First Class Negative Cash Flow Statement

A negative cash balance results when the cash account in a companys general ledger has a credit balance.

Negative cash flow statement. Its important to remember that long-term negative cash flow isnt always a bad thing. This is often viewed as an indicator of financial ill health by people who are assessing companies to determine whether or not to invest in the company. If negative cash is included in the definition of cash the cash captions in the statement of cash flows should be revised accordingly eg Cash Cash Overdraft at end of year.

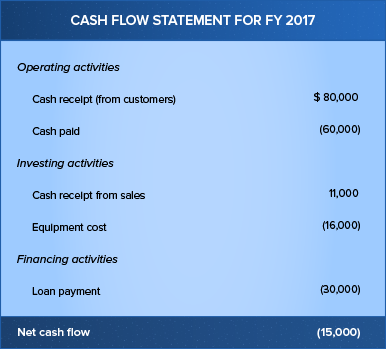

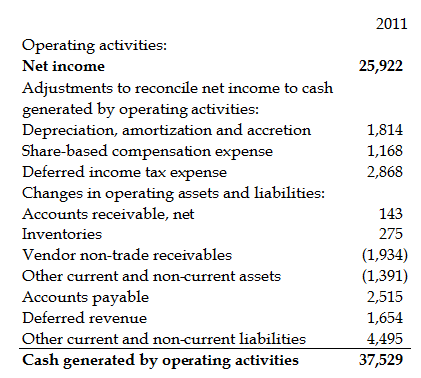

You cannot cover your expenses from sales alone. Is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year. When your cash flow statement shows a negative number at the bottom that means you lost cash during the accounting periodyou have negative cash flow.

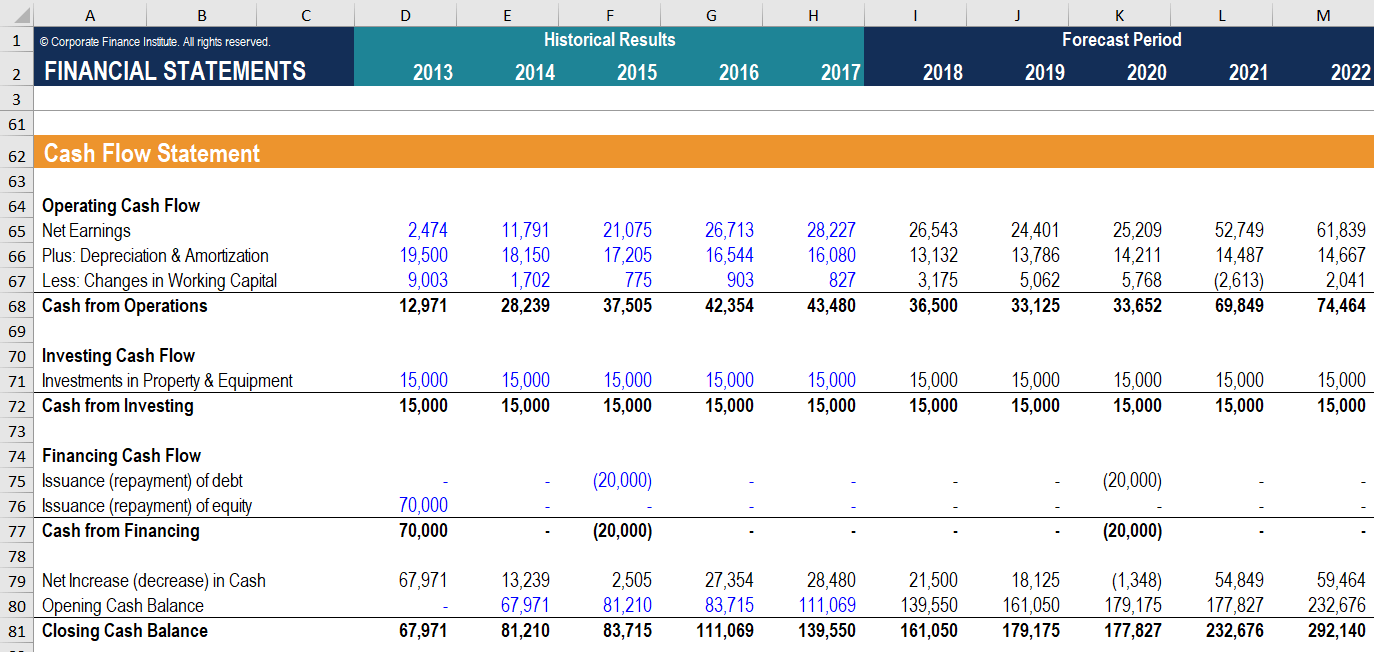

75 net income 100 increase in accounts receivable -25 Cash Flows from Operations which is negative cash flow. Of course not all cash flow statements look this healthy or exhibit a positive cash flow but negative cash flow should not automatically raise a red flag without further analysis. Negative or unfavorable for the companys cash balance.

If the former youre losing more money than youre gaining which could mean its time to cut costs and figure out how to up your revenue. Looking at a cash flow statement will tell you if you have negative cash flow or positive cash flow. If the balance sheet contains a positive cash balance in assets and a cash overdraft in liabilities provide a reconciliation a t the bottom of the cash flow statement or in a disclosure.

Since the purchase of additional inventory requires the use of cash it means there was an additional outflow of cash. Instead you need money from investments and financing to make up the difference. A use of the companys cash.

Three Sections of the Statement of Cash Flows. Instead negative cash flow may be caused by expenditure and income mismatch which should be addressed as soon as possible. On the Cash Flow Statement you have.