Fun Ifrs 16 Cash Flow Statement Presentation

This is not simply the amount shown for lease payments as part of financing activities in the cash flow statement which includes only principal repayments.

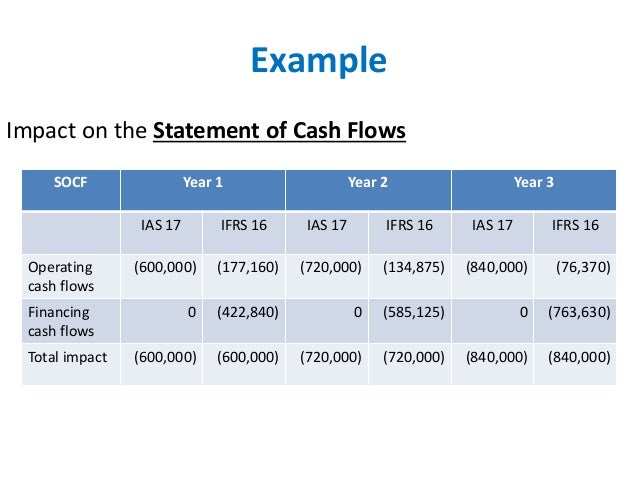

Ifrs 16 cash flow statement presentation. IAS 1 sets out overall requirements for the presentation of financial statements guidelines for their structure and minimum requirements for their content. IFRS 16 requires most leases to be recorded on balance sheet and therefore cash outflows arising from financing activities will generally increase due to IFRS 16. Statement of cash flows presents inflows and outflows of cash and cash equivalents and is dealt with in IAS 7.

Scope IFRS 16 will apply to all lease contracts except for. It introduces the subject and reproduces the official text along with explanatory notes and examples designed to enhance understanding of the requirements. Follow IFRS 16 classification and treat lease payments as cash flows to debt providers in the discounted cash flow model and subtract the fair value the lease liability from the outcome as applicable.

In doing so a right-of-use asset and lease liability are brought on to the balance sheet. Under US GAAP defined benefit pension plans that present financial information under ASC 960 3 and certain investments companies in the scope of ASC 946 4 may be exempt from presenting a statement of cash flows. In contrast IFRS 16 includes specific requirements for the presentation of the ROU asset and lease liability and the corresponding effects on the results and cash flows in the primary financial statements.

Based on a fictitious multinational listed corporation. The September 2017 guide helps you to prepare financial statements in accordance with IFRS illustrating one possible format for financial statements. The objective of the disclosure requirements is to give a basis for users of financial statements to assess the effect that leases have on the financial statements.

Differences between IFRS 16 and the expected new guidance in US GAAP in the Appendix. 211 Statement of financial position. Where previous accounting recognized rent expense on a straight-line basis under IFRS 16.

A right-of-use asset and lease liability interest expense on the lease liability depreciation expense on the right-of-use asset. Discounted cash flow analysis which if applied correctly should lead to the same estimate of the RA. IFRS 16 paragraph 53 g requires disclosure of the total cash outflow for leases.

.png.aspx?lang=en-NZ)