Stunning Operating Expenses Formula Income Statement

Operating expenses are the operating costs that occurred by an entity as the result of its daily operating activities and those are recording the income statement bases on the accrual principle.

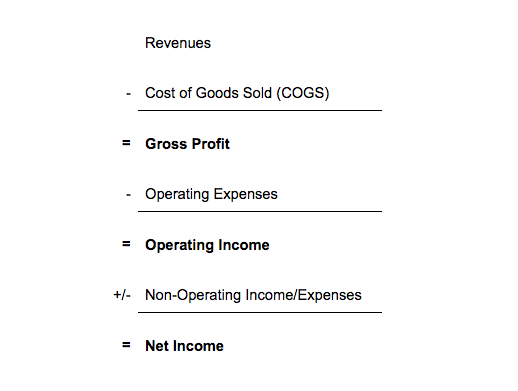

Operating expenses formula income statement. These costs are different from the cost of goods sold since they are not directly associated with the cost of goods or services. Then operating income is calculated by subtracting operating expenses from gross profit. Operating expenses are found on the income statement.

Operating expenses are summarized on a companys income statement. Operating Expense Definition Operating Expense OPEX is the cost that is incurred in the normal course of business and does not include expenses such as the cost of goods sold which are directly related to product manufacturing or service delivery. Different business models and industries require different operating expenses.

A basic operating expense calculation can be used in company income statements. To determine the operating cost go through your income statement for a given accounting period. This is usually done monthly quarterly or annually.

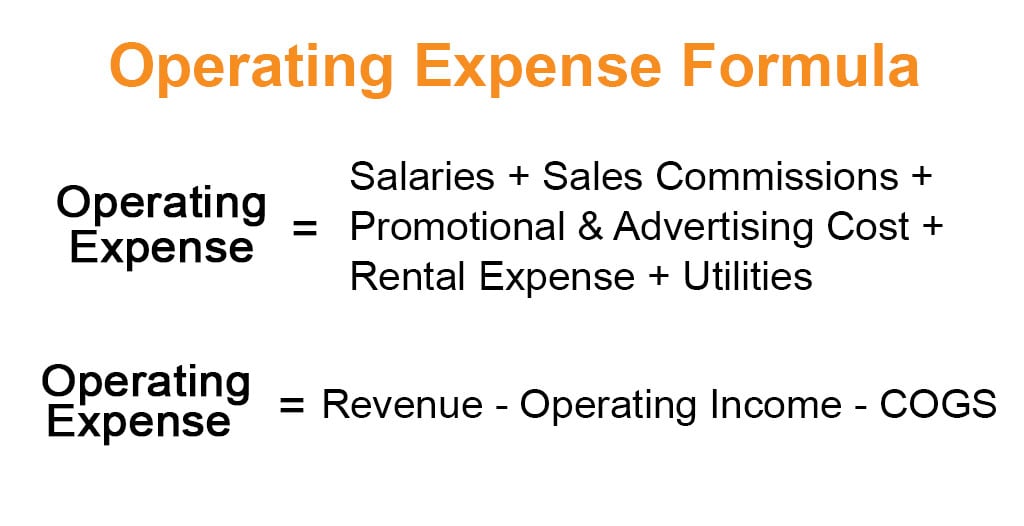

This represents the amount of cash generated after reinvestment was made back into the business. Operating expenses on an income statement are costs that arise in the normal course of business. A basic example of an operating expenses formula is below.

To calculate net operating income subtract operating expenses from the revenue generated by a property. Income From Operations is calculated using the formula given below Income From Operations Net Income Interest Expense Taxes Income From Operations 54286 million 3240 million 13372 million Income From Operations 70898 million. Then use the following operating cost formula.

In addition to interest income and interest expense companies may have other non-operating income and expenses presented on the income statement for which the nature is not explicitly disclosed. For most businesses these costs should be between is 60 to 80 of gross revenue. Revenues Cash sales 88750.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)