Best Amortization Of Patent Cash Flow Statement

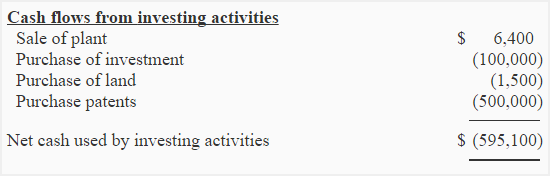

The acquisition of long-term investments.

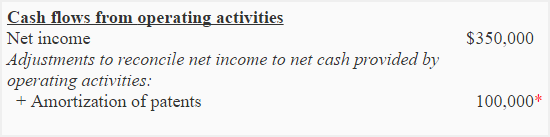

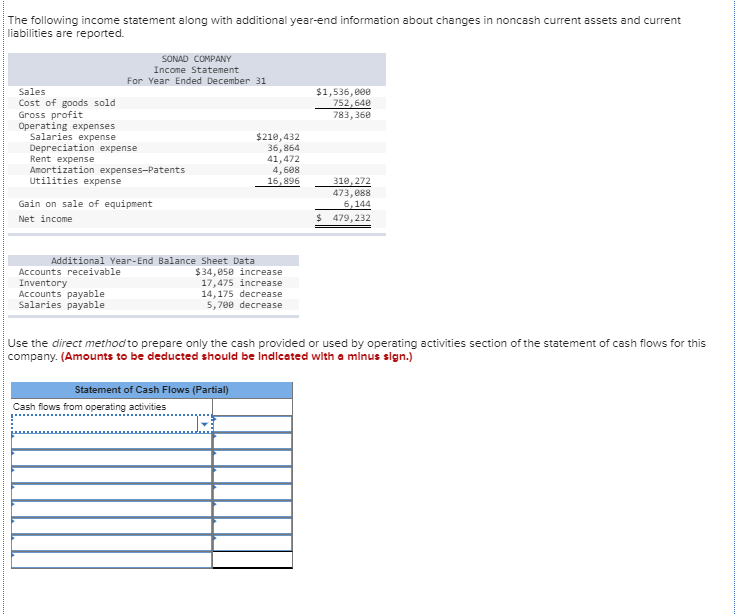

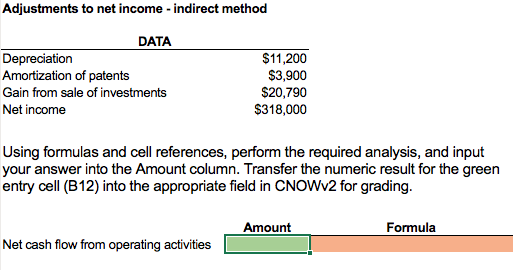

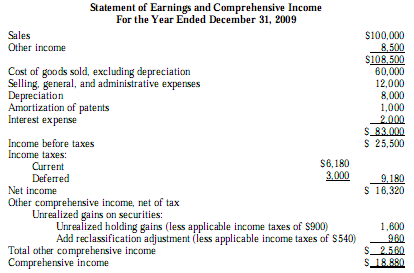

Amortization of patent cash flow statement. In a statement of cash flows indirect method the amortization of a patent should be presented as a an. Amortization expenses can affect a companys income statement and balance sheet as well as its tax liability. A deduction from net income in arriving at cash flows from operations.

Cash flow from investing activities b. Record the patent purchase into the general ledger. The exchange of common stock for a building.

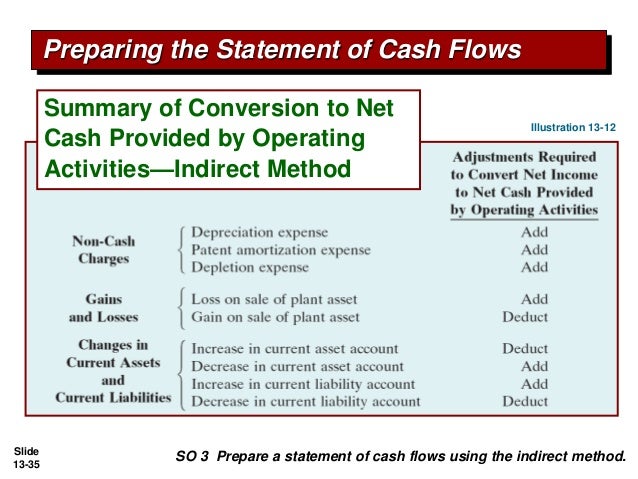

In a statement of cash flows indirect method the amortization of patents of a company with substantial operating profits should be presented as a n. Deprecation expenses are added to net income in the statement of cash flow c. Add back noncash expenses such as depreciation amortization and depletion.

Therefore like all non-cash expenses it will be added to the net income when drafting an indirect cash flow statement. Depreciation expense reported on the income statement. Amortization is also added to net income in the statement of cash flow.

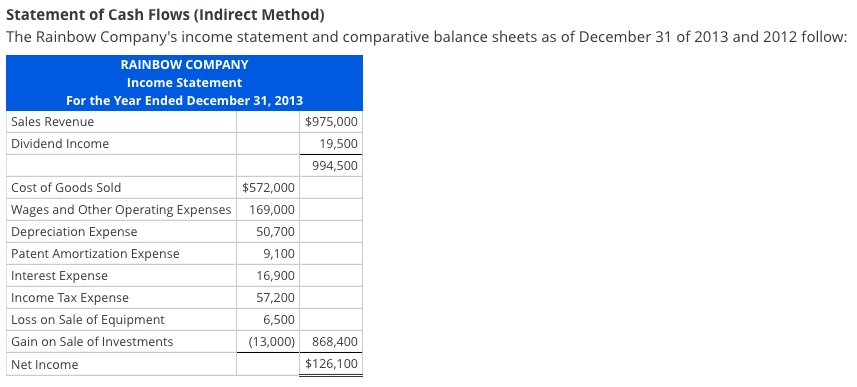

Machinery and equipment 35000. The Statement of Cash Flows The statement of cash flows is the financial statement that aims to reconcile the net income for the period to the increase or decrease in the cash balance. Addition to net income bartleby.

Is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year. Like depreciation amortization utilizes a straight-line method meaning the company calculates the expense in a fixed amount over the useful life. Report the patent purchase on the statement of cash flows by listing an outflow for the total price paid for the patent.