Recommendation Gaap Accounting For Unrealized Gains And Losses On Investments

The purpose of this article is to provide a brief overview of these possibilities.

Gaap accounting for unrealized gains and losses on investments. Statement of Financial Position. In the past FASB required that changes in the fair value of available-for-sale equity investments be parked in accumulated other comprehensive income an equity account until realized--that is until the equity investment was sold. Unrealized gains and losses are recognized 1 at each balance sheet date.

When you do eventually sell the security then any. An important concept in the accounting for investments is whether a gain or loss has been realized. For example lets say Mike purchased 100 shares of Sallys Software Inc.

Losses are similar to gains in that both are recognized on the income statement only when an asset is sold and a loss is taken. In other words the unrealized gains and losses of equity investments were not recognized. Are you aware of the coming changes in accounting for equity securities.

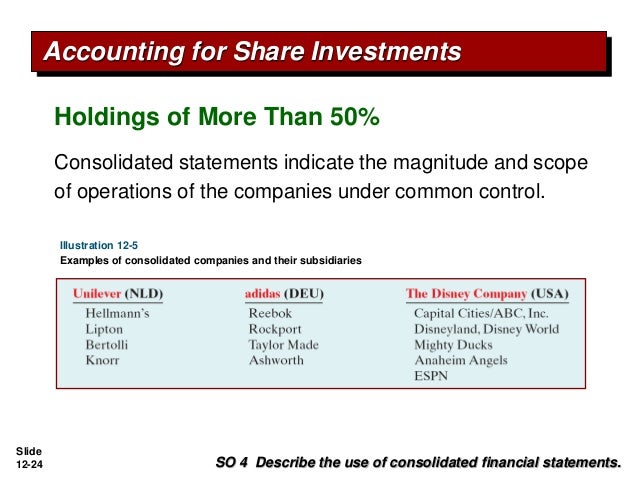

GAAP must report investments at fair value for nonprofits unrealized gains and losses flow through the statement of activities rather than through other comprehensive income. As an example nonprofit accounting for investment income is unique. This Statement addresses the accounting and reporting for investments in equity securities that have readily determinable fair values and for all investments in debt securities.

A realized gain is achieved by the sale of an investment as is a realized loss. If the value of the stock at the end of the period is 10 Mike will have. If American Airlines paid a 3 dividend the 120 40003 would be a realized gain.

It is also called paper profit or paper loss. Conversely an unrealized gain or loss is associated with a change in the fair value of an investment that is still owned by the investor. GAAP unrealized gains and losses flow through the statement of activities.