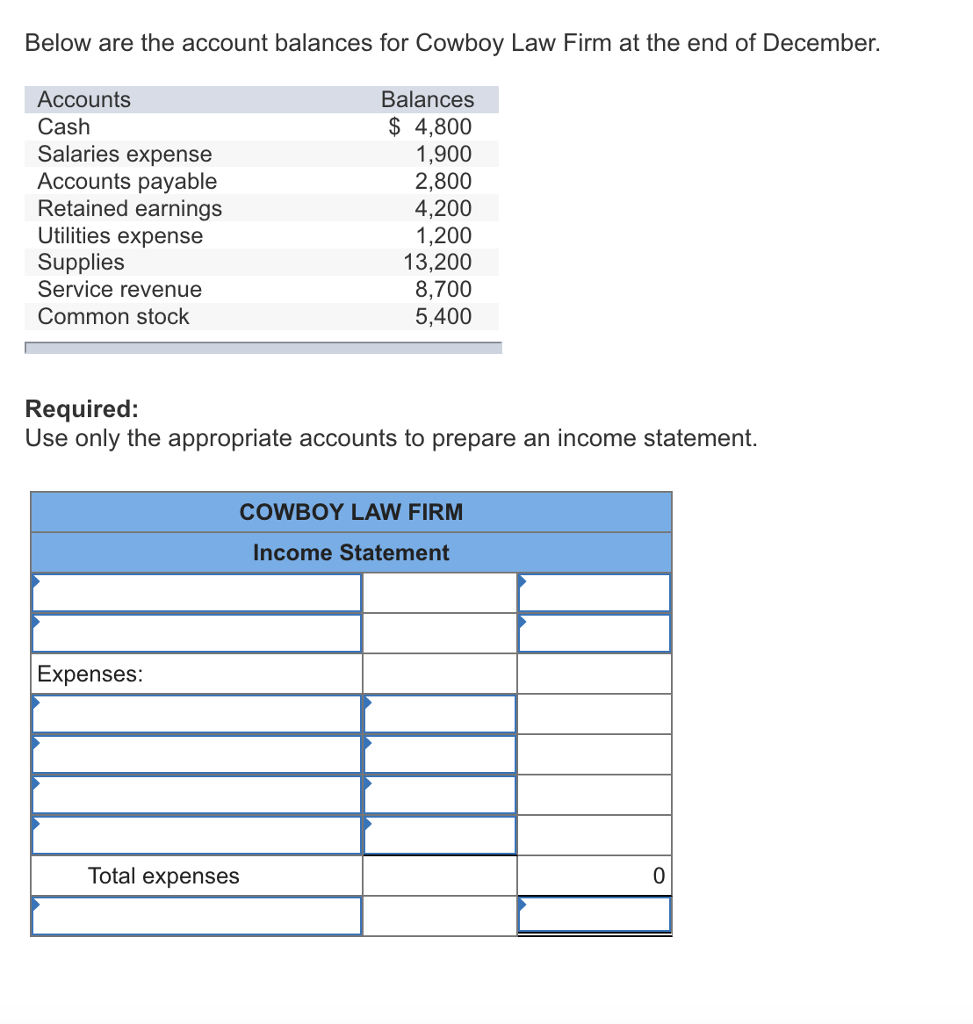

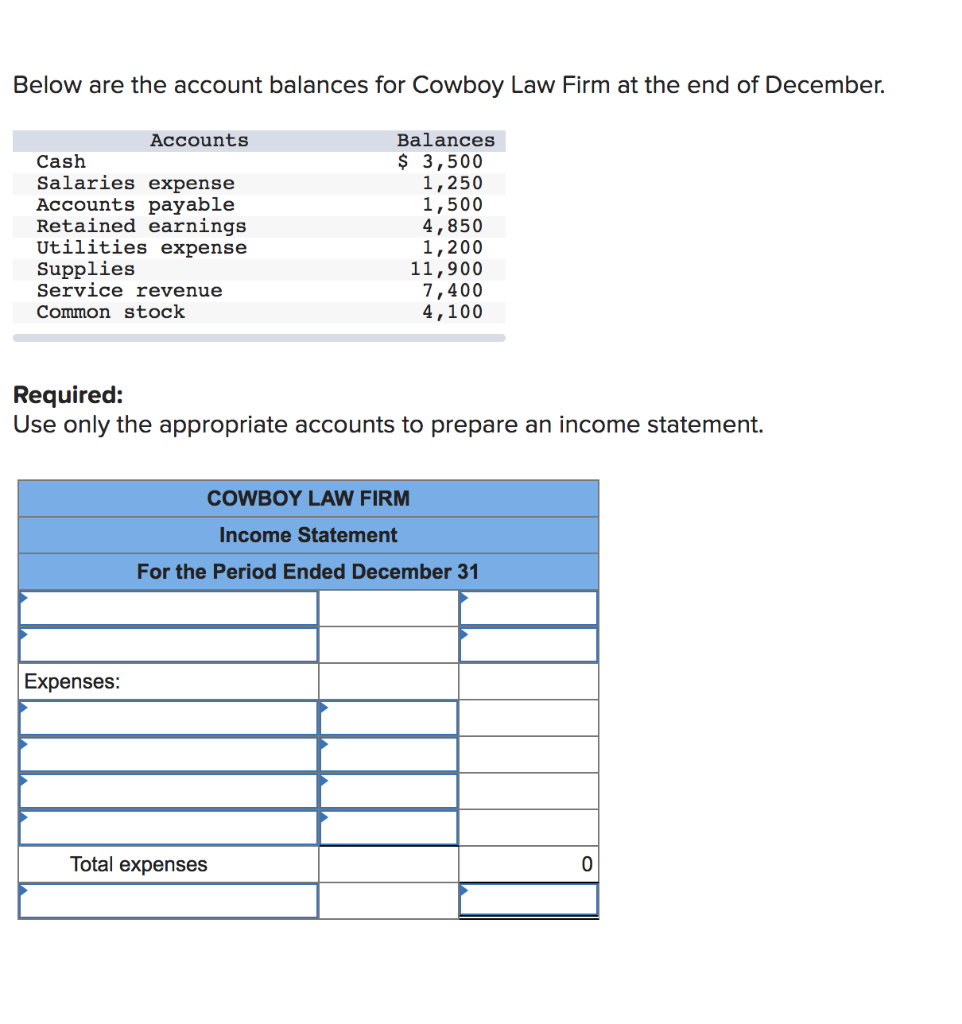

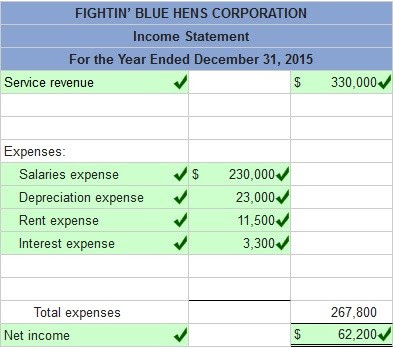

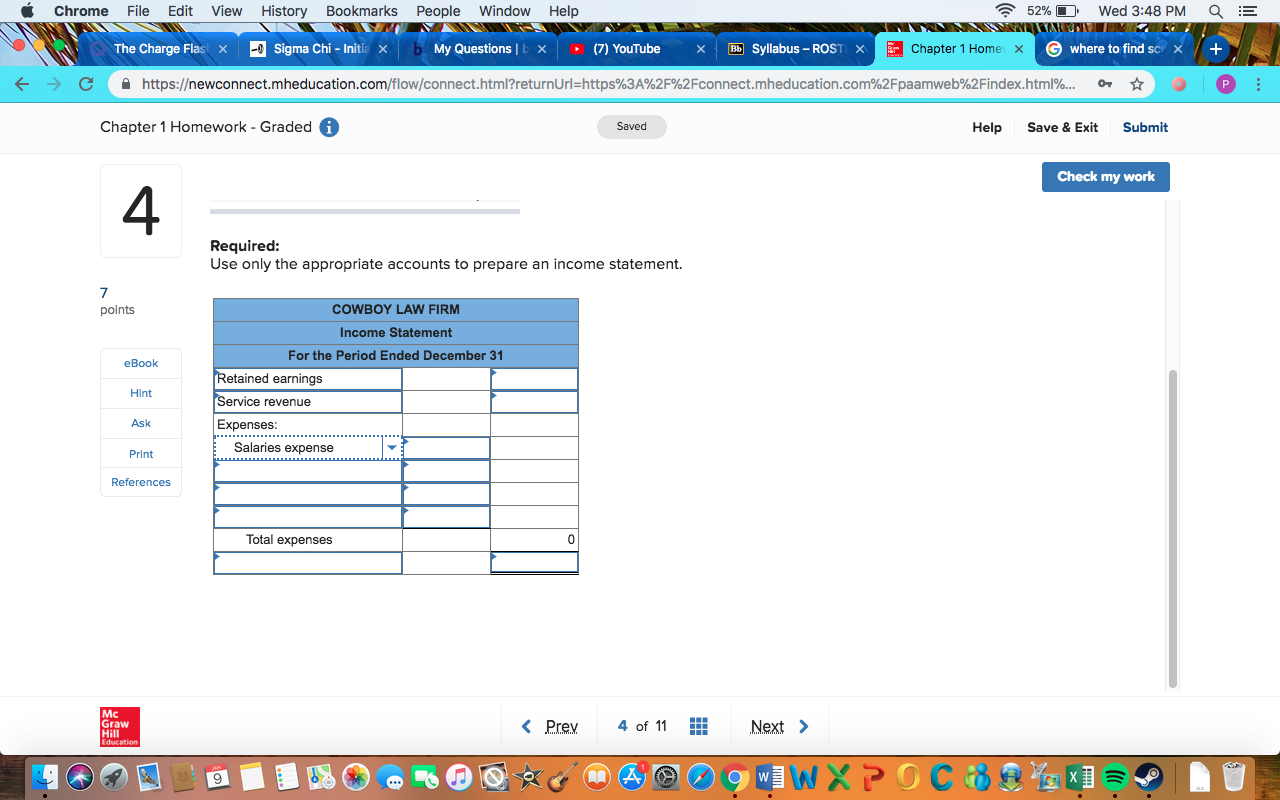

Cowboy law firm income statement. Below are the account balances for Cowboy Law Firm at the end of December. Use only the appropriate accounts to prepare an income statement. Use only the appropriate accounts to prepare an income statement.

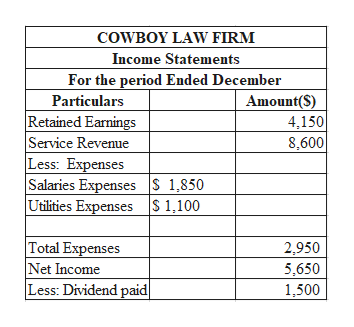

Accounts Balances Cash 5 400 Salaries expense 2 200 Accounts payable 3 400 Retained earnings 3 900 Utilities expense 1 200 Supplies 13 800 Service revenue 9 300 Common stock 6 000. COWBOY LAW FIRM INCOME STATEMENT revenues Expenses. Law Firm Financial Statements Lawyerist.

Screenshot 21 Png Exercise 1 6 Prepare An Income. Below are the account balances for Cowboy Law Firm at the end of December Accounts Cash Salaries expense Accounts payable Retained earnings Utilities expense Supplies Service revenue Common stock Balances 3400 1200 1400 4700 1000 11800 7300 4000 Required. Below are the account balances for Cowboy Law Firm at the end of December.

In addition Buffalo issues additional common stock for 7000. Use only the appropriate accounts to prepare an income statement. Below are the account balances for Cowboy Law Firm at the end of December.

Use only the appropriate accounts to prepare an income statement. View Homework Help - homework 1xlsx from ACCT 2302 at Texas AM University San Antonio. Accounts Balances Cash 5100 Salaries expense 2050 Accounts payable 3100 Retained earnings 4050 Utilities expense 1200 Supplies 13500 Service revenue 9000 Common stock 5700 Required.

Cash 5400 Salaries expense 2200 Accounts payable 3400 Retained earnings 3900 Utilities expense 1200 Supplies 13800 Service revenue 9300 Common stock 6000 -COWBOY LAW FIRM Income Statement For the Period Ended December 31 Revenue. Salaries expense Utilities expense Supplies 2200 1200 13800 Total expenses Net loss 17200 8500 Below are the account balances for Cowboy Law Firm at the end of December. COWBOY LAW FIRM Income Statement For the Period Ended December 31 Service revenue 5400 8 9300 Cash Expenses.