Fun Comparing Two Companies Financial Ratios

Solvency Ratios such as Debt-to-Equity Debt-to-Capital Interest coverage etc.

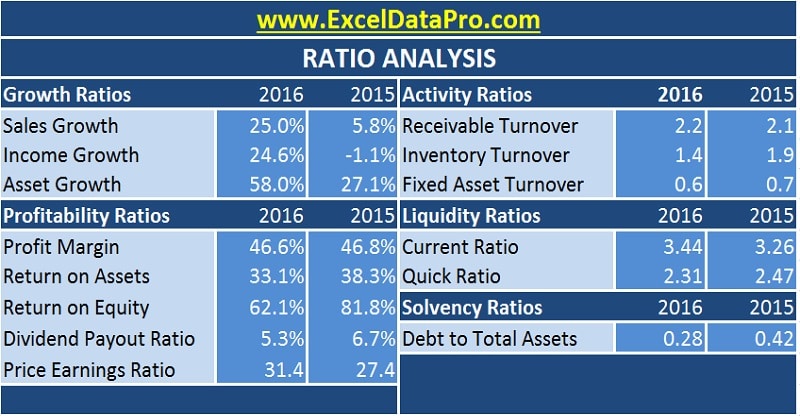

Comparing two companies financial ratios. For example the debt to equity ratio is a financial ratio. Financial ratio analysis is the calculation and comparison of ratios which are derived from the information in a companys financial statements. Introduction This is the project about financial statement analysis of two companies of the same industry.

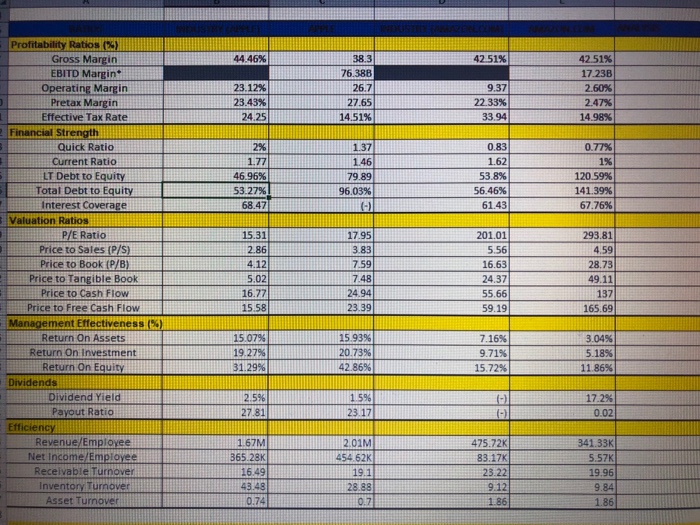

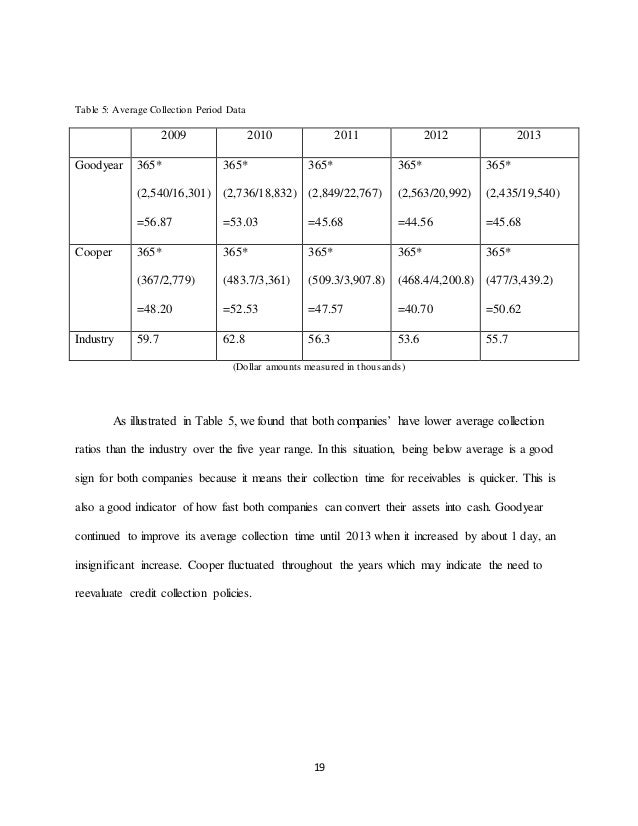

The third section Appendix B contains the actual financial ratio analysis techniques showing the companys performance in 2000 and 2001 the percent change in performance between these years a short description of the meaning of each ratio as well as a short assessment of the companys change in performance between 2000 and 2001. A ratio analysis looks at various numbers in the financial statements such as net profit or total expenses to arrive at a relationship between each number. Du Pont Analysis to.

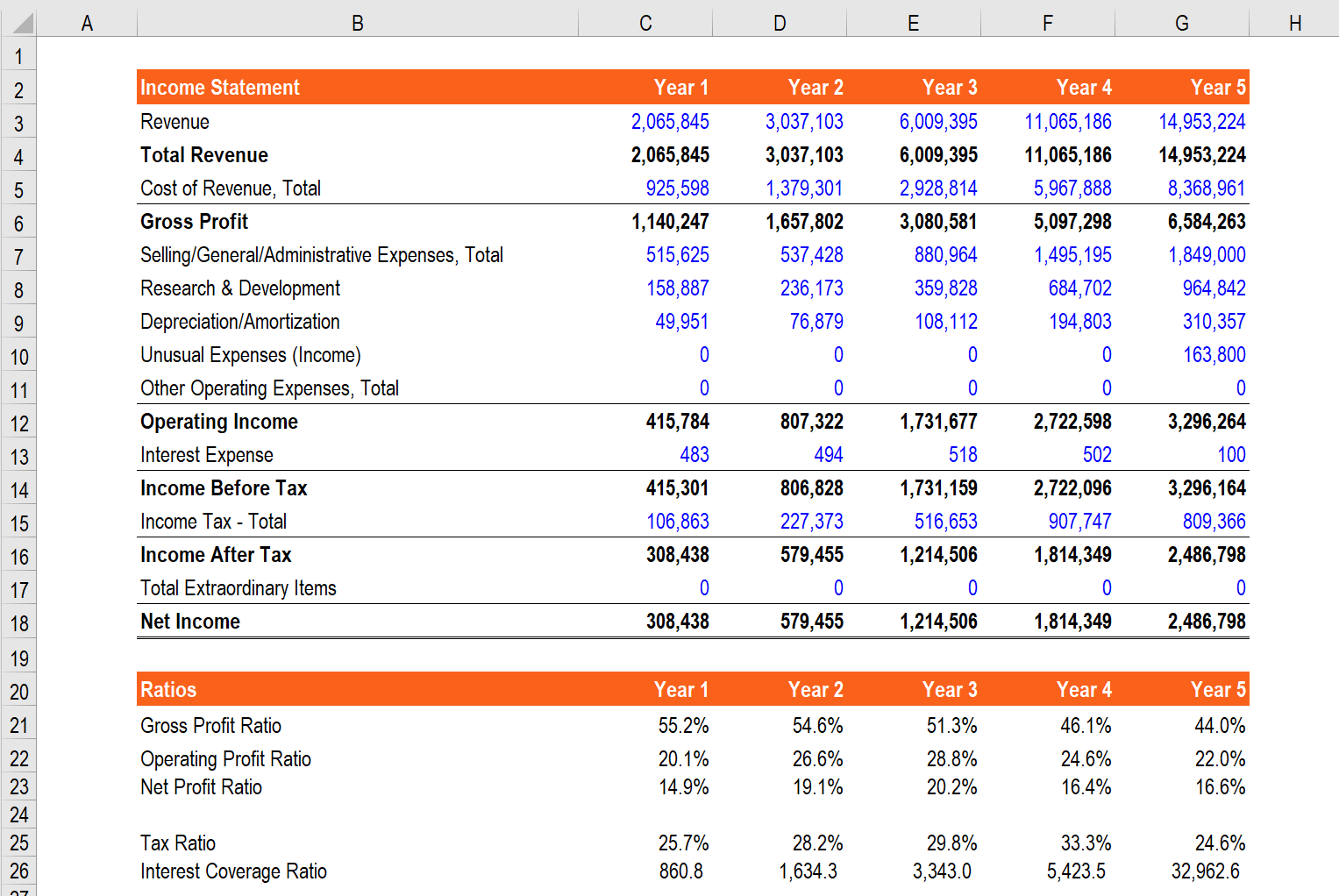

The level and historical trends of these ratios can be used to make inferences about a companys financial condition its operations and attractiveness as an investment FRA 2009. It shows the different income ane different profits earned by these companies. Ratios make it very easy to compare firms against each other.

It is calculated by dividing total debt by the sum of debt plus equity. Revision of some simple ratios. The limitations or problems of using accounting ratios for performance analysis should be included in your conclusion.

In the report history of both companies SWOT analysis financial statements financial ratios financial ratio analysis cash budget and finally the report is concluded and recommendations are given at the end. Ratio analysis involves comparing different relevant numbers of financial statements and studying the relationship. A ratio of two financial numbers compared to each other.

This will show the difference of everything between both these companies. Net profit margin often referred to simply as profit margin or the bottom line is a ratio that investors use to compare the profitability of companies within the same sector. Liquidity Ratios such as Current Ratio Quick Ratio Defensive interval etc.

/GettyImages-1085069872_journeycrop_financial_ratios-2beca482cffe497a97be706cc07a2124.jpg)