Fun Income Tax 26as Pdf

26 AS is available to view Online in HTML Format.

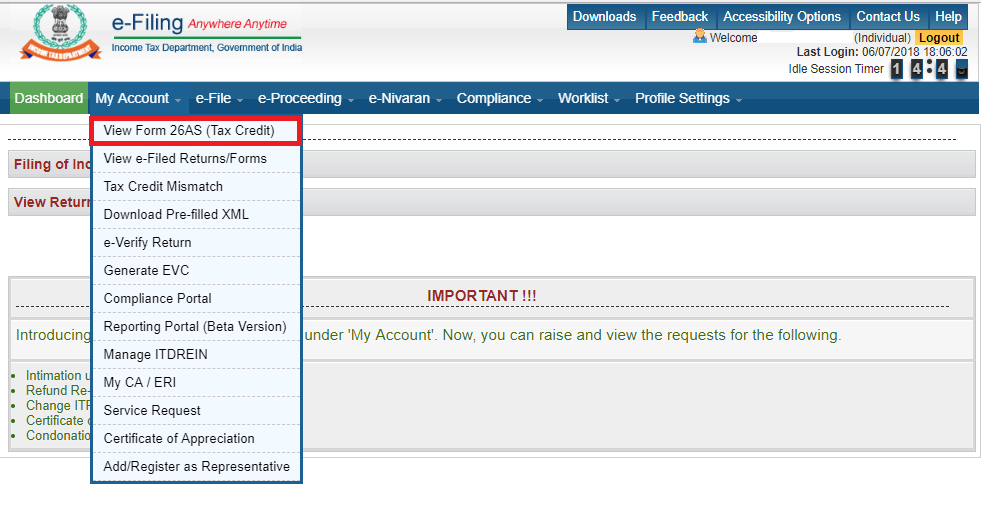

Income tax 26as pdf. Ad Find How To Do My Income Tax. Go to the My Account menu click View Form 26AS Tax Credit link. Form 26AS contains the following information partwise.

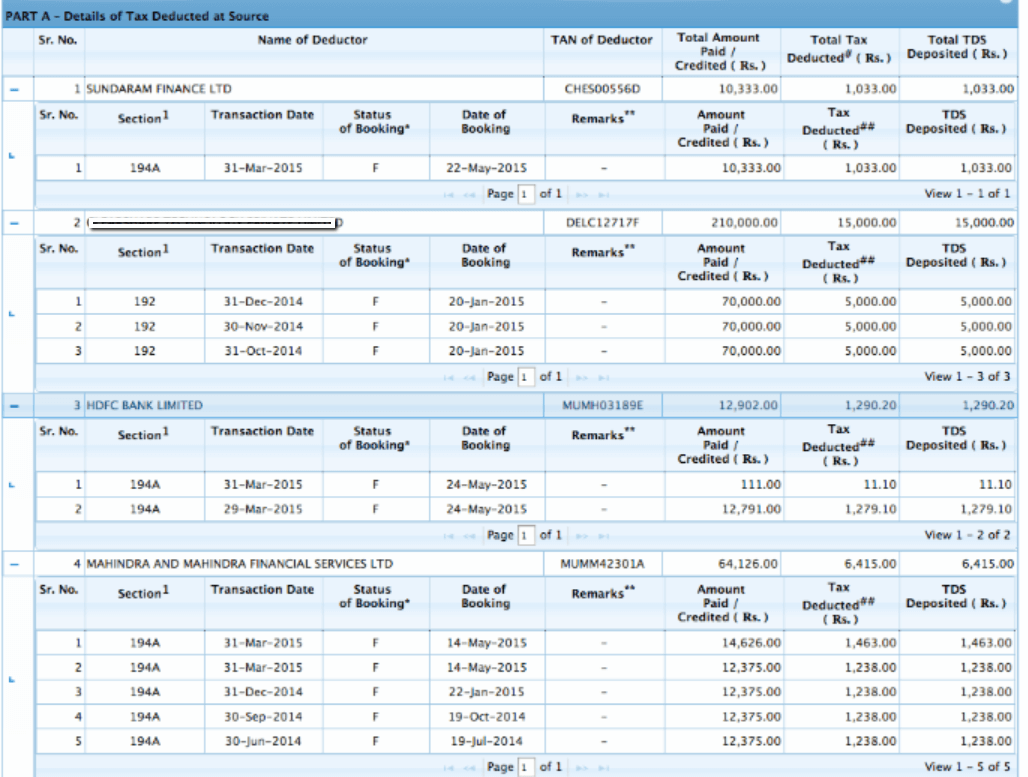

Form 26AS is an annual statement which includes all the details pertaining to the tax deducted at source TDS information regarding the tax collected by your collectors the advance tax you have paid self-assessment tax payments information regarding the refund you have received over the course of a financial year regular assessment tax that you have deposited and information regarding. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal. Form 26AS is consolidated from multiple sources like your salary pension interest income etc.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Ad Find How To Do My Income Tax. It is one of the most important documents taxpayers should verify before filing their ITR.

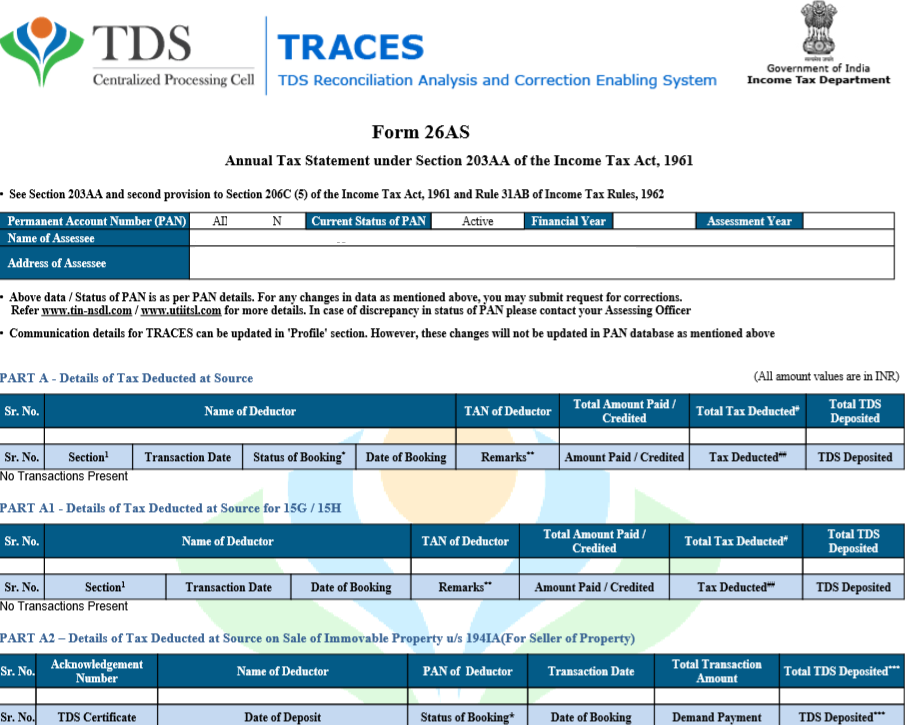

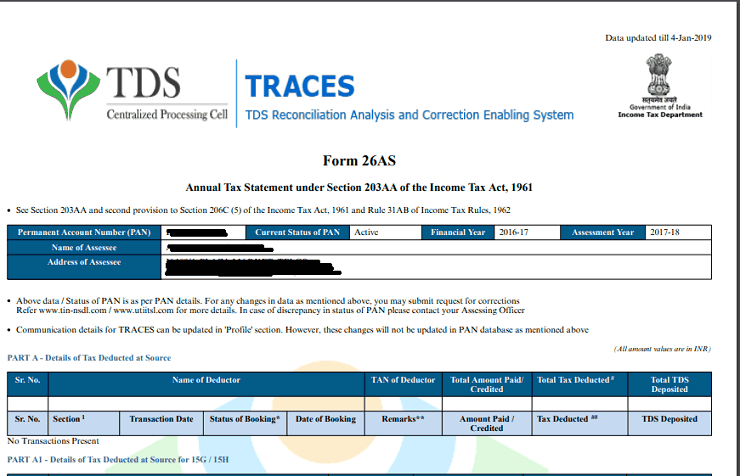

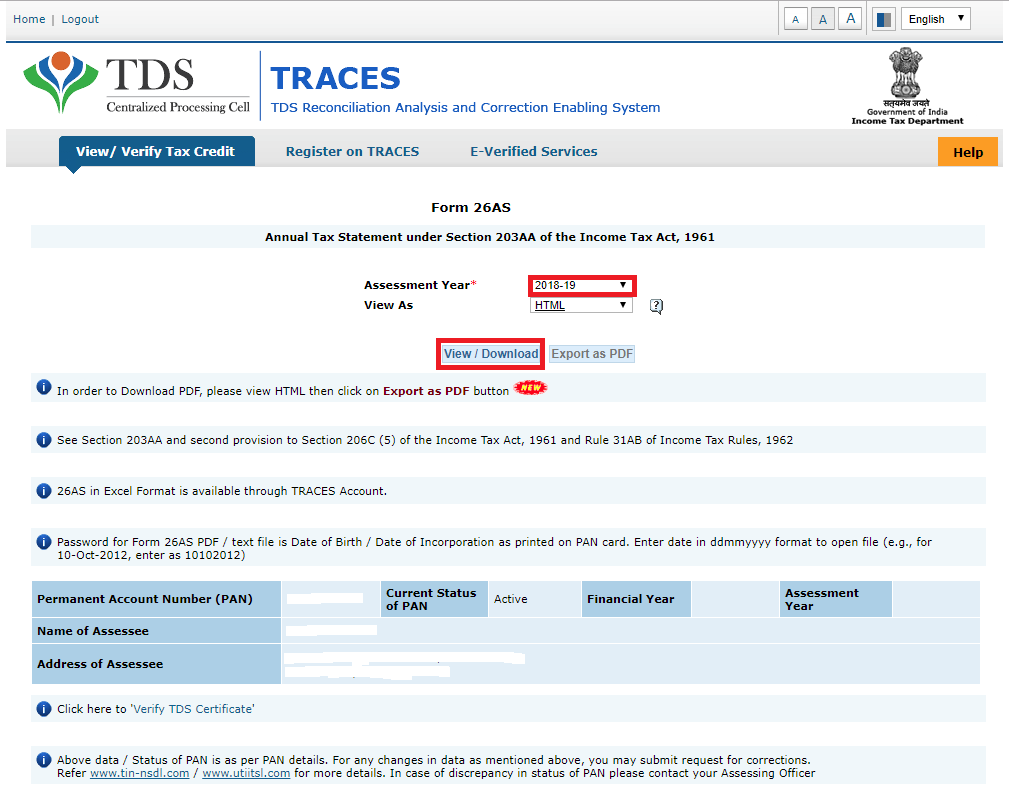

Form 26AS Annual Tax Statement under Section 203AA of the Income Tax Act 1961 See Section 203AA and second provision to Section 206C 5 of the Income Tax Act 1961 and Rule 31AB of Income Tax Rules 1962 Permanent Account Number PAN AKNPS1129B Current Status of PAN Active Financial Year 2017-18 Assessment Year 2018-19. View Tax Credit Traces. Income Tax Department facilitates a PAN holder to view its Tax Statement Form 26AS online.

The form also shows details of salepurchase of immovable property mutual funds cash. The Income Tax Department will allow a taxpayer to claim the credit of taxes as reflected in his or her Form 26AS if no other payments are due from him or her as income tax or interest thereon. Pick the Assessment Year and Also the format in which you Would like to View That the Form 26AS.

View Tax Credit Statement Form 26AS Perform the following steps to view or download the Form-26AS from e-Filing portal. Part A- Part A provides details of tax deducted for taxpayer by deductors This part of form 26AS mentions the amount of TDS deducted and deposited TAN of the deductor. Form 26AS is an annual consolidated tax credit statement that taxpayers can access view or download from the income tax departments e-filing website.