Glory Accounting For Loss Contingencies

This Roadmap provides Deloittes insights into and interpretations of the accounting guidance in ASC 4501 on loss contingencies gain contingencies and loss recoveries.

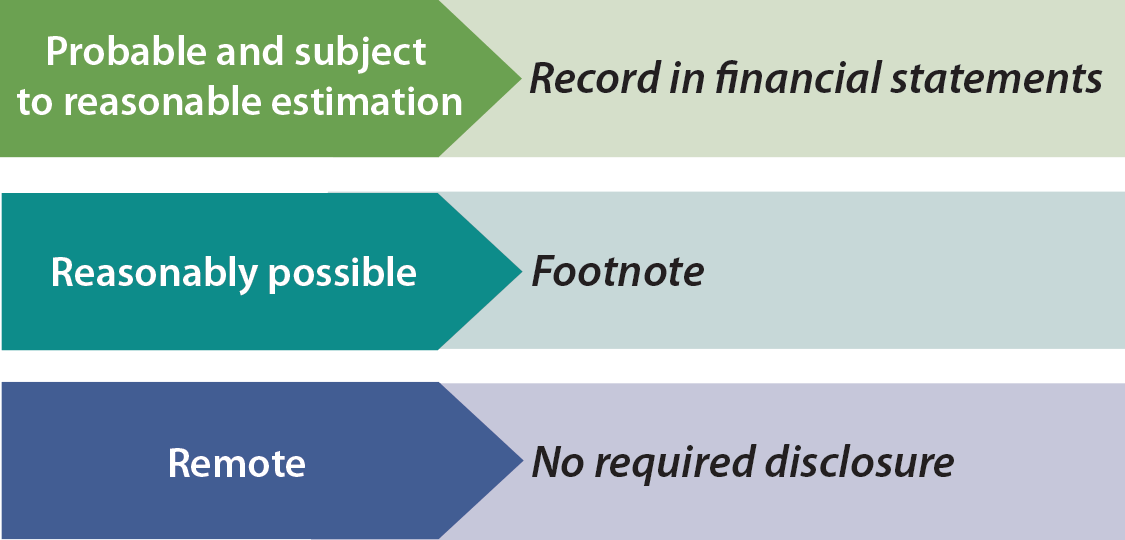

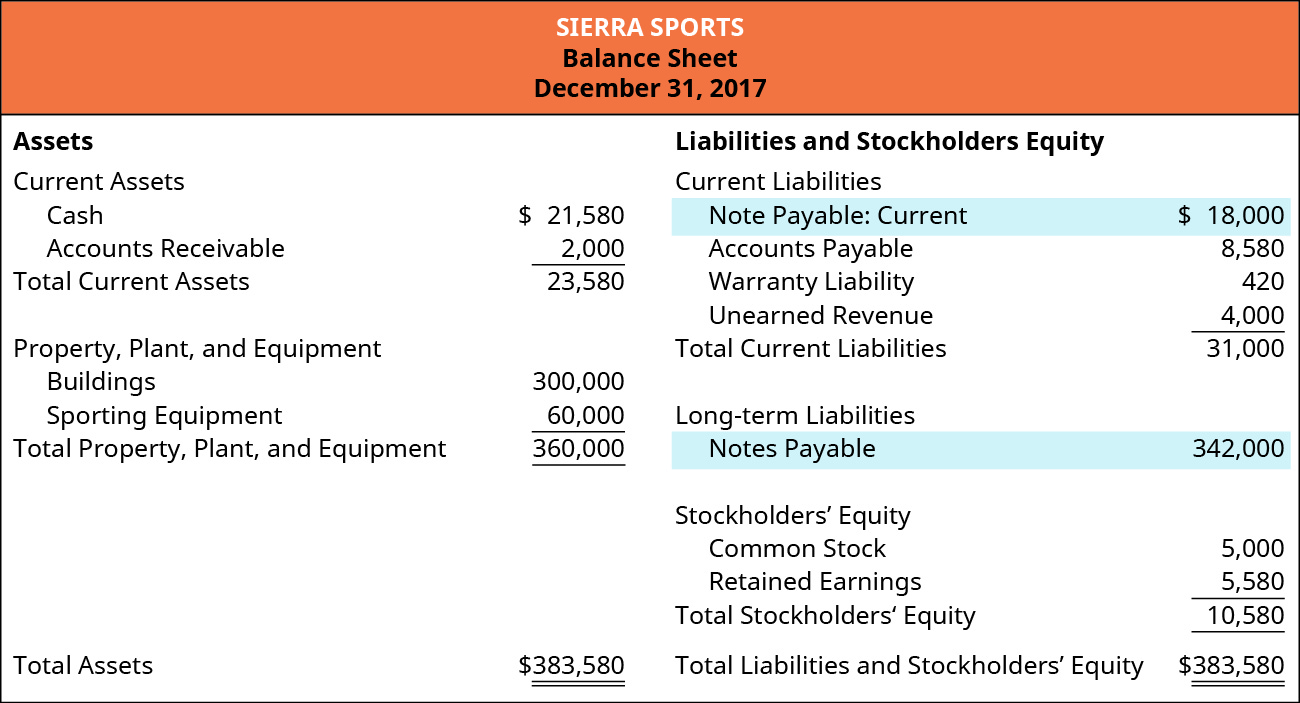

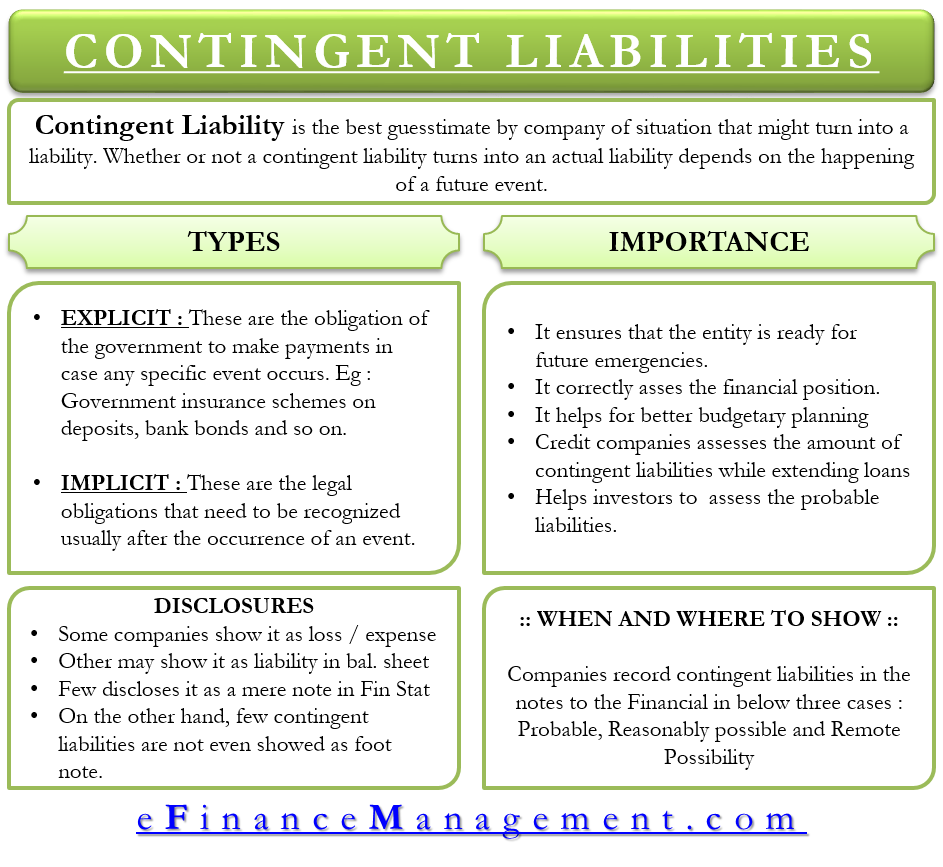

Accounting for loss contingencies. Fairly attainable losses are solely described within the notes and distant contingencies may be omitted fully from monetary statements. Recognized in the financial statements. We are pleased to present the 2020 edition of A Roadmap to Accounting for Contingencies Loss Recoveries and Guarantees.

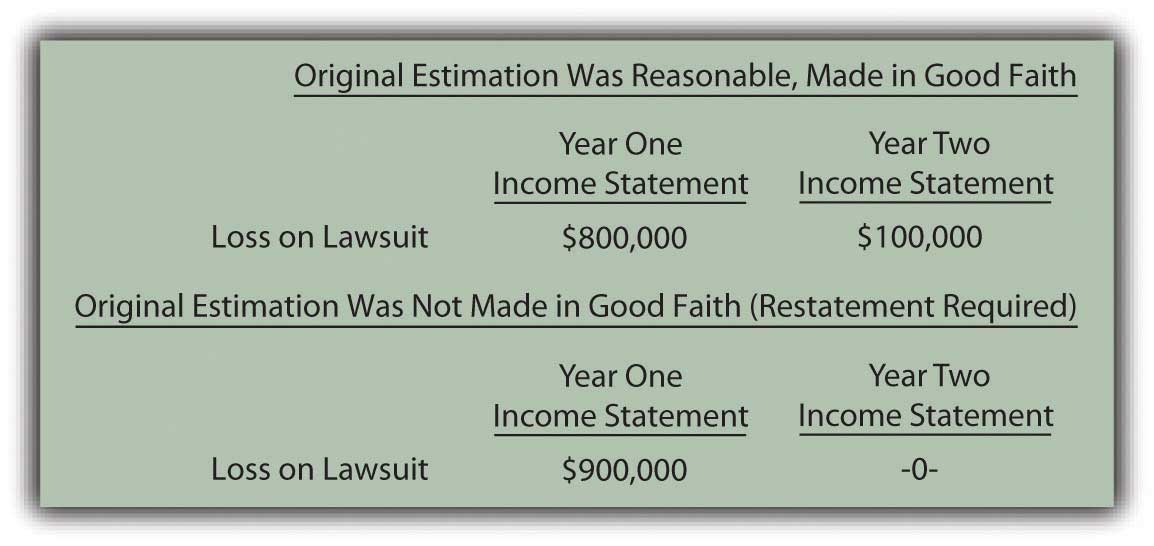

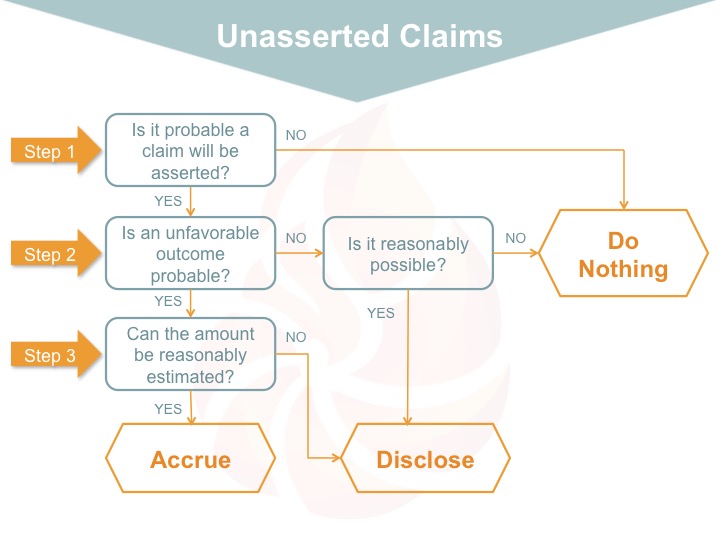

-- a loss will incur if certain future events occur or not occur. There are three separate potential recognition presentation and disclosure outcomes with regard to loss contingencies. Of course accounting for contingencies involves management estimates that hinge on assumptions about future events.

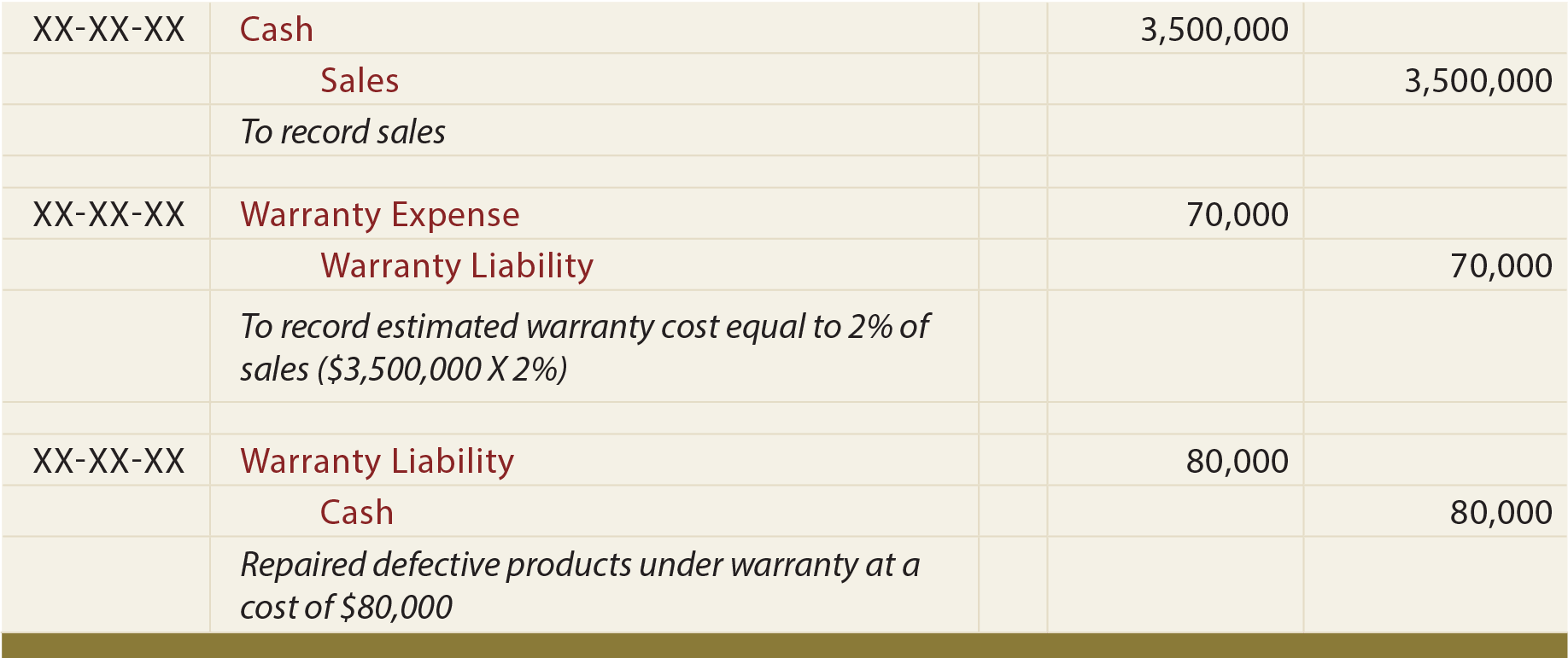

Loss contingencies are acknowledged when their chances are possible and this loss is topic to an affordable estimation. The accounting for contingent gains differs significantly from the accounting for loss recoveries. The Governmental Accounting Standards Board GASB provides guidance for contingencies in the Codification Section C50 paragraphs109-168.

Recognition of a loss contingency. If both A and B are satisfied. This publication also addresses the accounting guidance in ASC 460 on guarantees.

Recognized in the financial statements. It requires accrual by a charge to income and disclosure for an estimated loss from a loss contingency if two conditions are met. Loss contingencies are recognized when their likelihood is probable and this loss is subject to a reasonable estimation.

Recognition of a loss contingency. In this episode were going back to the basics and providing a refresher on the contingency. If the amount of such a loss cannot be reliably estimated and is not considered probable an entity may still choose to discuss the item in the footnotes that accompany its financial statements.