Nice Net Cash Provided By Investing Activities Formula

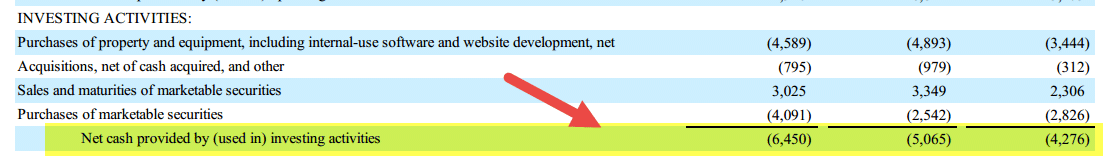

Subtract the total outflows from the total inflows to calculate the net cash flow from investing activities.

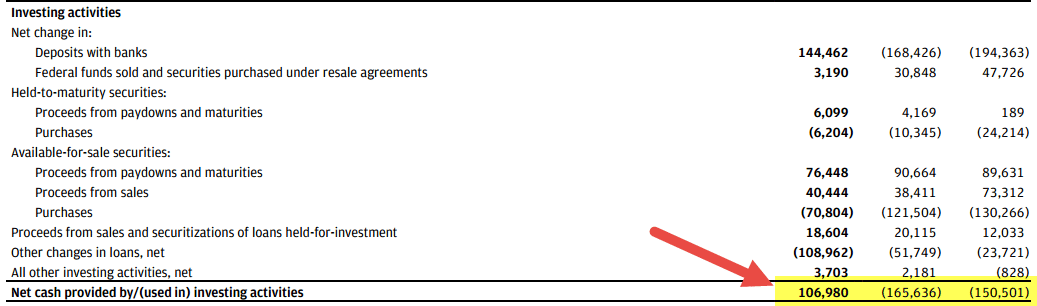

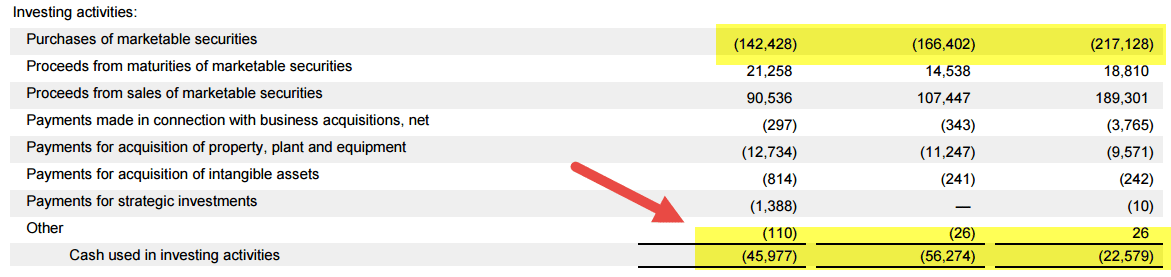

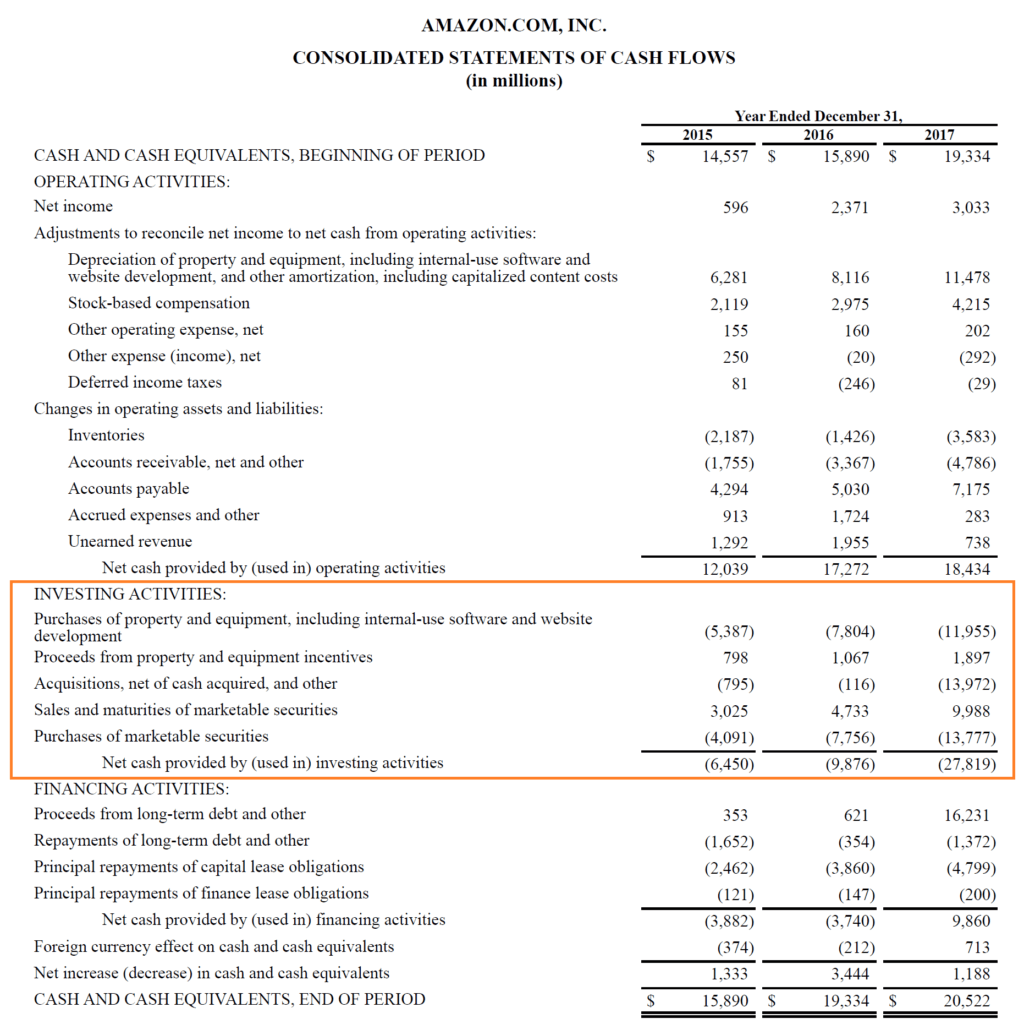

Net cash provided by investing activities formula. If net cash flows from investing activities are negative it means that there is a net addition to long-term assets and vice versa. The total is the figure that gets reported on your cash flow. Net cash flows from investing activities Net cash flows from financial activities Net cash flows from operating activities.

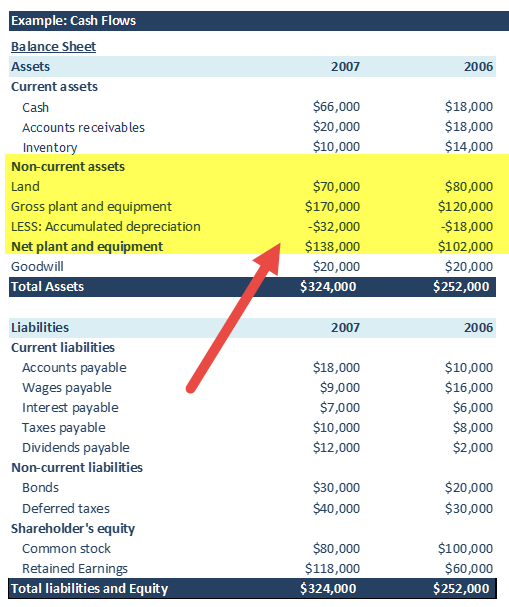

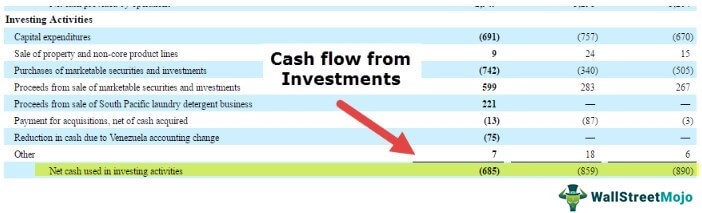

We deliver independent tailored unbiased advice for you your family your business. Cash flow from investing activities is the cash that has been generated or spent on non-current assets that are intended to produce a profit in the future. Subtract money paid out to buy assets make loans or buy stocks and bonds.

Negative net cash flows from investing activities are financed out of positive cash flows from operating activities andor cash flows from financing activities. Increase in accounts receivable. Compute net cash provided used.

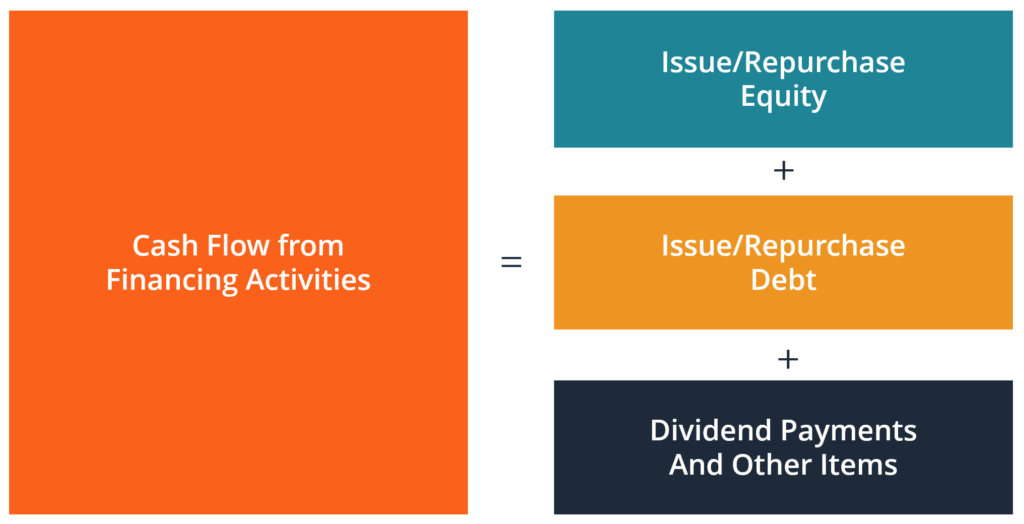

Any cash flow relating to available for sale securities is reported in investing activities section of statement of cash flows. Subtract the total cash outflows from the total cash inflows in the financing activities section to calculate the net cash provided by financing activities. Ad Open A Low Cost Easy-To-Use Investment Account In Minutes.

Cash flow from Financing Activities Net cash flow from these activities are net up with the profit loss value taken from the income statement. The Beta company provides only the following information for the year 2016. The net change in cash is calculated with the following formula.

Concluding the example subtract 65 million from 6 million to get -59 million which means that the companys investing activities reduced its overall cash position by 59 million. Cash Flow from Operations Net Income Non-Cash Items Changes in Working Capital. Book your free consultation.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)