Cool When Closing Stock Appears In Trial Balance

This nullifies the double effect as closing stock purchases are now adjusted and are treated separately.

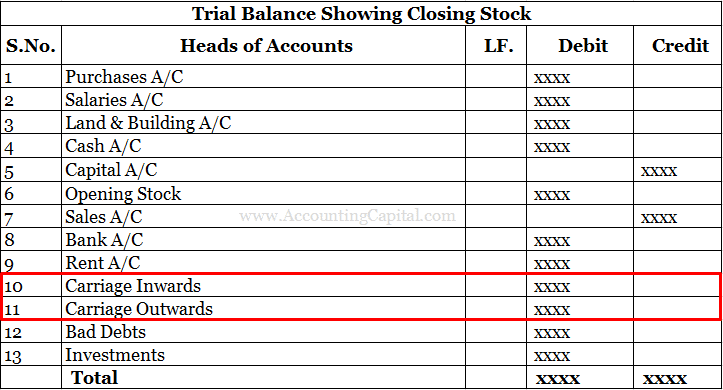

When closing stock appears in trial balance. A Real account b Liability account c Revenue account d Not recorded in. B Closing stock does not appear in the trial balance unless otherwise purchase is adjusted. 11 January 2011 If closing stock appeared in Trial balance it means the purchases has been reduced to the extent of stock amount at the end of the period.

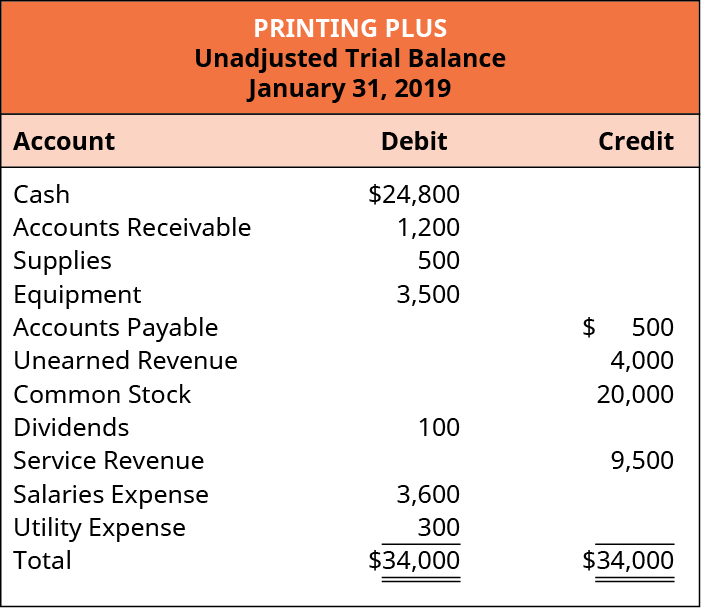

Interest on Capital is shown in the Trial Balance It wi. From the trading account gross profit is found out which is the excess of net sales over cost of goods sold. Ad Choose from the leading companies and make profit by buying and selling their stocks.

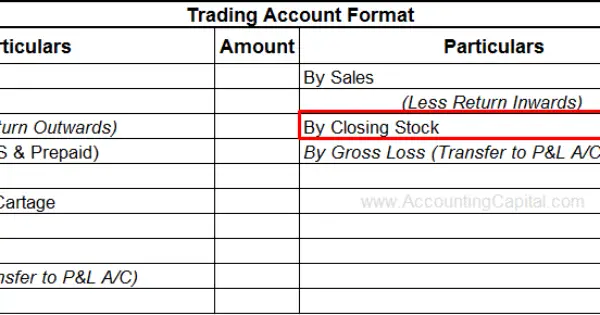

Hence it will be shown in the Balance Sheet only. If closing stock appears in trial balance what will be the treatment in final accounts. D Balance of ledger accounts are shown in the trial balance.

Closing stock generally does not appear in the trial balance because it is the leftover of the purchases which is already included in the trial balance. The accounting treatment will be closing stock to be shown in Balance sheet under current assets and it. Closing stock is the balance of unsold goods that are remaining from the purchases made during an accounting period.

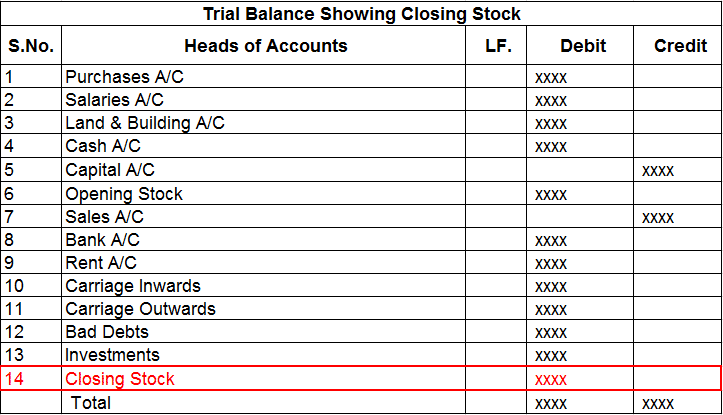

C Deducted from the purchases in the trading account. The only instance when closing stock will appear in trial balance is when the closing stock is adjusted against purchases with the below-mentioned journal entry. Then both the Adjusted Purchases Ac and the Closing Stock Account appear in the Trial Balance.

An exception is when closing stock is adjusted with the purchase account balance. The value of total purchases is already included in the Trial Balance. Thus based on its nature the Closing Stock ac appearing in the trial balance being a real account is shown on the assets side of the Balance Sheet.