Simple Preparation Of Profit And Loss Appropriation Account

Without profit and loss account income of partners also can not be ascertained.

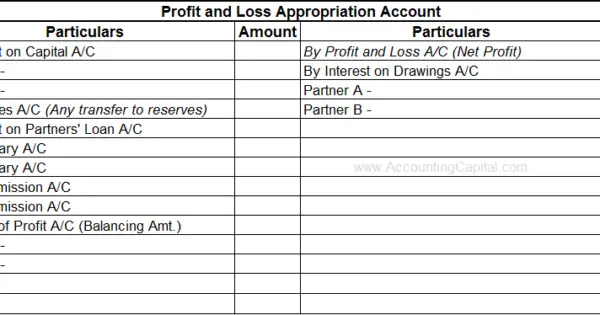

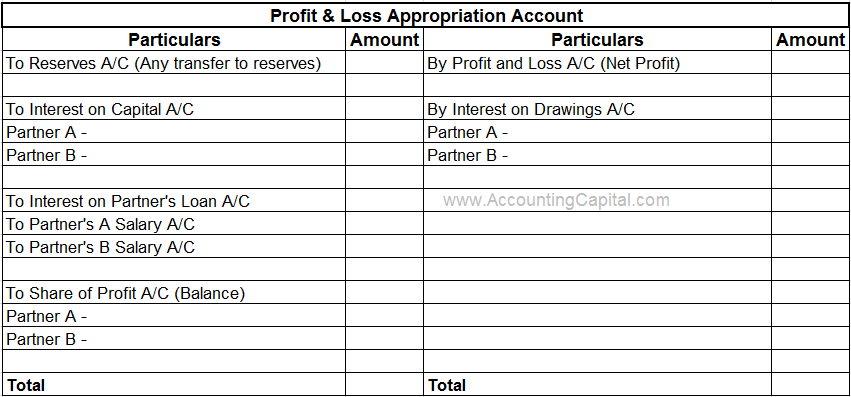

Preparation of profit and loss appropriation account. Step 1 Total the credit side of the Profit and Loss Appropriation Account. What are the benefits of preparation of Profit and Loss Account. Ad Find Loss Profit Statement.

It is prepared to distribute the profitsLosses among the partners. This is merely an extension of the profit and loss account and is prepared to show how net profit is to be distributed among the partners. Ad Find Profit Loss Statements.

In other words Net Profit or Net Loss from Profit and Loss Account will be transferred to opposite side Below the line method. Ad Find Loss profit statement. Now lets discuss various facts about the Profit and Loss Appropriation Ac.

Profit and loss Appropriation account is Prepared after preparing Profit and Loss Account. It is very necessary to prepare Profit and Loss Account to pay exact income tax to the income tax authorities. Ad Find Loss Profit Statement.

This account should not be confused with the typical Profit and Loss Account but rather seen as an extension of it as it is made after making the Profit and Loss Account. Step 2 Total the debit side of the Profit and Loss Appropriation Account. Prepare Profit and Loss Appropriation Account and the Partners Capital Accounts at the end of April 30 th 2020 after considering the following items.

Profit and loss Appropriation account is a nominal account. It is prepared to distribute the Net profitsNet Losses among the partners. It is a special account that a firm prepares to show the distribution of profitslosses among the partners or partners capital.