Heartwarming Income Statement V Balance Sheet

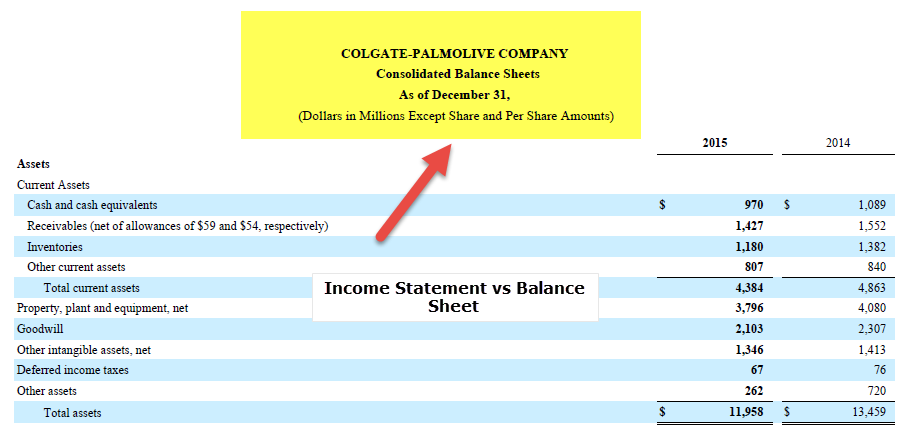

While an income statement looks at data for a specific period such as a month or a year the balance sheet is a snapshot of financial data at a specific point in time.

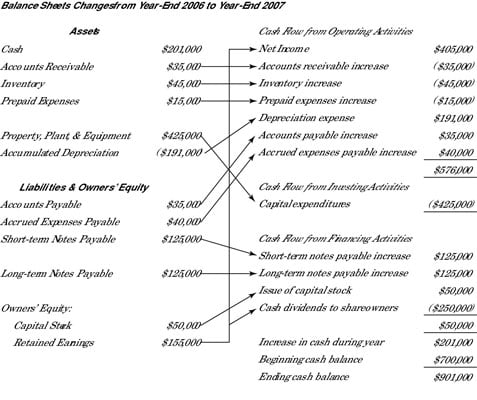

Income statement v balance sheet. You cant record a sale or an expense without affecting the balance sheet. Get the annual and quarterly balance sheet of Visa Inc. The cash flow statement takes the net profit from the income statement and accounts for changes in the amount of equity in the business shown on the balance sheet.

A Case Study for Financial Sustainability International Journal of Business and Management Canadian Center of Science and Education vol. Net income links to both the balance sheet and cash flow statement. Get the detailed quarterlyannual income statement for Visa Inc.

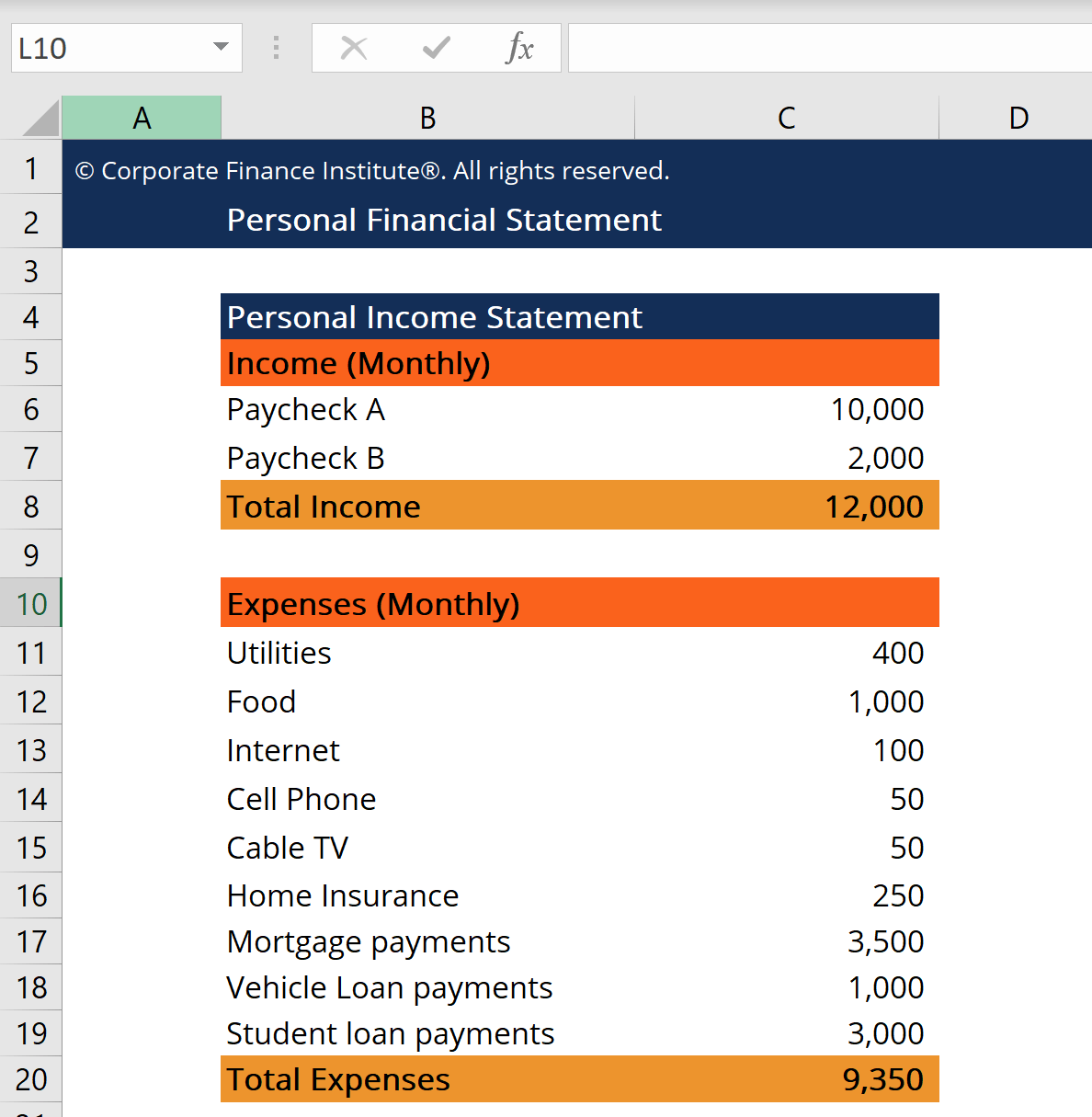

BALANCE SHEET Income Statement Assets Liabilities Stockholders Equity Common Stock Retained Earnings Revenue - Exp - Div Acct Rec Supp Prepaid Ins Equip AD Acct Pay Interest Pay A1 760 760 Service Revenue A2 450 450 Utilities expense A3 -400 -400 Depreciation expense 500 -500 Interest expense A4. The balance sheet shows a companys total value while the income statement shows whether a company is generating a profit or a loss. V including details of assets liabilities and shareholders equity.

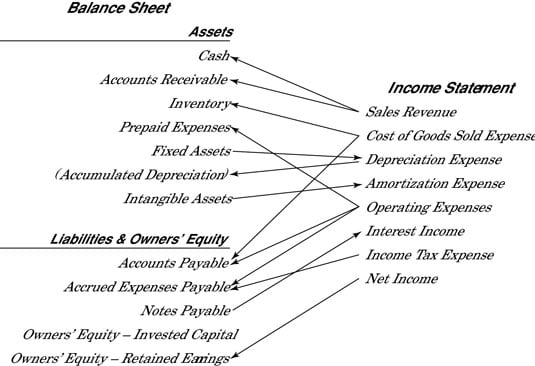

The bottom line of the income statement is net income. Therefore one side of every sales and expense entry is in the income statement and the other side is in the balance sheet. While a balance sheet provides the snapshot of a companys financials as of a particular date the income statement reports income through a particular time period and its heading indicates the.

In terms of the balance sheet net income flows into stockholders equity via retained earnings. However to know whether you should use a balance sheet vs income statement it is important to identify the structural differences between the two. How is the income statement linked to the balance sheet.

It is one of the three essential financial statements or documents for analyzing a companys financial performance. The other two financial statements are the income statement and cash flow statement. The final statement that should be checked monthly is the cash flow statement.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)