Perfect P&l Meaning In Accounting

Typically either one month or consolidated months over a year.

P&l meaning in accounting. Historically a primary financial statement showing the revenues earned in a period matched with the expenditures incurred in the same period to arrive at a figure of net profit or loss. PL or PL or PNL. When to use a PL Typically a profit loss statement is created at the end of accounting periods - for example at the end of each quarter.

A P. This allows a business to stay on top of their financial situation and make adjustments for the coming quarter. P L definition.

It is prepared to determine the net profit or net loss of a trader. Meaning and Definition of Profit and Loss PL Account. What is a profit and loss PL account.

PL stands for Profit Loss business finance accounting. Profit and loss account Definition. The PL statement is usually a very.

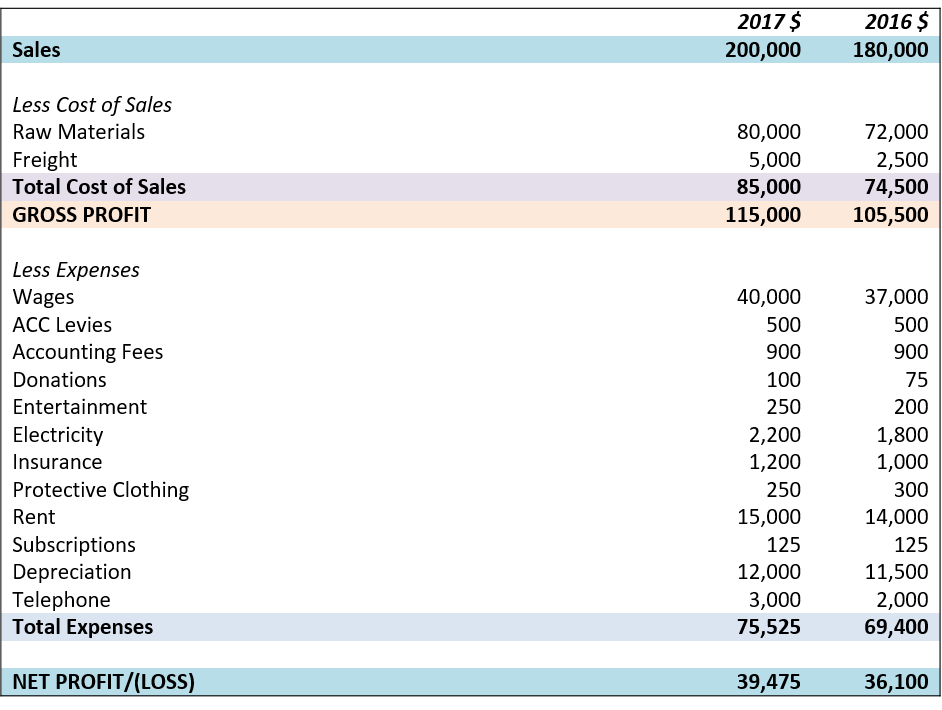

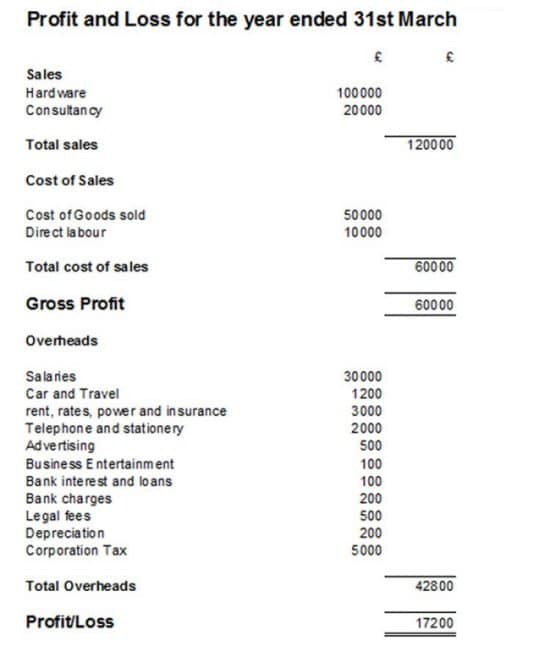

A PL statement is based on accrual accounting which recognizes revenues and expenses when they are incurred not when money actually changes hands. Profit and loss account This is often called the PL for short and it shows your businesss income less its day-to-day running costs over a given period of time often a year month or quarter. The PL statement shows a companys ability to generate sales manage expenses and create profits.

The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. PL account is a component of final accounts. The profit and loss PL statement is a financial statement that summarizes the revenues costs and expenses incurred during a specified period usually a fiscal quarter or year.

.png)