Looking Good Depreciation Fund In Balance Sheet

A contra account is needed to make a balancing entry on the balance sheet.

Depreciation fund in balance sheet. On an income statement or balance sheet. It is an estimated expense that is scheduled rather than an explicit expense. Depreciation is typically tracked one of two places.

In this example a 1000 depreciation expense is recognized annually on your income statement depreciation decreases net income even though no cash outlay occurs. It represents the reduction of the original acquisition value of an asset as that asset loses value over time due to wear tear obsolescence or any other factor. CFIs Financial Analysis Course.

For instance a company buys a new truck valued at 100000 and records 10000 in annual depreciation expense over 10 years. Depreciation may be regarded as the capital cost of an assets allocated over the life of the asset. It is quite interesting to note that if the Provision for Depreciation account is not given in the liabilities side of the Balance Sheet or not deducted from the fixed asset from the assets side of the Balance Sheet ie if it is given in the adjustment the treatment will be changed.

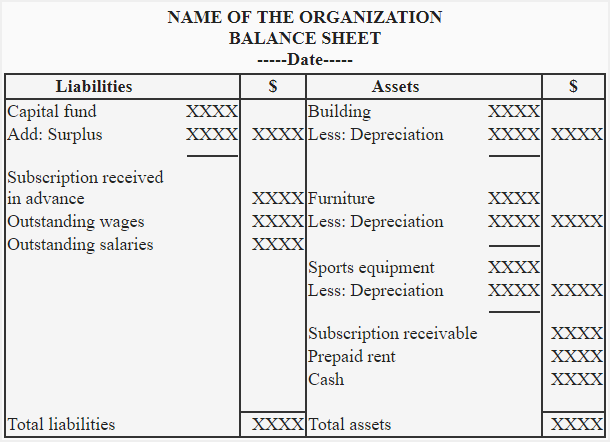

For income statements depreciation is listed as an expense. Both these itemsdepreciation and depreciation fund investmentsappear in the General Balance Sheet. In the balance sheet that is prepared during the period of building up the depreciation fund depreciation fund account shall be shown on the liabilities side and depreciation and depreciation fund investment account on the asset side whereas the asset for which this depreciation fund is being created will appear at its original cost.

The cost for each year you own the asset becomes a business expense for that year. 4 Two more terms that relate to long-term assets. The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the income statement from the time the assets were acquired until the date of the balance sheet.

The balance sheet is based on the fundamental equation. Depreciation is a type of expense that is used to reduce the carrying value of an asset. The balance sheet displays the companys total assets and how these assets are financed through either debt or equity.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)