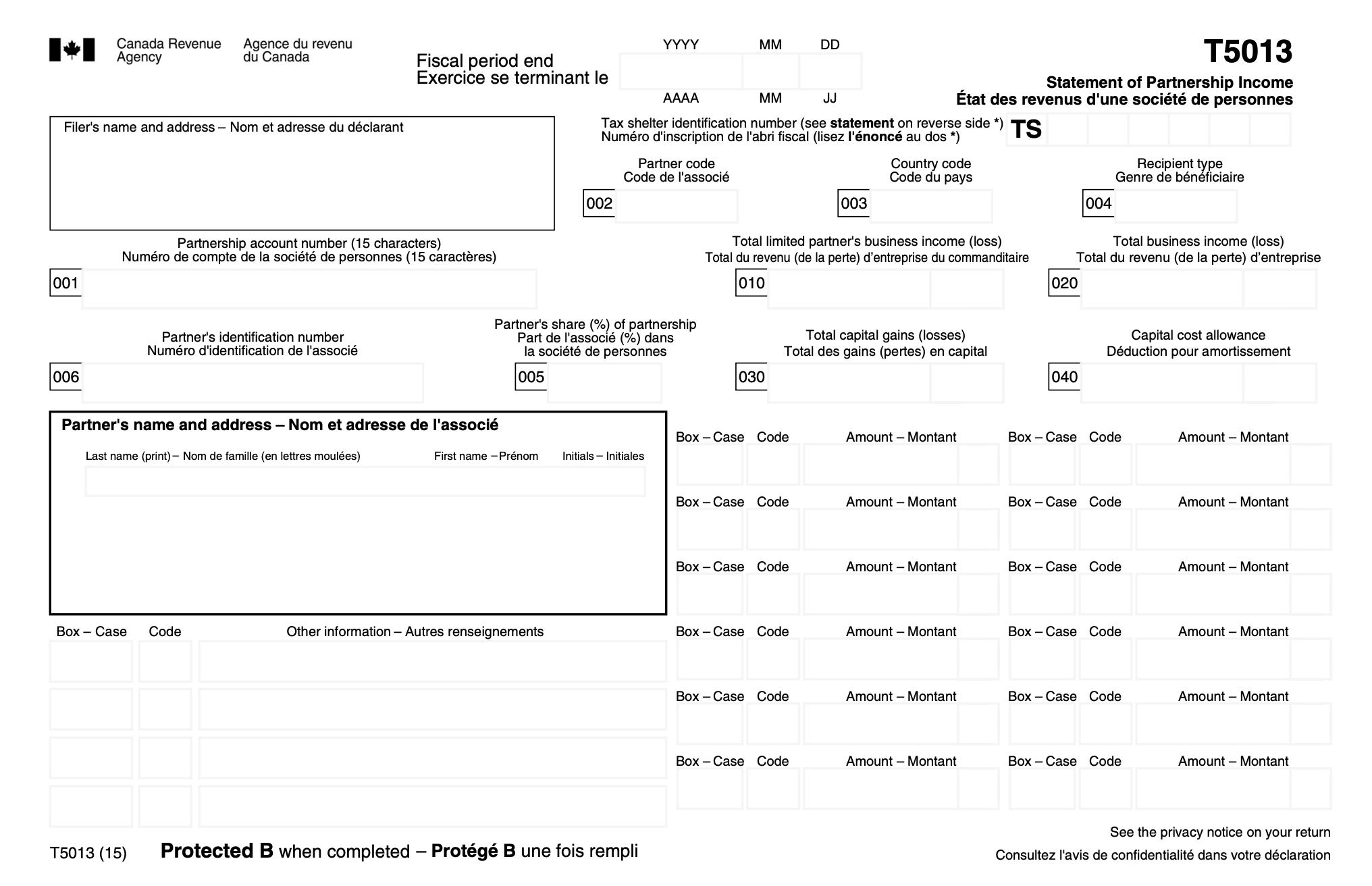

Marvelous T5013 Statement Of Partnership Income

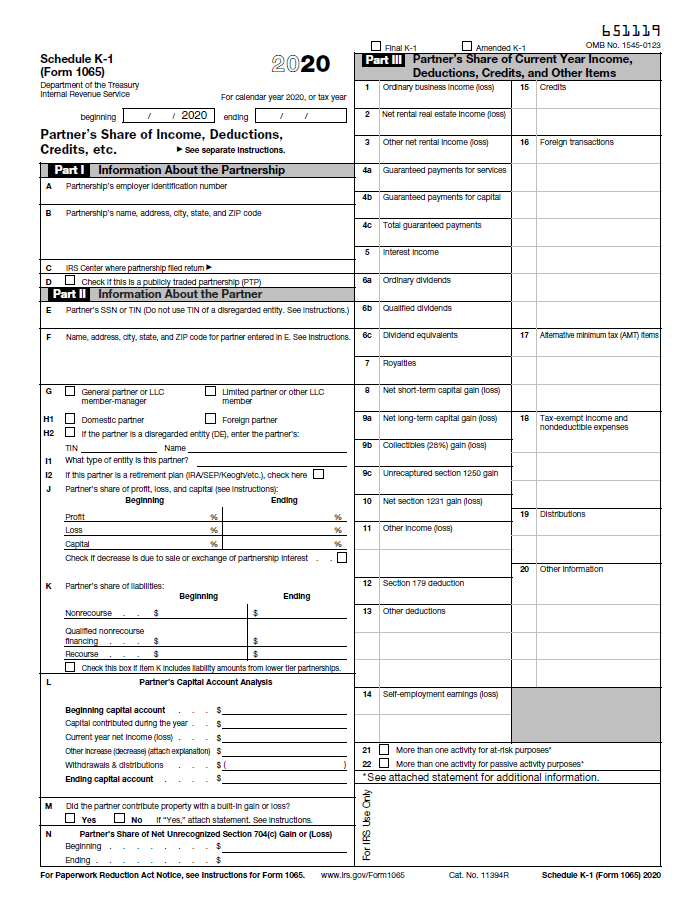

A partnership that receives a T5013 slip Statement of Partnership Income has to report the slip information on its financial statements for the fiscal period.

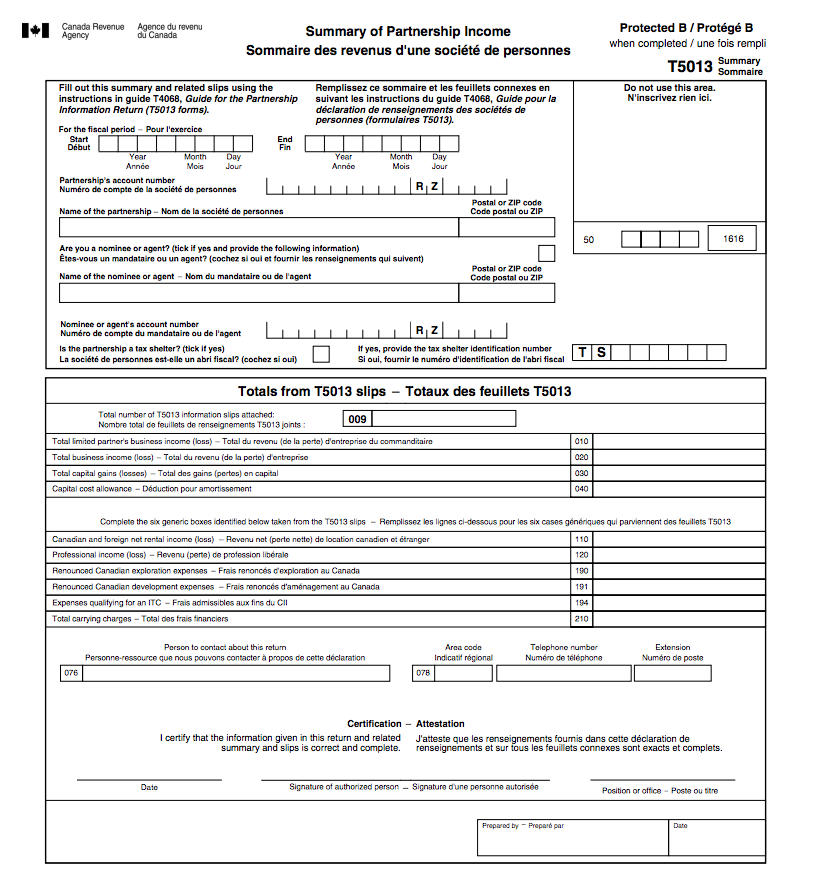

T5013 statement of partnership income. Canadian tax form T5013 also known as the Statement of Partnership Income is a form that partnerships in Canada use to report basic financial information about their business to the CRA. T5013 - Statement of Partnership Income Partnership Information Return. T5013 - Statement of Partnership Income Under subsection 2291 of the Regulations all partnerships that carry on business in Canada or are Canadian partnerships or specified investment flow-through SIFT partnerships must file a partnership information return.

To register go to. Since a partnership doesnt usually pay income tax on its income each partner needs to report their share on their own income tax return whether it was received in cash or as a credit to their capital account. Form T5013 or the Statement of Partnership Income is a document that partnerships use to report their financial status to the Canada Revenue Agency CRA.

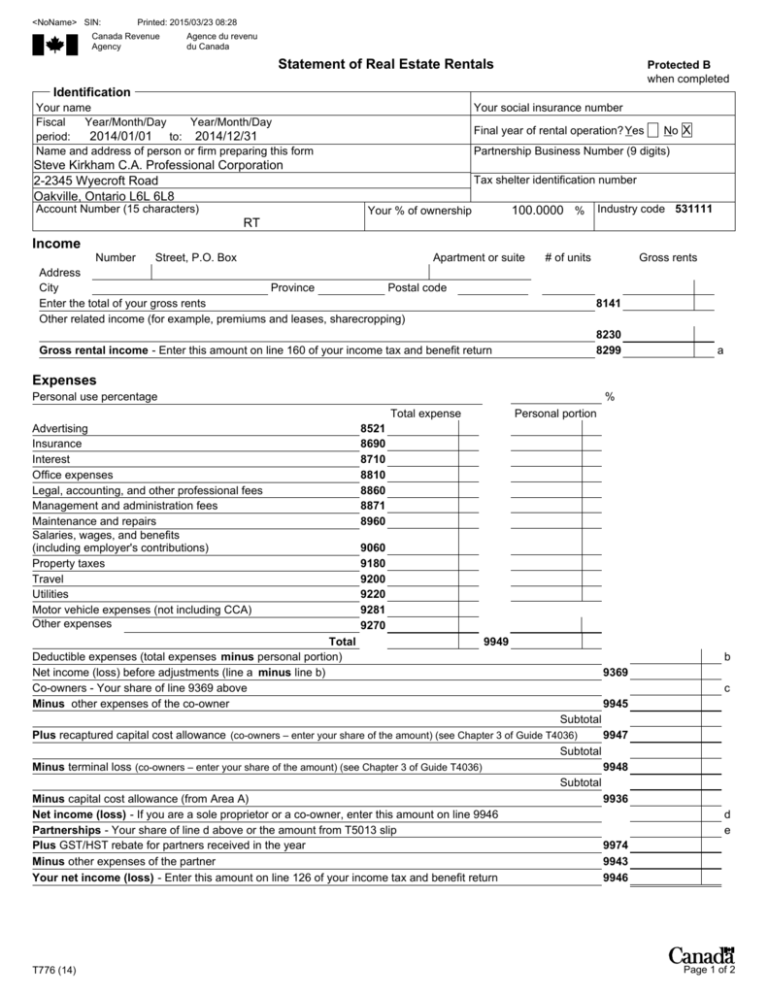

It is used in calculating their net income or loss so each partner can file it in hisher individual income tax return or other tax returns as it may apply. PDF t5013-flat-11bpdf 38 KB. Such businesses dont pay income tax and the CRA doesnt use the information provided to calculate a businesss tax liability.

Business income loss Multi-jurisdictional Enter this amount on line C on page 3 of Form T2125 Statement of Business or Professional Activities and report the income on line 135 of your T1 return. You must do this whether the share of income was received in cash or as a credit to one of the partnerships capital accounts. At the bottom of the form this information is provided.

If youre a member of a partnership youll receive a T5013. A partnership that receives a T5013 slip Statement of Partnership Income has to report the information on its financial statements for the fiscal period. The Minister of National Revenue asked in writing for a completed form T5013 Statement of Partnership Income To determine if a partnership exceeds the 2 million threshold add total expenses to total revenues rather than subtract expenses from revenues as you would to determine net income.

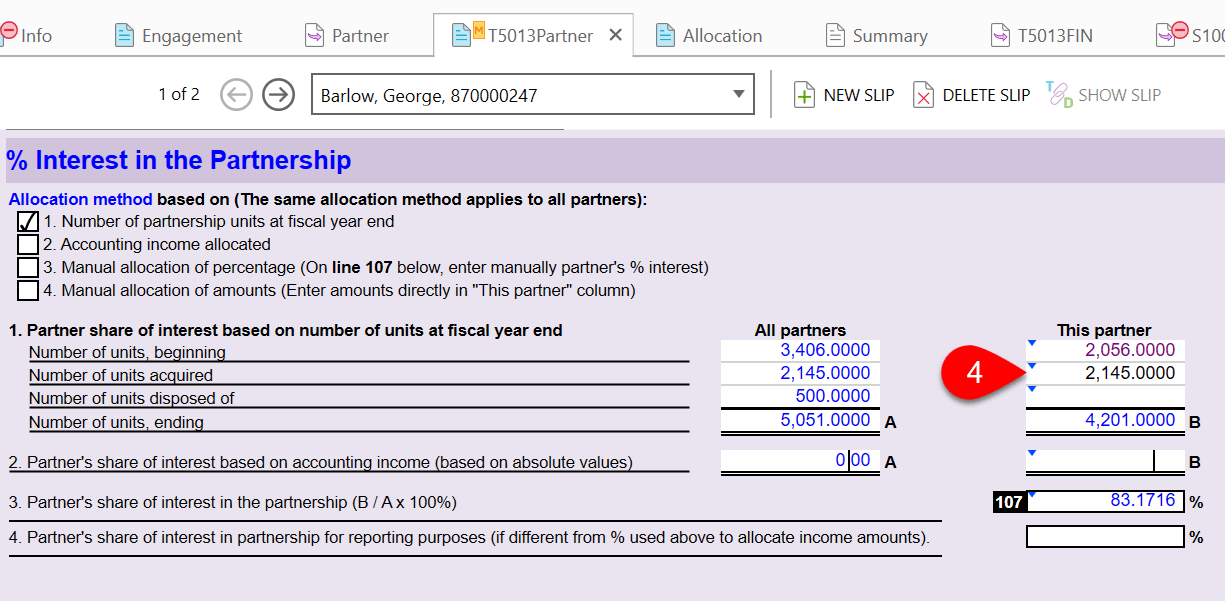

Information sheet T5013-INST Statement of Partnership Income Instructions for Recipient that should be included by the partnership with this information slip. AvanTax eForms T5013 data entry screen. Its fast convenient and secure.