Heartwarming Treatment Of Provident Fund In Balance Sheet

Now total is equal to.

Treatment of provident fund in balance sheet. What treatment should be given to Employees Provident Fund appearing in the liabilities side of the Balance Sheet in case of admission of a partner. Dear Student Employees Provident Fund is a retirement benefit fund created by the business for the welfare of its employees. Employers contribution is treated as expenses of the company.

By the name of the account To All partners Capital accounts in their old profit sharing ratio. Treatment of Accumulated Profits and Losses. The rate are given following on basic salary.

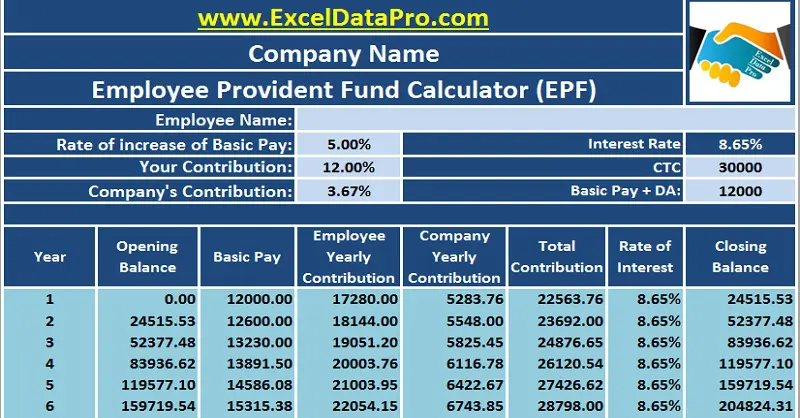

Enter monthly dearness allowance. Employee Provident Fund EPF is a welfare scheme framed under the Employees Provident Funds and Miscellaneous Provisions Act1952. For the financial year ending March 312017 the accountant of the company is not certain about the presentation of the following items under relevant Major Heads Sub Heads if any in its Balance Sheet.

Employers own contribution along with the employees share is. Therefore at the time of Reconstitution of Partnership Firm ie. In case of admission of a partner Employee Provident Fund remains on the liabilities side of the new balance sheet.

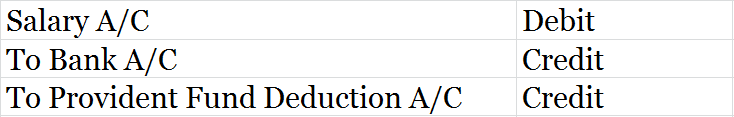

Accounting and Journal entry for provident fund is a 3 step process. Provident Fund is the contributory investment fund where both employees and employer contributes. Should be distributed as a part of reserve.

Nothing to be done coz it is the amount which employees have got deducted from their salary. 367 Provident Fund Ac 1 833 Pension Ac 10 110 Admin Charges onPF Ac 2 050 EDLI Ac 21 001 Admin Charges on EDLI Ac 22 Total employees provident fund. When salaries are paid to employees the employer deducts the employees contribution from it and only the net amount is paid.