Brilliant Frs 102 Example Accounts 2019

FRS 102 Accounting Results Schedule 31 August 2019Si-t 1 Results under ERS 102 LGPS funded benefits 2 Estimated pension expense in future periods 3 Sensitivity Analysis 4 Data summary Additional Information These results should be read in conjunction with the following documents previously provided by us which support the advice given.

Frs 102 example accounts 2019. The example annual report that follows includes the financial statements of Typipens Pension Scheme a United Kingdom Occupational Pension Scheme. This guide outlines the accounting requirements under FRS 102 when loan contract terms are renegotiated together with illustrative examples. 8 FRSSE v Micro.

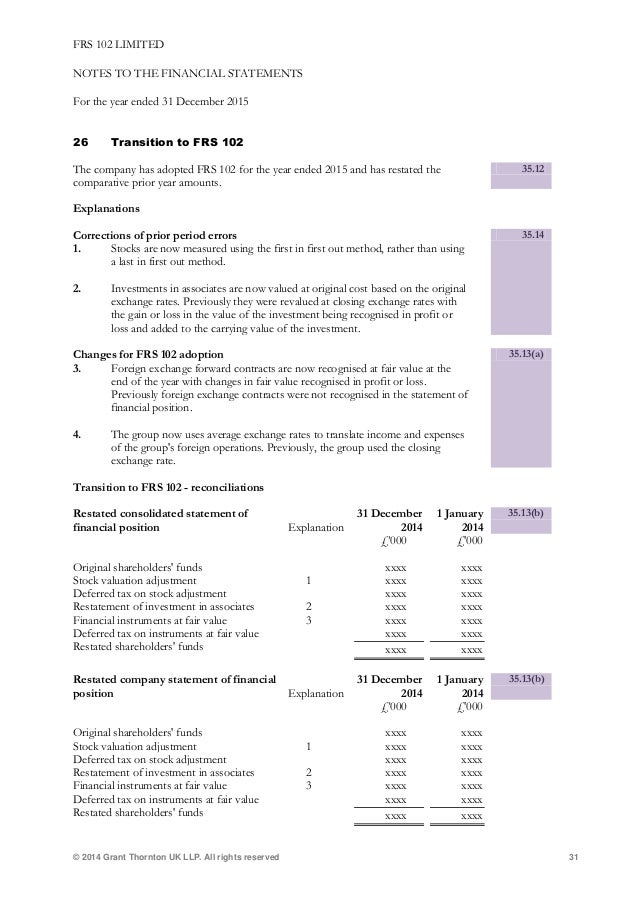

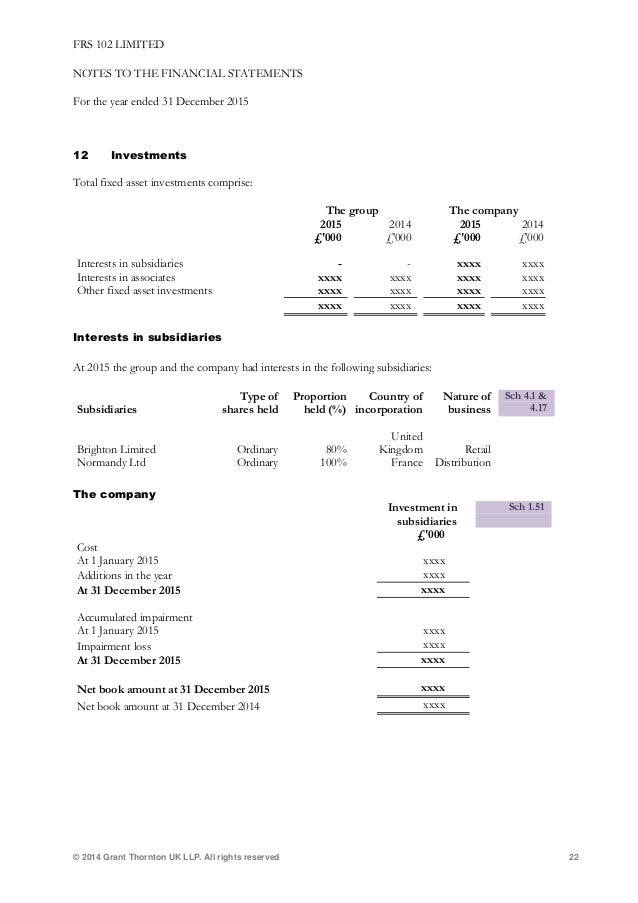

The example is updated each year to take account of any changes in financial reporting guidance this. These are illustrative FRS 102 financial statements of a large private entity company and LLP prepared in accordance with FRS 102 including UK Companies Act disclosure requirements as applicable. Example accounts A23 Example accounts for unaudited small company using FRS 102 Section 1A Model company accounts for a fictional company preparing accounts in accordance with FRS 102 Section 1A and subject to the special provisions of the small companies regime within Part 15 of the Companies Act 2006 and the small company regulations set out in SI 2008409 as amended by SI.

FRS 102 1A case study FRS 105 example accounts FRS 102 1A related party disclosures. In December 2017 the Financial Reporting Council FRC concluded their triennial review of new UK GAAP FRS102 by. 2019 year end accounts FRS102 update October 18 2019.

FRS 102 and FRS 105 Example small and micro company accounts InstantCPD 3 Section 1. 6 Small companies not micro 7 What is a micro company. Preparing accounts under the new small and micro company regimes 4.

Implications of COVID-19 for the preparation of accounts under FRS 102 Financial Reporting Faculty A checklist of some of the factors to consider when preparing your or your clients accounts. These illustrative financial statements show the principal requirements of FRS 102 including the 2018 Pensions SORP and include disclosures relating to the early adoption of the 2018 SORP and Improvements and Clarifications Amendments to FRS102. Transition from defined contribution accounting to defined benefit accounting B288A In May 2019 FRS 102 was amended to provide clear and unambiguous requirements for the transition from defined contribution accounting to defined benefit accounting when sufficient information becomes available.

FRS 102 permits the use of titles for the financial statements themselves other than those used in the standard provided they are not misleading. The example annual report and accounts has been developed by the HFMA under the guidance and direction of its Charitable Funds Special Interest Group. Model FRS 102 accounts.