Exemplary Income Statement Functional Method

This is the method of preparing income statement according to the nature of expense.

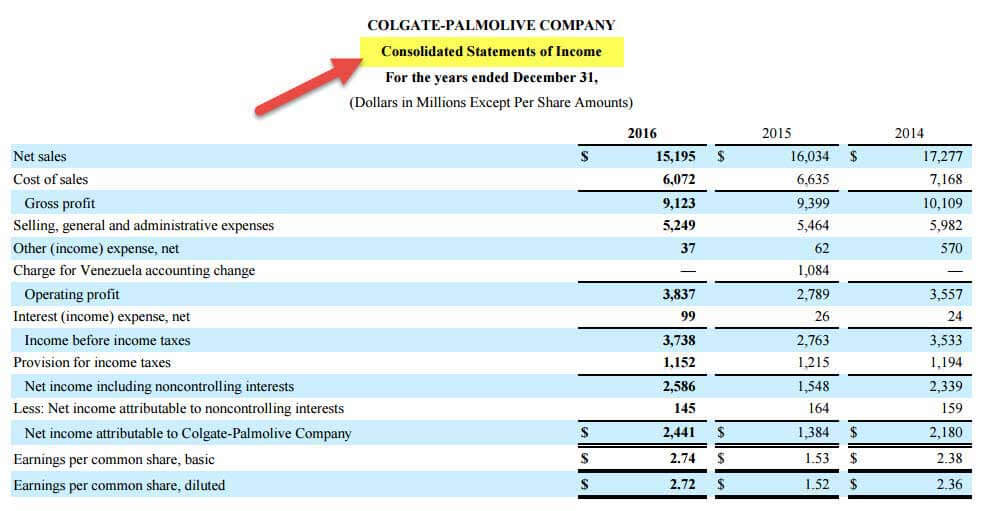

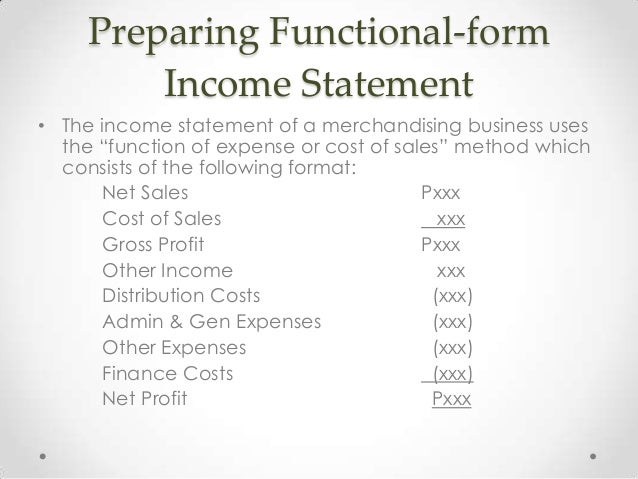

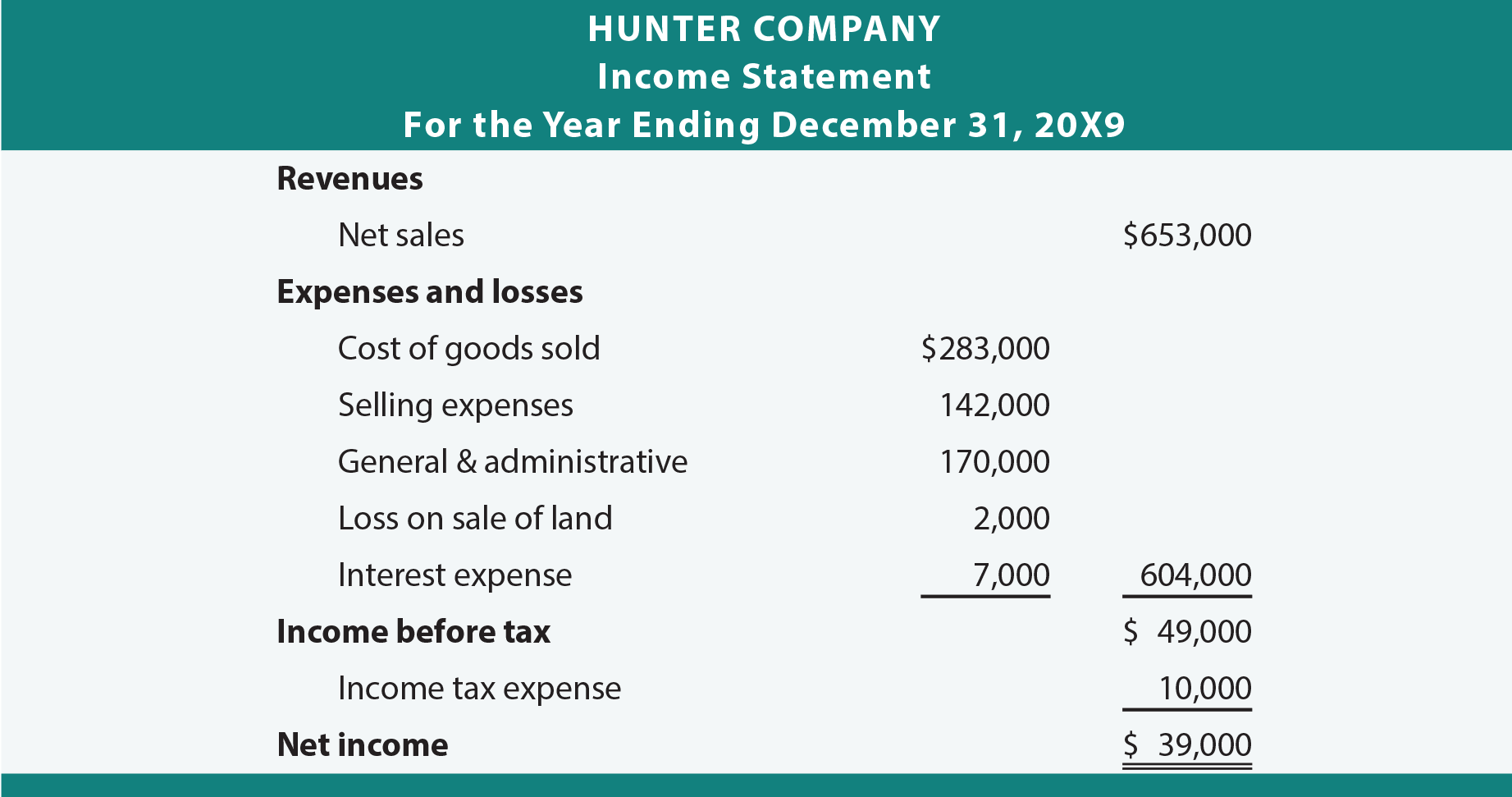

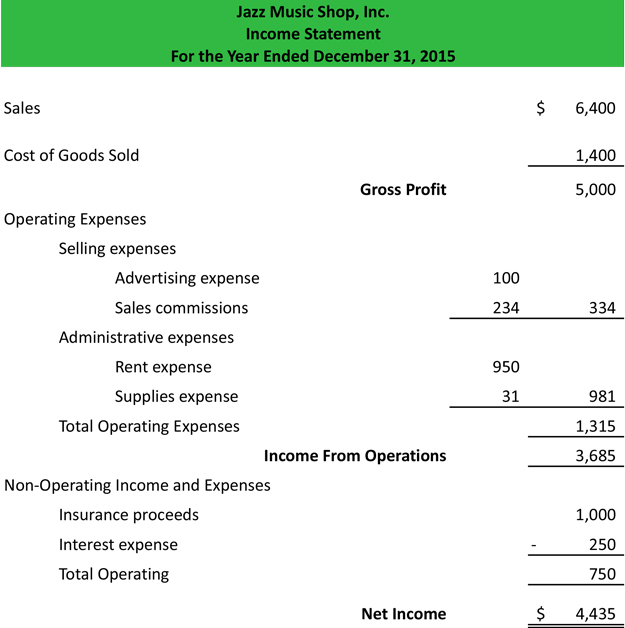

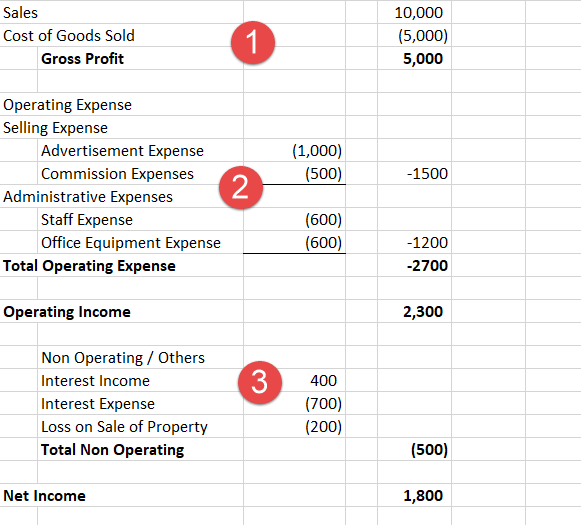

Income statement functional method. The Gross Profit and the Net Profit. The income statement may be presented in either 1 a single-step format whereby all expenses are classified by function and then deducted from total income to arrive at income before tax or 2 a multiple-step format separating operating and nonoperating activities before presenting income. Meaning of Income Statement.

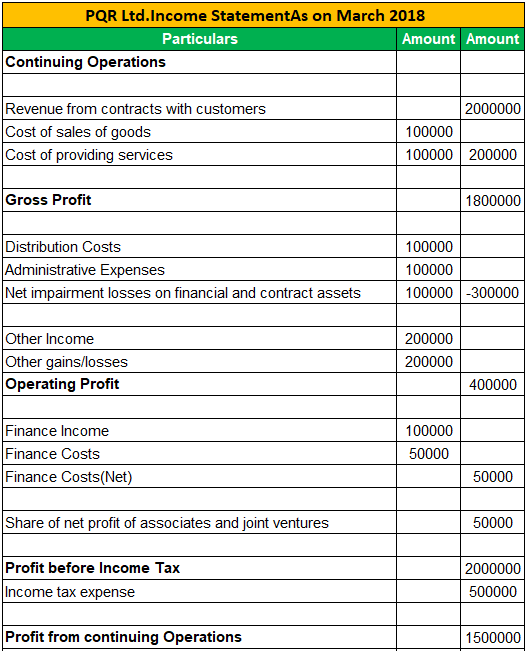

There is no reallocation of these expenses to different functions of the entity ie. Distribution Cost 4 P 950000 Administrative Expenses 5 800000 Other. The income state-ment summarizes these transactions.

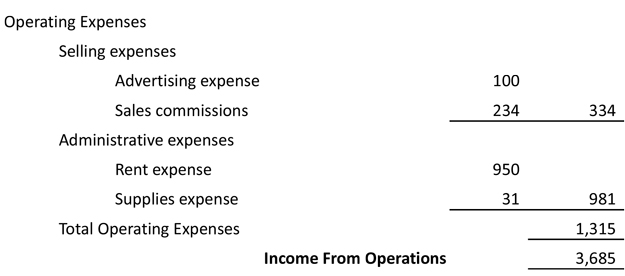

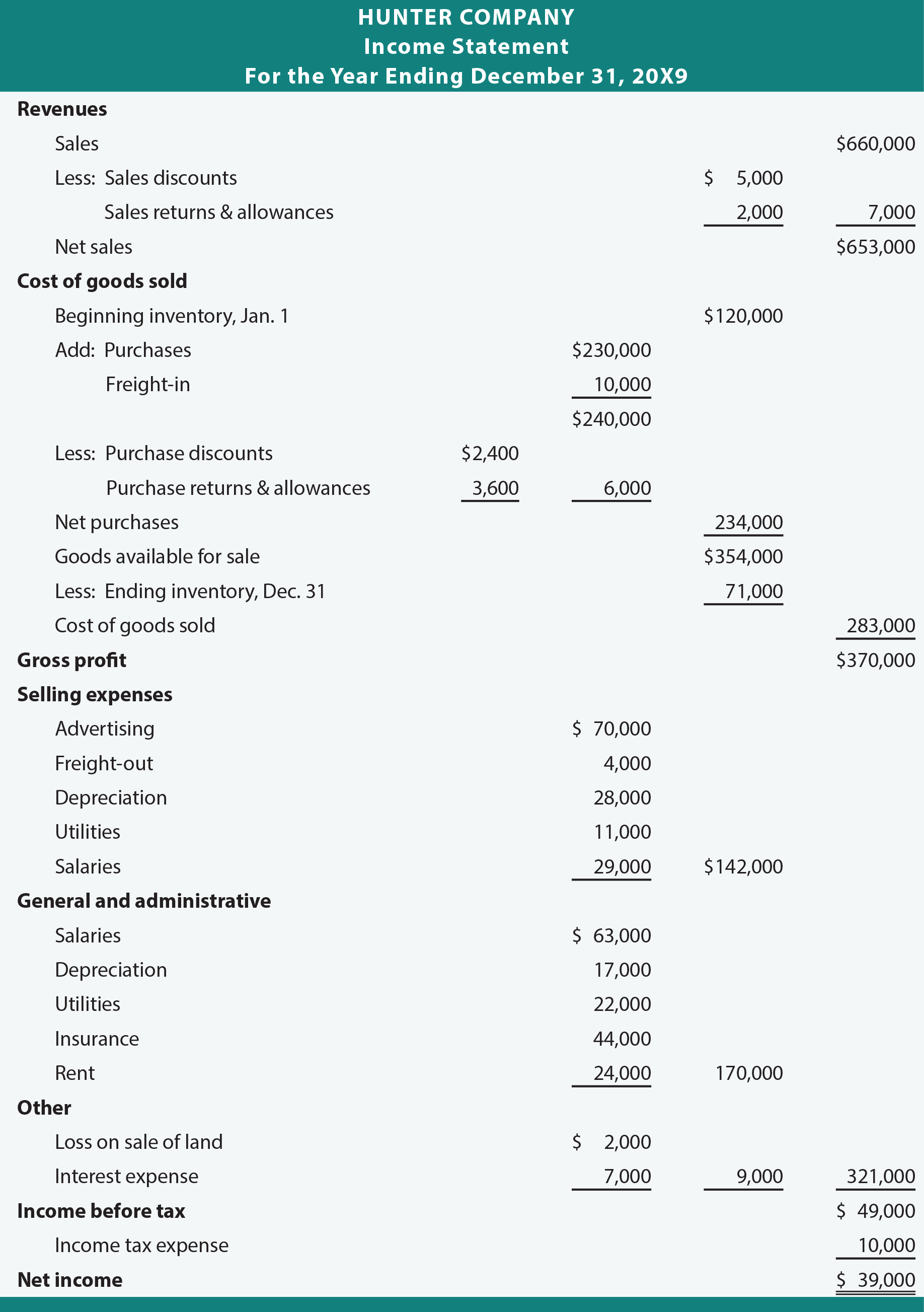

An entity aggregates expenses within profit or loss according to their nature for example. To better grasp functional expense allocation it helps to understand why its important for nonprofit organizations in particular to report their expenses by function. Income Statement by Functions This is the method of income statement in which expenses are grouped according to their functions or classes such as cost of goods sold administrative expenses selling expenses.

Examples of income statement line items that are presented by function are administrative expenses financing expenses manufacturing expenses marketing expenses and selling expenses. Below is an example of Amazons consolidated statement of operations or income statement for the years ended December 31 2015 2017. Income Statement using Functional method with supporting notes.

The performance of a business in its Income Statement is demonstrated by two key figures. The Income Statement of a business shows the financial performance of a business for a period usually produced quarterly semi-annually or annually. Income statements based on the function of expense method therefore require that functional areas are activated in your system.

KARLA COMPANY Income Statement Note Net Sales 1 P 7700000 Cost of Good Sold 2 5000000 Gross Income 2700000 Other Income 3 400000 Total Income 3100000 Expenses. Or a nonprofit entity that reports expenses by function could do so by aggregating its expenses into the following general functions. Requirements as per Companies Act 3.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)