Brilliant Cra T2125 Guide

As you have figured out there is an important distinction between rental income and business income.

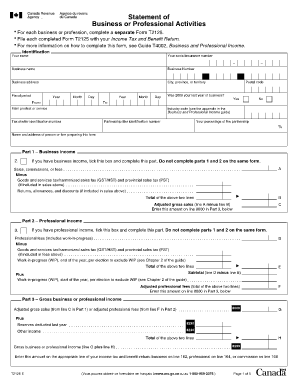

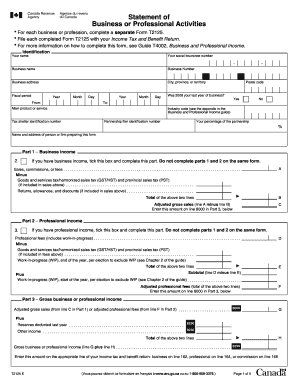

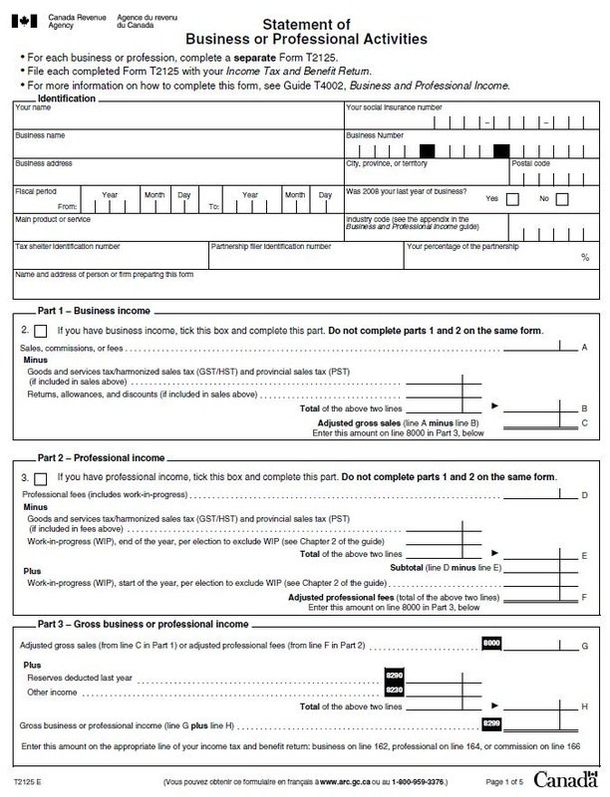

Cra t2125 guide. The CRA also uses these forms to determine the allowable capital cost deductions for capital outlays incurred to produce income for that tax year. T2125 Statement of Business or Professional Activities Expenses Advertising. If youre self-employed a business client may provide a T4A form that reports the income they paid you in the previous year.

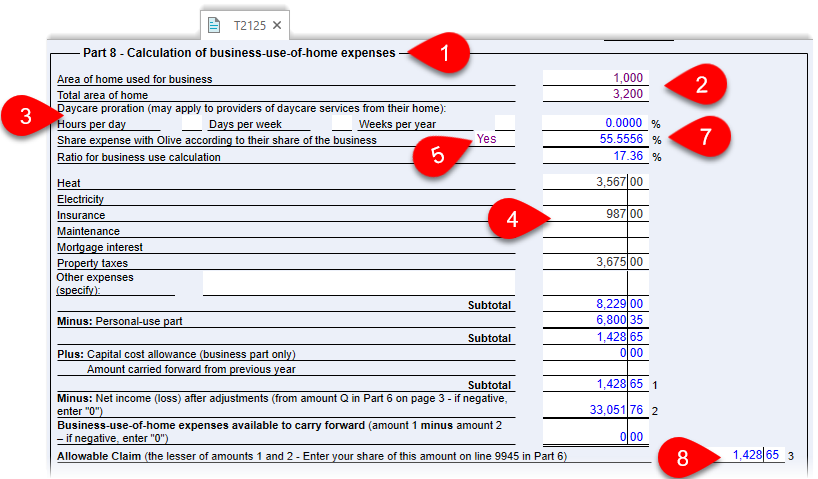

I learned that I couldnt expense my home office without prorating hours. If youre filing a Québec tax return youll also have to complete a TP-80-V. You must fill the T2125 with the T1 which covers income from regular employment.

Identification Complete all the lines that apply to your business or professional activities. T2125 Statement of Business or Professional Activities. It entails many expenses and costs but you will find all you need with the comprehensive CRA guide.

If more than one code describes your business or if your business has more than one activity use the code that most closely describes your main business activity. You can view this form in. T2125 is a Canadian taxpayers form for reporting self-employment and professional income taxes.

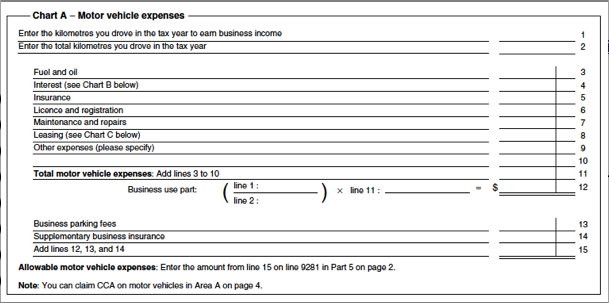

Its up to you to maintain your tax records tax filings and retain receipts for CRA reference. For example you can only claim 50 per cent of valid meals and entertainment expenses and you need to fill out Chart A in the form T2125 to calculate the motor vehicle expenses you are allowed to claim. The tax categories in QuickBooks Self-Employed are mirrored as closely as possible to the categories listed on the Canada Revenue Agencys CRA T2125 form to help make completing the form easier.

The Government of Canada has announced a series of tax measures to help support businesses impacted by the COVID-19 virus some of which affect payment deadlines. You are required to complete it and send it along with your income tax and benefit return. If you received business or professional income as a self-employed person use form T2125.