Top Notch Does Closing Stock Appear In Trial Balance

If we do not transfer closing stock out of Goods purchased ac we are not applying the accruals concept.

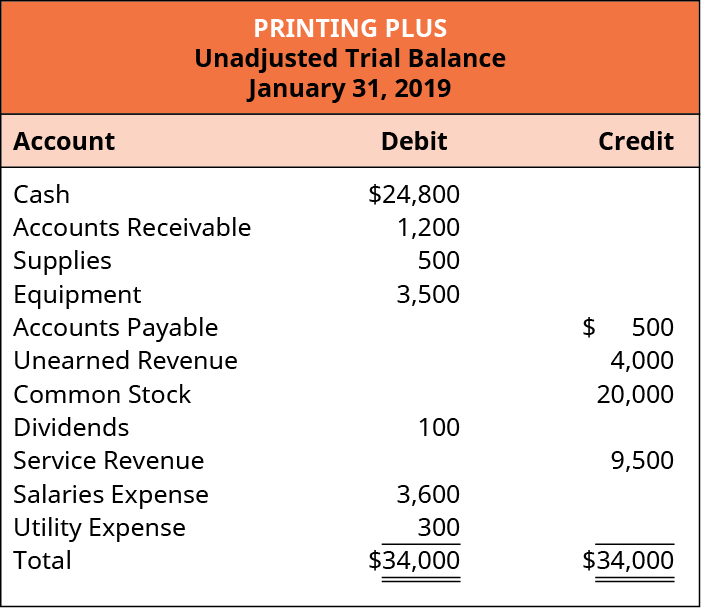

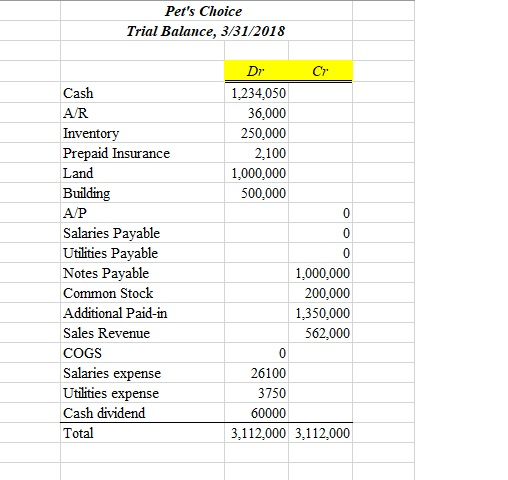

Does closing stock appear in trial balance. The main difference from the general ledger is that the general ledger shows all of the transactions by account whereas the trial balance only shows the account totals not each separate transaction. Closing Stock is shown on the Asset Side of Balance Sheet. Closing stock is the balance of unsold goods that are remaining from the purchases made during an accounting period.

When closing stock appears in adjustment it is recorded in the credit side of Trading Account and again in the asset side of Balance Sheet. Closing stock generally does not appear in the trial balance because it is the leftover of the purchases which is already included in the trial balance. While at times in the Trial Balance this is adjusted with the purchase which is given in the Opening Stock and Closing Stock are adjusted through purchases.

Let us read to understand the reason why closing stock is not shown in trial balance. D Balance of ledger accounts are shown in the trial balance. Normally closing stock does appear in the Trial Balance and it is shown in the list of adjustments.

Therefore closing stock cannot appear in the trial balance because there is no such account. What is Closing Stock. Closing stock or inventory is the amount that a company still has on its hand at the end of a financial period.

C All expenses will appear in the credit column of the trial balance. Over stating the value of goods sold The opening Stock last years unsold purchases will appear on the opening trial balance on the debit side and will be. If closing stock is included in the Trial Balance the effect will.

Which of the following statement is false. It is always written below the Trial Balance. On a broad level it includes raw material work in progress and finished goodsthe units of closing stock help in determining the total amount.