Recommendation Treatment Of Opening Stock In Trial Balance

Ad Try Stockopedia for free to join our supportive community of private investors.

Treatment of opening stock in trial balance. Closing stock is the value of goods unsold at the end of the accounting period. Print your trial balance report as of the date that you plan to keep accurate records in Buildium. XYZ already showed 10000 MT Billet as Purchase.

This is an advanced option that allows you to enter opening balances for multiple accounts such as income and expenses in addition to the cash balances of a bank account. Gain unique insights from our data-driven research team. You can refer to the Trial Balance of the previous period month.

To enter the figure use the obal button on the Nominal Record this posts the opposite entry to the Suspense nominal code and you can follow the Opening Closing Stock journals as normal. If it is included the effect will be doubled. Trial balance as additional information.

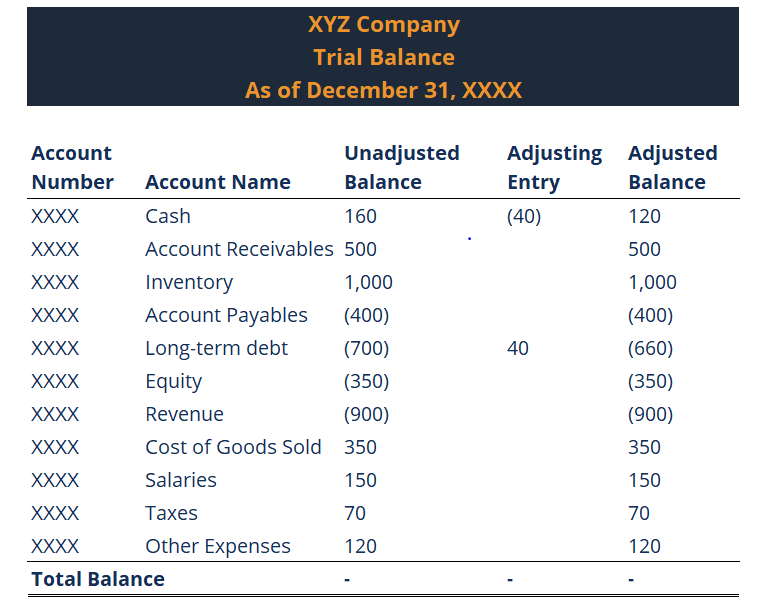

A Trial Balance is a listreport of all debits and credits closing balances on all ledger accounts for a set period and does not necessarily include opening balances or movements. Suppose total purchases during an accounting period inside a Trial Balance are. Sales cost of sales gross profit.

You will require an opening stock figure which should have been entered as part of the opening Trial Balance. Opening stock purchases - closing stock cost of sales. The opening Stock last years unsold purchases will appear on the opening trial balance on the debit side and will be classified as current assets.

If opening and closing stock journals are added you can then demonstrate the cost of sales too. Therefore logically trial balance should not contain opening stock in it. If your trial balance is produced on a date range calculate the total as.